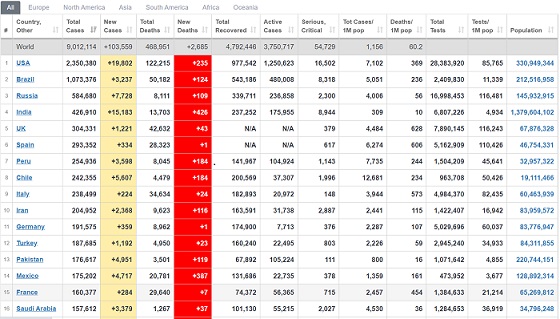

Summary: There was no let-down in the recent spike in global Covid-19 Corona Virus cases and deaths which kept markets in risk-off mode. The Dollar Index (USD/DXY), a favoured gauge of the Greenback’s value against a basket of 6 major currencies rose 0.25% to 97.663 (97.453 Friday). According to data compiled by Johns Hopkins University, the US reported 30,000 new coronavirus cases over the weekend, the highest daily total since May 1. The Johns Hopkins worldometer saw India’s Covid-19 death toll spike to 426 on Saturday. For the week, USD/DXY was up 0.95%. Sterling slumped 0.85% to 1.2350 (1.2430) after Britain’s Public Sector Net Borrowing (debt) rose more than expected. The Euro was weaker, down 0.35% to 1.1209 from 1.1240. At the European Union’s summit, ECB head Christine Lagarde told EU leaders that their economy was in a “dramatic fall” and called for the bloc to act to spearhead a revival. The Australian Dollar led risk currencies lower, down 0.39% to 0.6854 (0.6884 Friday). In early Monday morning Asia, AUD/USD slipped further to 0.6822 after China suspended its meat imports from Tyson Foods, a US chicken, beef, and pork producer and exporter. China’s backed media Global Times cited Covid-19 infections linked to meat plants in the US as well as trade tensions between the two nations. The USD/JPY pair was marginally lower to 106.90 from 107.00. Against the Canadian Loonie, the Greenback climbed to 1.3620 in early Asia from its NY close at 1.3600 and 1.3565 opening on Friday. Wall Street stocks retreated. The DOW was 1.49% lower to 25,650 (26,075) while the SP 500 dropped 1.25% to 3,072 from 3,112.

Data released on Friday saw Japan’s National Core CPI drop to -0.2% against forecasts at -0.1%. Australia’s Retail Sales in May rose 16.3% from April’s -17.7% which was expected. Germany’s PPI dipped to -0.4%, lower than expectations of -0.3%. UK Public Sector Net Borrowing climbed to GBP 54.4 billion, against forecasts at GBP 49.3 billion. Britain’s May Retail Sales rose 12% after falling by 18% in April. Canada’s Core Retail Sales in May slumped -22.0% underwhelming forecasts at -12.7% and Aprils upwardly revised -0.2% (from -0.4%.

On the Lookout: Today’s economic data calendar is light, and traders will continue to focus on the second wave of coronavirus new cases and deaths as well as the China-US trade tensions.

RBA Governor Philip Lowe is due to speak this morning (9 am Sydney) at a panel discussion in the Australian National University Crawford Leadership forum on Covid-19 and the global economy.

New Zealand reports it Credit Card Spending (year on year). China releases its Conference Board’s Leading Index (May). The UK kick off European data with its CBI (Confederation of British Industry) Industrial Order Expectations. Germany’s Bundesbank its Monthly Report. The Eurozone follows next with its Consumer Confidence data. Finally, the US releases its Existing Home Sales report.

The week ahead sees Global Flash and Services PMI’s released tomorrow. The RBNZ policy meeting and rate announcement is scheduled Wednesday. US Headline and Core Durable Goods Orders data is released on Thursday.

Trading Perspective: Risk aversion will continue to support the Dollar on dips, dominating Asian trade. The spotlight will be on the rising number of new daily cases and deaths in the US and other current hotspots like India, Brazil, and Mexico in the developing nations, as well as Germany, Japan, and Beijing. Ongoing China-US trade tensions will also occupy traders today. We take a look at the individual currencies in their reports.

AUD/USD – Slip- sliding away, Shaky above 0.6800 on China-US Tensions

The Australian Dollar extended its downtrend which began last week from a high at 0.6977 to this morning’s low at 0.6810. AUD/USD currently sits at 0.6817. China’s Global Times reported a suspension of the country’s beef imports from US poultry and meat company Tyson Foods. China was citing pandemic infections linked to meat plants as well as ongoing trade tensions between the two countries. Fears of a second wave of the coronavirus where several US states are reporting fresh spikes in cases, continue to weigh on the Battler.

Governor Philip Lowe is currently participating in a panel discussion about corona virus Covid-19 and the global economy at the Australian National University’s Crawford Leadership Forum in Canberra. The RBA has shown its readiness to act during the pandemic and Lowe’s comments will be scrutinised for any signals on the economy which could affect the Battler.

The Aussie has had good support so far at the 0.6800 level where commercial buying and profit-taking orders support the bid. However, a break of this level will automatically see a test of the 0.6760 level. The next support level lies at 0.6730. Immediate resistance can be found at 0.6840 followed by 0.6880 and 0.6910. Look for consolidation in a likely range today of 0.6770-0.6870. Prefer to sell rallies.

EUR/USD – Downward Correction Intact, Range Shifts Lower, 1.11 Next Hold

The Euro was leaned on by the overall stronger US Dollar, doubts regarding a recovery fund, and a net long market positioning on the currency. EUR/USD closed at 1.1177, not far from its overnight low at 1.11682. Early Asia saw a brief recovery t0 1.1190 before settling at 1.1175 currently. Reuters reported that ECB President Christine Lagarde tell EU leaders at their summit on Friday that their economy was in a “dramatic fall” and called on the bloc to act to spearhead revival. The bloc’s so-called “frugal four” – comprised by Sweden, Denmark, Austria and the Netherlands – said that the recovery fund is too big, and the allocation of the money is not sufficiently linked to the corona virus pandemic.

Meantime Germany’s corona virus reproduction rate jumped to 2.88 on Sunday from 1.79 a day earlier according to health authorities. The rate of 2.88, published by the Robert Kock Institute for public health means that out of 100 people who contract the corona virus, a further 288 people will get infected. Which increases the possibility of renewed restrictions in Europe’s largest economy. This week’s calendar sees Eurozone economic data kick off tomorrow with Euro area and Eurozone Flash Manufacturing and Services data.

EUR/USD has immediate support at 1.1170 followed by 1.1140 and then 1.1100. Immediate resistance can be found at 1.1200 and 1.1240. Look to sell rallies with a likely range today of 1.1160-1.1230.

USD/CAD – Risk-Off, Dismal Retail Sales Lift USD/CAD, Expect Higher

The USD/CAD pair saw a modest gain to 1.3605 NY close on Friday despite a dismal Headline and Core Retail Sales report on Friday. Headline Core Sales slumped to -26.4% against forecasts of -15.0% while Core sales dropped to -22.0% against expectations of -12.7%. USD/CAD jumped initially to its overnight high at1.3617 before settling at its New York close.

This morning, risk aversion hit Asian markets and USD/CAD rallied further to 1.3630 before settling at its current 1.3615. In the current environment, expect the USD/CAD to drive higher. Immediate resistance can be found at 1.3630 followed by 1.3630 and then 1.3700. Immediate support lies at 1.3600 followed by 1.3570 and 1.3540. Look to buy dips in a likely range today of 1.3580-1.3680.