Summary: It was always going to be about the Euro. The Single Currency had a roller coaster ride after the ECB launched new stimulus measures but failed to match dovish expectations. The ECB cut its deposit rate by 10 basis points to -0.5% (from -0.4%) and restarted bond purchases (QE) by EUR 20 billion/month effective November. The Euro initially plunged to 1.09268, within less than a pip from Sept 3 low at 1.0926, before rebounding to 1.1087, one-week highs. Mario Draghi, in his last ECB meeting chair before handing it over to the incoming Christine Lagarde urged governments to go big on fiscal stimulus. The ECB also announced that it would exempt Eurozone banks from paying penalty charges on idle cash worth 6 times of their mandatory reserves. The Dollar lifted 0.3% against the Yen to 108.10 (107.88) on signs of further trade deal hopes between China and the US. Against other currencies, the Dollar was little changed. Sterling was trading at 1.2335 (1.2330) while the Australian Dollar settled at 0.6865 (0.6867). Emerging Markets gained as risk appetite stayed healthy. Stocks edged up following the ECB’s stimulus measures with the DOW ending up 0.12% (27,195.), while the S&P 500 added 0.3% to 3010.00. Global bond yields rose, the US 10-year rate climbed 3 basis points to 1.77%. Two-year US bond yields were up 5 basis points to 1.72%.

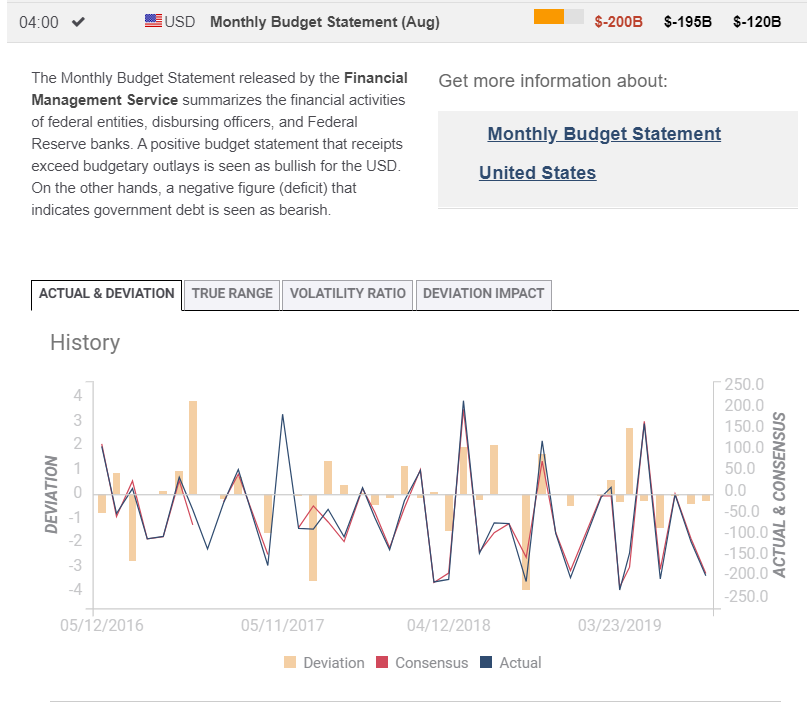

Eurozone Industrial Production in August missed forecasts at -0.4% against -0.1%. US Headline CPI (August) matched expectations at 0.1% while Core CPI rose 0.3% against an expected 0.2%. US Weekly Jobless Claims fell to 204,000 which bettered forecasts of 215,000. The US Budget Deficit ballooned to – USD 200 billion against a forecast of -USD 195 billion and July’s -USD 120 billion.

- EUR/USD – The Euro closed at 1.1065 up 0.45% from 1.1015 yesterday after falling to 1.09268 and rallying to a one-week high at 1.09268. ECB policymakers announced multiple stimulus steps to boost the Eurozone economy, which initially pressurised the Euro. The ECB move virtually guarantees that the Fed will cut rates next week. Which lifted the Euro. Short market positions moved to cover.

- USD/JPY – The positive trade news brought about by the delay and roll-back of tariffs from the US and China saw the Dollar gain versus the Yen. The 10-year US bond yield climbed to 1.77% (1.74% while Japan’s 10-year rate was unchanged. USD/JPY rallied to 108.19, the highest since August 2. The Dollar closed at 108.10, up 0.3%.

- AUD/USD – The Aussie finished little changed at 0.6865 (0.6867). AUD/USD traded within a relatively tight 0.68602-0.68945 range overnight. The Battler remains supported on upbeat trade reports and the ECB stimulus moves.

