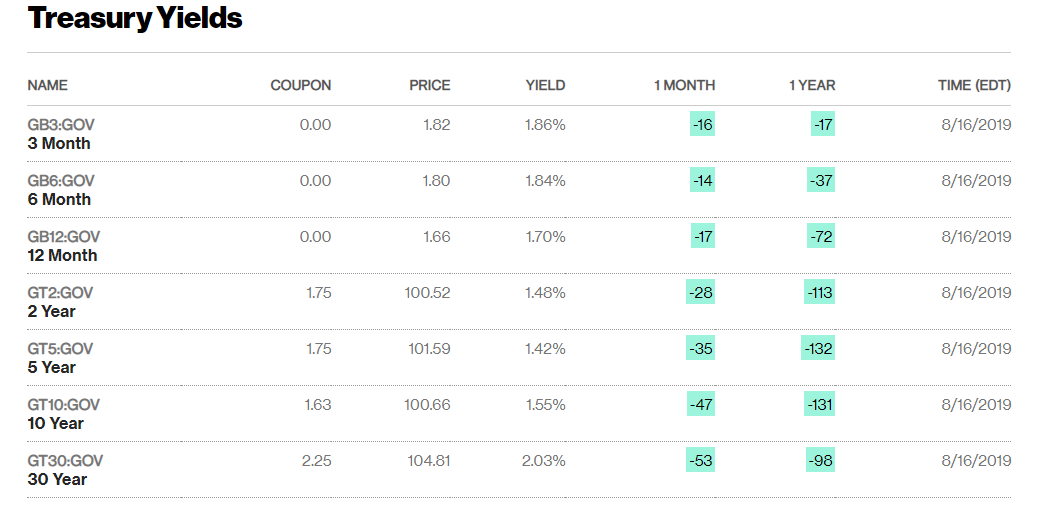

Summary: The Euro extended its drop for the 4th straight day to 1.1090 (1.1115) on rising bets of a bold stimulus package from the ECB in their next meet (September 12). On Thursday, ECB Governing Council Member Olli Rehn suggest that the Europe’s central bank could restart its QE program. Sterling rallied 0.4% to 1.2145 (1.2105) as growing opposition to PM Boris Johnson’s promise to take Britain out of the EU with or without a deal forced crowded shorts to cover. The Dollar Index (USD/DXY) steadied to 98.203 (98.096) after a jump in US Building Permits offset a fall in Housing Starts. On Sunday, White House Economic Adviser Larry Kudlow said that there is little risk of a recession despite a volatile week for bond markets. Treasury yields stabilised with the benchmark 10-year rate finishing up 2 basis points at 1.55%.

Wall Street stocks gained with risk appetite with the Dow finishing the week up 1.2% to 25,920. (25,600). The S&P 500 gained 1.4% to 2,892.

The Eurozone’s Trade Surplus narrowed to EUR 17.9 billion in July. US Building Permits rose to 1.34 million units from 1.23 million while Housing Starts dropped to 1.19 million from 1.25 million the previous month.

– EUR/USD – slip-sliding away, the Euro extended its retreat to finish at 1.1090 from 1.1115. The shared currency fell for the fourth day in a row as market bets grow for an ECB stimulus move in their upcoming September policy meeting.

– GBP/USD – Sterling rallied as crowded shorts ran for cover on growing opposition from political parties to Boris Johnson’s pledge to take Britain out of the European Union with or without a deal. The British Pound climbed against both the US Dollar (1.2145 from 1.2105) and Euro (0.9130 from 0.9183).

– USD/JPY – The Dollar edged higher against the Japanese currency to 106.35 (106.05 Friday) as US treasury yields steadied. The 10-year US yield climbed 2 basis points to 1.55% while Japan’s 10-year yield was at -0.24% from -0.25% Friday.

– AUD/USD – The Aussie finished little changed at 0.6775 (0.6778) after the risk of a September rate cut was lessened by RBA speak last week.

On the Lookout: Trade tensions will still drive the markets as we look to the week in front of us. Latest media releases saw President Trump accuse Chines tech giant Huawei as a national security threat. Trump also warned China of negative trade impacts should they use force on Hongkong protesters.

Today’s economic report releases are mostly second tier, but they will pick up starting tomorrow. The week’s big event is Friday’s annual Kansas City Fed’s Jackson Hole, Wyoming global central bank symposium where Jerome Powell is scheduled to open the gathering. Markets will be looking to Powell to gauge if US policy makers will add to July’s rate reductions.

New Zealand PPI input and output start today’s reports. Japan’s Trade Balance follows. The Eurozone’s Current Account Balance, Final Headline and Core CPI reports round up today’s data releases.

Trading Perspective: The latest Commitment of Traders/CFTC report saw speculative US Dollar longs trimmed further. Which gives more room for a Dollar rally, particularly against the Euro. We look at the breakdown of currencies in tomorrow’s report. The Dollar Index (USD/DXY), a mirror of the Euro, gained for 4 out of 5 trading days closing at 98.20. On Friday, China fixed its Yuan weaker against the Greenback which saw Emerging Market currencies mostly weaker. This is also mildly Dollar supportive.

1. EUR/USD – The Euro traded to an overnight and eight-day low at 1.10663 before steadying to close at 1.1090. Immediate support can be found at 1.1060 and 1.1040. A break could see us down to 1.1025, July 31 lows. Immediate resistance can be found at 1.1110 and 1.1140. Tomorrow sees the release of Euro area Manufacturing and Services PMI data which could pile on more pressure on the single currency if they point to a Euro area recession. For today look for a likely trading range of 1.1070-1.1120. Can’t go wrong trading that range.

2. GBP/USD – The British Pound extended its gains as shorts scrambled to cover when the currency didn’t rall any further. We reported last week that speculative GBP shorts rose to multi-year highs which is a danger sign to any further shorts. GBP/USD closed at 1.2145. Immediate resistance lies at 1.2175, overnight highs. The next resistance level can be found at 1.2210 and 1.2250. Immediate support can be found at 1.2110 followed by 1.2075. Look for a likely trading range today of 1.2120-1.2180, prefer to buy dips.

3. USD/JPY – The Dollar has traded between 105 and 107 for the past three weeks and held both levels well. No reason to see any change in that for now. USD/JPY closed at 106.35 (106.05 Friday). Overnight high traded was 106.50, which is immediate resistance. The next resistance level can be found at 106.70 and then 107.00. Immediate support lies at 106.00 (1060.025 overnight low) and 105.85. Look to trade a likely range of 106.00-106.60 today. Just trade the range shag on this one today.

4. AUD/USD – The Australian Dollar ended little changed at 0.6775 (0.6778 Friday). Overnight low traded was 0.670 which is today’s immediate support. The next support level lies at 0.6740. Immediate resistance can be found at 0.6800 (overnight high was 0.67951). The next resistance level is at 0.6820. The RBA’s latest meeting minutes are released tomorrow. There has been less negative rate cut chatter since after two policymakers (Kent and Lowe) poured cold water on the possibility. We reported last week that with the Australian Dollar TWI so low, there was less likelihood of that possibility. Like Sterling, Aussie net short speculative bets continue to grow. This supports the downside. Look to trade a likely range today of 0.6770-0.6820. Prefer to buy dips.

Have a good week ahead, happy trading all.