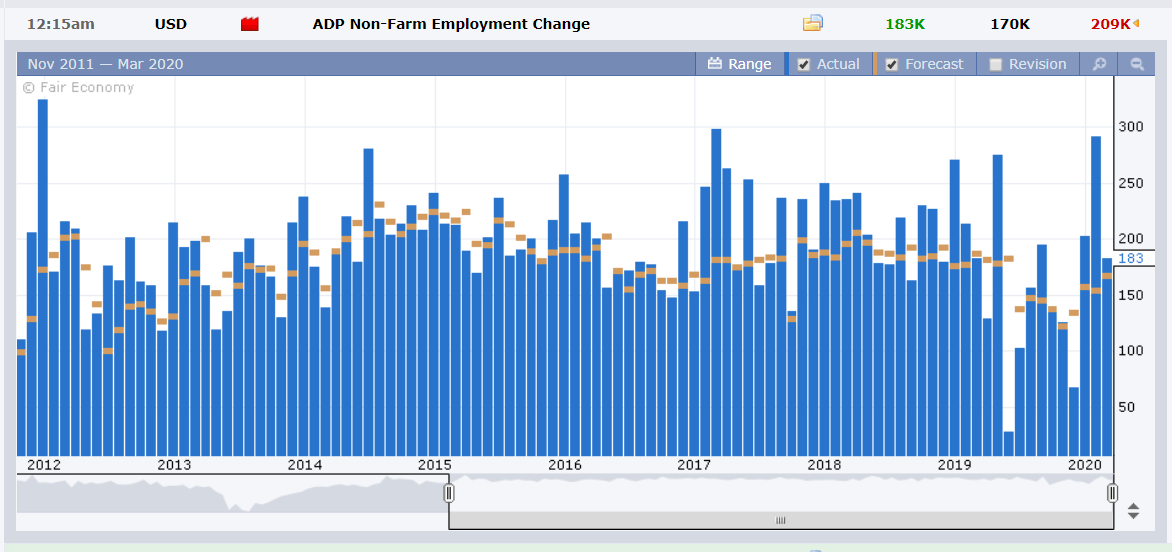

Summary: US stocks and the Dollar rebounded after Congress agreed to an emergency spending bill of USD 8.3 billion to combat the spread of Covid-19. The Dollar weakened across the board after the US Federal Reserve slashed interest rates by 0.5% yesterday. Data released yesterday showed US ADP private payrolls gained 183,000 jobs in February beating forecasts of 170,000. The move by Congress, the data and the strong showing across key US states by Joe Biden in the contest to select a Democratic challenger to President Trump in the November 3 election all contributed to the Dollar’s advance. The Euro, one of the currencies to advance on the broad-based US Dollar weakness, retreated 0.34% to 1.1135 (1.1182). USD/JPY, which hit a low of 106.85 in Asian trade yesterday, climbed to 107.692 before settling to close at 107.37. Against the Canadian Loonie, the Dollar soared to 1.3431 from 1.3375 after the Bank of Canada cut it’s Overnight Rate by 0.5% to 1.25%, a move which was widely expected. USD/CAD finished in New York at 1.3400. The Australian Dollar extended its rally to 0.6615 from 0.6595. Against the trend, the British Pound climbed to 1.2870 (1.2800 yesterday) after incoming Bank of England Governor Andrew Bailey said that more evidence was needed on the coronavirus before any policy decision is made.

Wall Street stocks rallied on the news of the US Congress agreement on an emergency funding bill. The DOW was up 34.3% to 26,945 (26,007). The S&P 500 rose 4.06% % to 3,111 (3,015). US Treasury yields hovered at the lows. The key 10-year rate held at 1.00% while the 2-year fell to 0.65% from 0.69% yesterday.

Euro area Services PMIs mostly matched forecasts. China’s Caixin Services PMI slumped to 26.5 in February from 51.8 the previous month. US Final Services PMI in February matched median expectations with a reading of 49.4, and January’s 49..

On the Lookout: While asset markets and the US Dollar steadied following the US spending bill to combat the coronavirus, the disease continued to spread outside China. In the US mainland, Washington state confirmed 39 infected and 10 deaths from 27 and 9 yesterday. New cases reported saw 6 in Los Angeles and 4 near New York, two of the most populous US cities. More volatility lies ahead.

US ADP Private Payrolls and ISM Services PMI reports showed that the US economy remained on solid footing before the coronavirus. Economists expect the coronavirus to limit economic growth in the first half of 2020 to around 1%. (US economy grew 2.3% in 2019).

Today’s economic data releases are thin. Asia sees Australia’s Trade Balance. The US reports on its Challenger Job Cuts, Revised Non-Farm Productivity, Revised Unit Labour Costs, Factory Orders and Weekly Unemployment Claims.

Trading Perspective: The Dollar regained its footing after the Fed emergency rate cut yesterday. The Bank of Canada joined the Fed, slashing its Overnight Cash rate by 0.5%. Traders will look to see which other major central banks will follow the Federal Reserve and make emergency cuts. This should see the Dollar consolidate against the other majors within the recently established ranges. Trading will remain choppy and volatile.

US bond yields hovered near their lows, the 10-year at 1.0% while the 2-year dropped 4 basis points to 0.65%. Rival bond rates were a touch lower.

