Summary: The US Federal Reserve (Fed) raised rates by 0.25% as expected for the 4th time this year. In his press conference, Jerome Powell lowered their forecasts to two from three hikes in 2019. The Dollar which had been falling prior to the announcement rallied to ended with mild gains in choppy trade. The Dollar Index (USD/DXY) closed 0.11% higher. Sterling slipped 0.3% while the Euro finished flat. The Aussie underperformed, slumping 1.2%, leading risk currencies lower. Copper led base metal prices lower. Gold fell 0.5%.

Wall Street stocks tumbled as Powell failed to quell investor angst on slowing global growth.

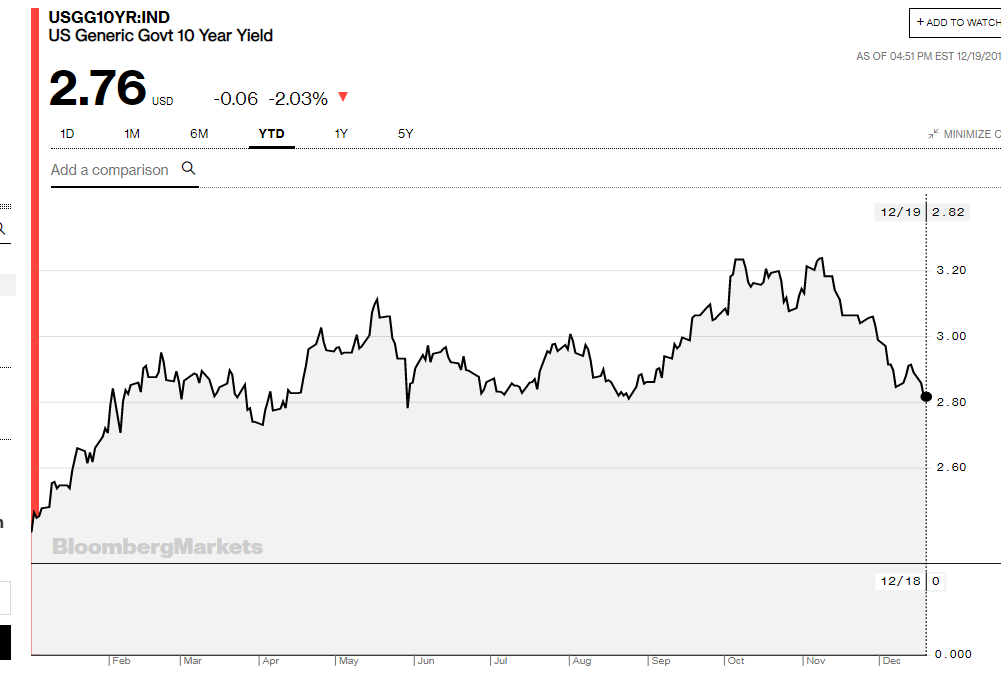

The yield on the benchmark US 10-year bond fell to 2.76%, down 6 basis points.

- AUD/USD – The Aussie under performed and slumped to 7-week lows as the risk-off sentiment extended. Falls in industrial and base metals added weight to the already heavy antipodean. AUD/USD closed at 0.7110 from 0.7170 yesterday after hitting a low of 0.7087. Australian Employment data up next.

- USD/JPY – The Dollar currently sits at 112.47 after falling to an overnight low of 112.088 prior to the Fed announcement. We then saw a bounce to 112.664 before settling lower. The Bank of Japan has its policy rate meeting today. BOJ Governor Haruhiko Kuroda has his press conference after.

- EUR/USD – the single currency closed little-changed at 1.1365 (1.1358 yesterday). EUR/USD traded to a high of 1.14394 before the Fed, dropped to 1.13588 after and now sits at 1.1385.

- US 10-year bond yield – the benchmark dropped a whopping 6 basis points to a 9-month low of 2.76%. Based on the chart, this puppy may be headed to 2.60%. Yields of global peers fell less.

On the Lookout: After the choppy trade following the Fed rate hike and statement, the market should settle while traders try and find where the Dollar should be. Given the current level of the US 10-year bond yield, the Dollar will drift lower against its peers.

Up next, the BOJ and BOE policy rate meets. Data just released saw New Zealand’s Q3 GDP miss forecasts, growing 0.3% vs 0.6% f/c. The Kiwi trade deficit beat forecasts. Australia’s Employment and Jobless rate for November are up next. The Bank of Japan Policy Rate meeting, statement and press conference follows. In Europe, we have UK Retail Sales followed by the Bank of England Monetary Policy Meeting, MPC official bank rate votes , and summary. US Philly Fed Manufacturing rounds up today’s data and events. A busy one ahead.

Trading Perspective: The dust has settled after the choppy trade into and following the Fed rate hike and assessment. The risk-off sentiment prevails as equity markets try to stabilize. US yields are lower while market positioning is still long US Dollar bets.

- AUD/USD – the Aussie closed 1.2% lower and the risk-off sentiment will prevent any meaningful bounce for now. Immediate support lies at the lows earlier which is 0.7085. Further support can be found at 0.7060. Immediate resistance can be found at 0.7130 and then 0.7160. Australian Employment is due out later with a median forecast of 20,000 jobs created from the previous 32,800. The Jobless rate is expected unchanged at 5.0%. If we see a jobs creation around FLAT or negative, the Aussie will tank first up. Anything upwards of 20,000 will see a jump higher. Market positioning remains short of Aussie bets and a gradually weaker Dollar should see the Aussie find a base and grind higher.

- USD/JPY – The Dollar traded between 112.088 and 112.633 overnight settling at its current 112.43. The marked drop in the US 10-year bond yield should cap the USD/JPY at the 112.70 level. USD/JPY would have been lower if it were not for the BOJ policy meet later today. The BOJ is expected to leave its policy rate unchanged while adding no new revisions to growth after its last downgrade. The yield on Japan’s 10-year JGB was up one basis point to 0.02%. Given the prevailing risk-off sentiment and lower US 10-year yield (2.76%), USD/JPY will drift lower barring any surprises from the BOJ. Immediate support lies at 112.10 and 111.80. Immediate resistance can be found at 112.70 and then 113.00. Look to sell rallies.

- GBP/USD – Sterling finished a touch lower against the Greenback at 1.2615 from 1.2635 yesterday. The British Pound rallied to an overnight high of 1.2680 before the Fed announcement. The Bank of England is expected to keep the Official Bank Rate unchanged at 0.75% given the uncertainty of Brexit and the outlook for the economy. Theresa May is struggling to push her Brexit deal through the UK Parliament. Sterling 10-year Gilt yields were a touch lower at 1.27% from 1.28%. Immediate support can be found at 1.2600 and 1.2570. Short term resistance lies at 1.2680 and then 1.2710.

- USD/DXY (Dollar Index) – The Dollar Index finished slightly higher at 97.07 from 97.04 yesterday. Currently, USD/DXY, which is a measure of the Dollar’s value relative to a basket of foreign currencies, trades at 97.00. It is poised to breakout of its recent 96.50-97.50 range. The Euro takes 57.6 weight in the Index, JPY has 13.6%, GBP 11.9% among the Majors. Without yield support, the Dollar will struggle higher and the move in the 10 year to 2.76% suggests the downside is vulnerable. Immediate resistance lies at 97.20 and then 97.40. Immediate support can be found at 96.70 and 96.50. A break of 96.50 targets 96.00 and 95.50.