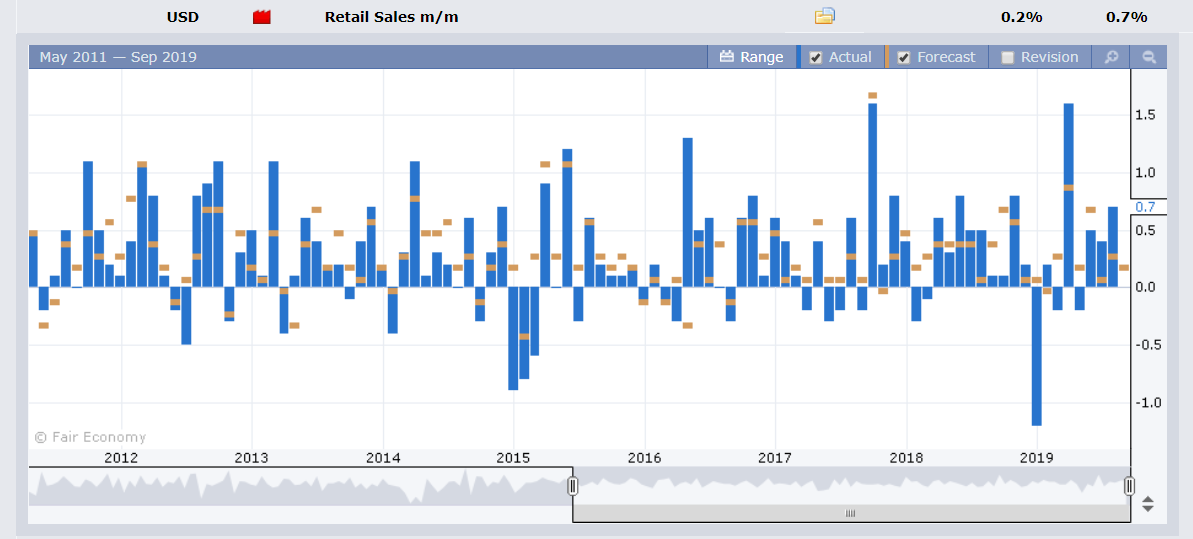

On the Lookout: Markets will continue to monitor trade headlines for clues to the next significant step to any deal between China and the US. Meantime data today sees crucial the US Headline and Core Retail Sales for August, which is expected to have dropped from July.

Other data today are Japan’s Industrial Production and Capacity Utilisation for July. Euro area reports see Germany’s Wholesale Price Index and Eurozone Trade Balance (August). The Eurogroup meetings which involve Eurozone Finance Ministers, the Eurogroup President and the ECB President are occurring today in Brussels. The other US report is its University of Michigan Preliminary Consumer Sentiment Index which finishes off the day’s data releases.

Trading Perspective: The recent trading ranges, wider for some currencies following last night’s Euro move should stay intact until tonight’s US Retail Sales reports. The Eurogroup meetings today following the ECB stimulus measures and Mario Draghi’s call for fiscal stimulus from other countries will be closely watched for comments from other Eurozone leaders.

The Dollar Index (USD/DXY), often a mirror of the EUR/USD slipped 0.29% to 98.372 (98.627). The Federal Reserve meets next week. The ECB move virtually guarantees a Fed rate cut. The question now is to what extent? This should keep a lid on the Dollar unless tonight’s retail sales data outperforms.

- EUR/USD – The strong rebound off the near Sept. 3 low at 1.09268 suggests an interim base for the shared currency. EUR/USD closed at 1.1063, settling currently at 1.1058. Immediate resistance lies at 1.1090 (overnight high 1.10871). The next resistance level is at 1.1120. Immediate support can be found at 1.1040 followed by 1.1010. Germany’s 10-year Bund yield was up 5 basis points to-0.52%. Look for a likely range today of 1.1010-1.1090. Look to trade the range today.

- USD/JPY – The Dollar rallied against the Yen as risk appetite remained healthy. A rise in US 10-year yields also supported the currency pair. Tonight’s US Retail Sales report is expected to show a fall in August. A more pronounced drop in the retail sales report and expectations of a Fed rate cut at next week’s meeting could see USD/JPY ease back from current levels. USD/JPY has immediate resistance at 108.20 (this morning’s high was 108.19). The next resistance level can be found at 108.50 (strong) and 108.90. Immediate support lies at 108.00 and 107.70. Look for a likely range today of 107.65-108.25. Prefer to sell rallies.

- AUD/USD – The Aussie kept its bid and dipped to an overnight low of 0.68602 before closing little changed at 0.6865. AUD/USD traded to an overnight high at 0.68945. Immediate resistance lies at 0.6900 followed by 0.6930 (strong). Immediate support can be found at 0.6950 and 0.6830. The Australian Dollar will follow the US Dollar’s lead from here. With markets expecting slowdown in US August retail sales, the risk may be for a less pronounced slowdown. Look to trade a likely 0.6840-0.6890 range today with the preference to sell rallies.

Happy Friday and trading all.