Earnings cues boost European equities, central bank expectations continues to dominate price rally. US macro data in Focus.

Earnings cues boost European equities, central bank expectations continues to dominate price rally. US macro data in Focus.

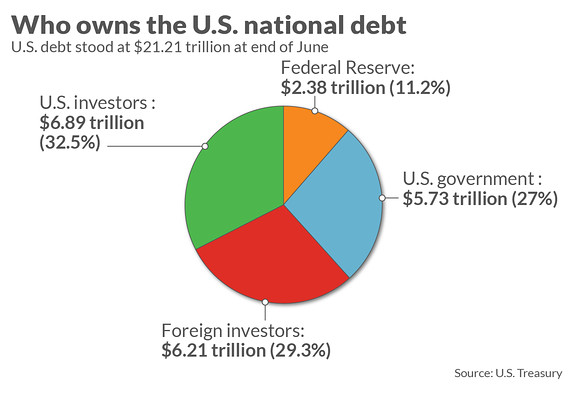

Summary: Global equity market is seeing price action dominated by cues from central bank decision expectations. While declining fed rate cut bets caused Asian indices and futures to decline yesterday, increase in expectations on rate cut from US Fed and ECB caused major high risk Asian indices, stock and futures to trade with positive bias in the global market today. European equities are trading with positive bias for third consecutive session today on cues from auto stocks and earnings report of major European financial firms aside from positive support received from dovish ECB expectations. Auto sector shares gained on news that China’s Beijing Automotive Group Co Ltd purchased 5% stake in German automaker Daimler and positive earnings from car parts supplied Continental. Also positive earnings from Swiss bank UBS and Apple supplier AMS underpinned European market bulls. Further, US Dollar saw sharp upsurge in Asian and European markets on an announcement of US leaders agreeing to a two year extension in debt limit.

Precious Metals: Precious metals subdued on healthy risk appetite in the global market, but both gold and silver are still trading in positive territory. However, strong USD in the global market capped participation from emerging markets and traders who hold other global currencies while profit booking activity ate away at gains.

Crude Oil: While upbeat global cues underpinned crude oil price momentum in early trading session, price of crude oil fell in both major global crude oil benchmarks WTI and Brent as Middle Eastern tensions have temporarily calmed down. While other major cues such as US data and OPEC supply cut have been priced in, traders struggle to make solid bets on volatile Middle East tensions causing today’s decline.

AUD/USD: The pair is continuing to trade with bearish bias in the global market for third consecutive trading session today. Despite prevalent risk on investor sentiment, rebound in USD caused the pair to decline further. The pair continues to struggle near 0.7020 handle for now but given the current price momentum it is well on its way to test 0.7000 handle unless AUD bulls manage to cap Bear’s momentum.

On The Lookout: While there is some level of optimism surrounding Sino-U.S. trade deal, the caution in market on prolonged trade war continues to outweigh positive influence from optimism. But Sino-U.S. trade talk update continues to remain in backseat as it lacks strength required to drive a new wave of global price rally. On the other hand, UK saw Boris Johnson win the race in ruling party for candidate to succeed Ex-PM Theresa May. What this means for UK and Europe now is that, if both parties fail to come to agreement on some sort of Brexit deal, the most likely outcome is no-deal Brexit during upcoming deadline in October. In the meanwhile, cues from corporate earnings and macro calendar updates of major global economies continue to dictate price momentum in the global market. US calendar will see the release of Existing Home Sales Data later today.

On The Lookout: While there is some level of optimism surrounding Sino-U.S. trade deal, the caution in market on prolonged trade war continues to outweigh positive influence from optimism. But Sino-U.S. trade talk update continues to remain in backseat as it lacks strength required to drive a new wave of global price rally. On the other hand, UK saw Boris Johnson win the race in ruling party for candidate to succeed Ex-PM Theresa May. What this means for UK and Europe now is that, if both parties fail to come to agreement on some sort of Brexit deal, the most likely outcome is no-deal Brexit during upcoming deadline in October. In the meanwhile, cues from corporate earnings and macro calendar updates of major global economies continue to dictate price momentum in the global market. US calendar will see the release of Existing Home Sales Data later today.

Trading Perspective: In forex market, gains will continue to remain capped owing to rebound in USD. However price momentum will mostly be range bound with slight bearish momentum and major currencies are unlikely to see sharp declines. US Stock and Index futures trading in the international market saw positive price action ahead of Wall Street opening which suggests Wall Street is likely to open on positive note and trade with positive bias today. Some of the major earnings reports awaited by US traders today include Coca-Cola, Discover, Biogen, Harley-Davidson, Hasbro and Lockheed Martin.

EUR/USD: The pair is trading with dovish bias in the global market well near mid-1.11 handle as momentum influenced by USD’s rebound pressured EURO into sharp decline. Traders now await US macro data for short term profit opportunity and better than expected outcome will lead to pair declining further towards 1.1100 handle.

GBP/USD: The pair is trading with dovish bias pressured on multiple fronts by bearish cues. While USD rebound was major dovish factor, Boris Johnson succeeding PM Theresa May opens door for no-deal Brexit, further weighing down GBP. Traders now await US macro data for short term profit opportunity with odds in favor of further decline in US market hours.

USD/CAD: The USD/CAD pair has been trading with positive bias since trading session opened for the week. Rebound in USD on debt extension decision caused the pair to scale to 2-week tops while pullback in crude oil price weakened CAD pushing the pair towards monthly highs. Traders now await US macro data for directional cues and positive data could help the pair gain solid hold above mid-1.31 handle.

Please feel free to share your thoughts with us in the comments below.