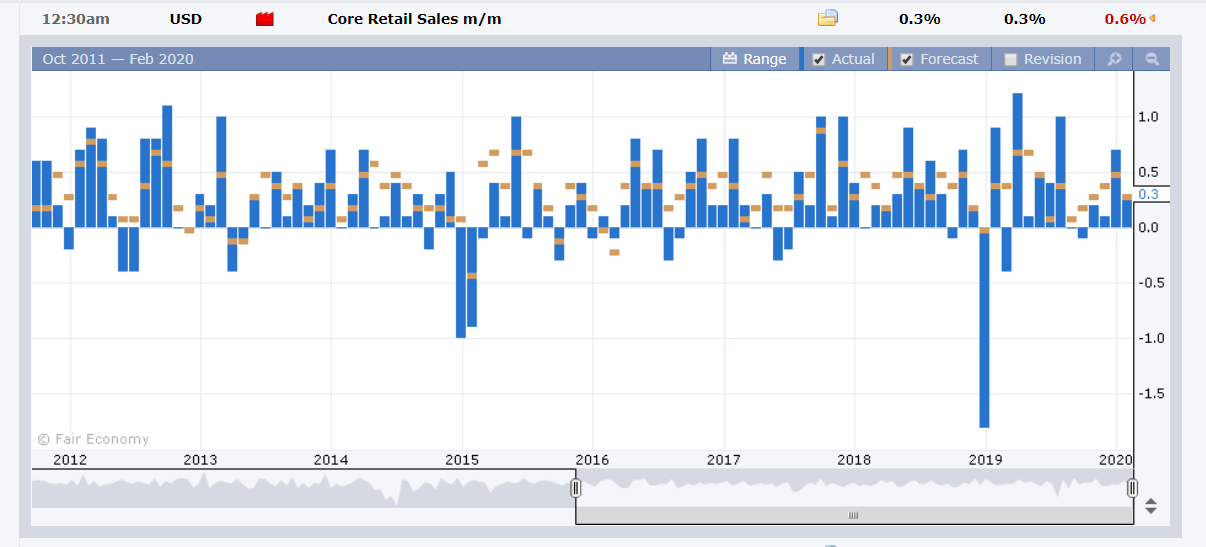

Summary: Markets stayed cautious with coronavirus developments its key focus with risk-off supporting the US Dollar. The Dollar Index (USD/DXY) was up 0.09% to 99.161 (99.068), fresh 2020 highs despite a downward revision to Headline and Core Retail Sales in December, which is the holiday season. While January Sales matched forecasts, the downward revisions gave the New Year a soft beginning. The Euro languished near April 2017 lows at 1.0832 (1.0845 Friday) after Germany’s 2019 Q4 GDP showed 0% growth (0.1% forecast). Sterling was little changed at 1.3047 (1.3052) while USD/JPY edged lower to 109.78 from 109.82. The Australian Dollar slipped to 0.6715 (0.6725). Covid-19 (coronavirus) developments kept markets on edge. China’s National Health Commission reported 2,009 new cases down from the previous day. Europe reported the first fatality, an 80-year old Chinese tourist infected with the virus who died in France.

Wall Street stocks closed mixed. The DOW fell 0.17% to 29,415 while the S&P 500 was up 0.08% to 3,382. Demand for treasuries lifted prices as yields dropped. The benchmark US 10-year bond yield fell 3 basis points to 1.58%. Germany’s 10-year Bund yield dipped to -0.40% from -0.41%. Japanese 10-year JGB rates were flat at -0.04%. Other data released Friday saw US Industrial Production for January fall to -0.3%, below expectations of -0.2%. Preliminary University of Michigan Consumer Sentiment rose to 100.9, beating forecasts at 99.5.

- EUR/USD – The Euro continued to slide further, touching fresh April 2017 lows at 1.08272 from 1.0845 Friday. The shared currency closed in New York at 1.0832. Euro short bets continued to grow as sentiment in the current environment stayed decisively bearish.

- USD/JPY – The Dollar was on the defensive against the Yen on the overall risk off mode. Lower US 10-year bond yields also kept USD/JPY on the defensive.

- AUD/USD – The Aussie slipped to close at 0.6815 from 0.6725 on Friday, down 0.14% against the US Dollar. AUD/USD fell to an overnight low at 0.67092, with risk sentiment still fragile amidst the coronavirus outbreak.

On the Lookout: The US and China moved to implement Phase One of their trade agreement, both cutting by half some tariffs on tens of thousands of one another’s products amidst the coronavirus outbreak. In the wake of the COVID-19 epidemic, questions on China’s ability and willingness to fulfill its commitments remain. Markets will monitor developments.

The US celebrates their President Day holiday today and the banks will be closed.

Today’s report start-off with New Zealand Visitor Arrivals (January). Japan reports on its Preliminary GDP Price Index (annual), Preliminary Q4 GDP, and Revised Industrial Production data. The UK reports its Rightmove House Price Index (February). China reports on its Direct Foreign Investment and New Loans.

The week ahead sees Global and US Flash Manufacturing and Services PMI’s.

Trading Perspective: Market positioning continues to crowd the short Euro, long US Dollar trade amidst the low volatility and risk off. US reports saw disappointments in Retail Sales and Industrial Production. Bond yields dipped with the benchmark US ten-year yield down to 1.58%. Without yield support, the Dollar will have difficulty climbing. The risk is for a lower US Dollar.

Net speculative Euro shorts continue to build near 3-year low. A technical bounce is in the making. Which will see the Dollar Index lower.

- EUR/USD – The Shared currency dipped to an overnight low at 1.08272 as bearish sentiment continued to attract sellers even near 3-year lows. EUR/USD settled a touch higher at 1.3032. Immediate support can be found at 1.0820 followed by 1.0790. Immediate resistance lies at 1.0860 followed by 1.0900. Look for a likely range today of 1.0825-1.0885. Prefer to buy dips.

- USD/JPY – The Dollar was little-changed against the Yen at 109.78 (109.82). USD/JPY hit an overnight low at 109.699 before settling at 109.78. USD/JPY has further room downside given the drop in the US 10-year yield. Immediate support can be found at 109.70 followed by 109.40. Immediate resistance can be found at 109.90 and 110.10. Look to trade a likely range today of 109.50-110.00. Prefer to sell rallies.

- AUD/USD – The Aussie Battler was little changed against the Greenback to 0.6715 from 0.6725. Concerns on the COVID-19 epidemic and its global economic impact will keep the Australian Dollar topside limited. Speculative short Aussie market positioning will support the Battler. Immediate support can be found at 0.6700 followed by 0.6680 (overnight low 0.6682). Immediate resistance lies at 0.6750 followed by 0.6780. Look to trade a likely range today of 0.6695-0.6755. Prefer to buy dips.

Have a good week ahead all, happy trading.