AUDUSD : The Aussie held on to it’s gains and kept its momentum going above 0.66 cents. AUDUSD advanced 0.55% to 0.6625 in early Sydney trade this morning. AUD/USD hit a high at 0.66277. Following the RBA’s 0.25% rate cut on Tuesday, the Aussie has recovered as speculative shorts scrambled for cover.

Today traders will focus on Australia’s Trade Balance for January. The US Dollar bounced off a four-week low which should put a cap on the Aussie today. The yield gap between US and Australian 10-years widened last night (US 10-year at 1.0%, Australian 10-year at 0.71%). This should also cap any further short-term Aussie gains.

Immediate resistance today is found at 0.6630 (overnight high 0.66277) The next resistance level lies at 0.6660. Immediate support can be found at 0.6600 and 0.6570. Look to trade a likely range today of 0.6585-0.6635. Prefer to buy dips.

USDJPY : It held on to its gains following its drop to overnight and near 5-month lows at 106.85, closing 0.25% higher at 107.38. Wall Street’s rally and the overall US Dollar recovery lifted USDJPY to an overnight high at 107.692. US measures to fight the coronavirus helped the Dollar Index (USD/DXY) to recover from one-month lows. The Bank of Canada and Hongkong Monetary Authority joined the Fed with rate cuts.

The coronavirus spread continues to grow outside of China. Covid-19 infections increased in the US mainland. This should put a cap to any significant USDJPY rallies. US Treasury yields hovered near their lows. The key US 10-year rate stuck to 1.00%.

USDJPY has immediate resistance at 107.70 followed by 108.00. Immediate support lies at 107.00 and 107.80. Look to trade a likely range today of 107.0070. Prefer to sell rallies.

EURUSD: The Euro retreated to 1.1135 following its spike to 1.12133 highs on Tuesday. Overnight the shared currency managed to trade to 1.11876. EURUSD slipped to an overnight low at 1.10954. The generally stronger US Dollar provided the catalyst for the Euro reversal.

Euro area Services PMI data were mostly in line with forecasts. With little in the way of economic data from Europe today, trader will look to US reports with US Payrolls the highlight tomorrow. And of course, developments on the spread of Covid-19, particularly in Europe.

EURUSD has immediate resistance at 1.1175 followed by 1.1210. Immediate support can be found at 1.1100 followed by 1.1070. Expect the Euro to consolidate its recent gains in a likely 1.1090-1.1150 range today. Prefer to buy dips.

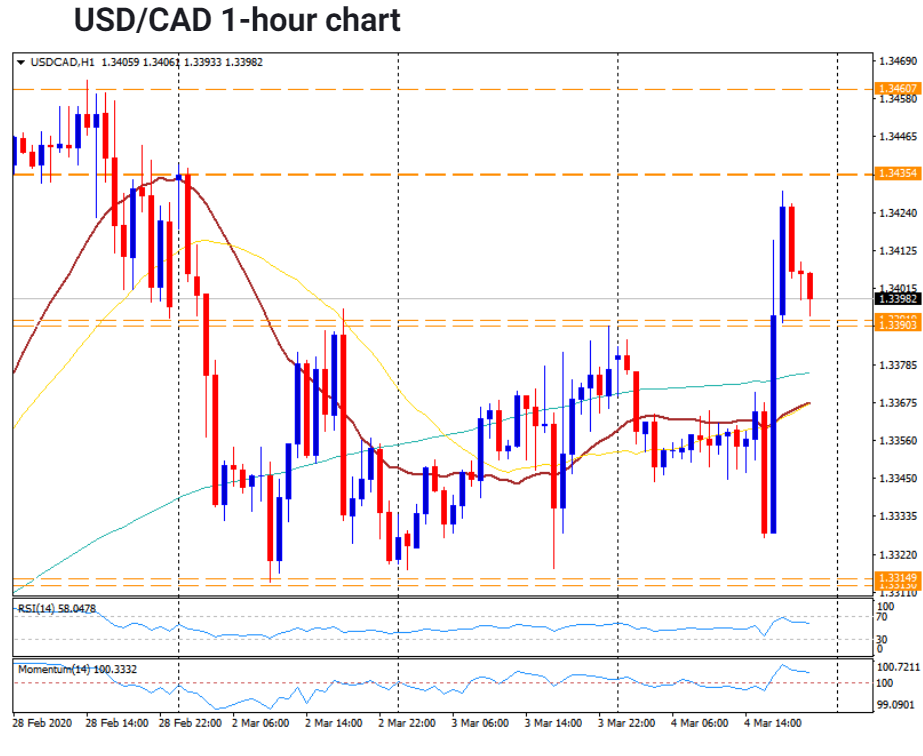

USDCAD : It jumped to an overnight high at 1.34313 (1.3375) following the Bank of Canada’s decision to slash its prime Overnight Cash rate by 0.5% to 1.25% (1.75%). The Dollar slipped to close at 1.3400, for a gain of 0.2%. Canada’s 10-year bond yield was steady at 0.95% (0.96% yesterday). The BOC’s move was widely expected.

Expect the USDCAD to consolidate its gains. Immediate resistance lies at 1.3390 followed by 1.3350 and 1.3315. Immediate resistance can be found at 1.3435 followed by 1.3465, last week’s highs.

Look to trade a likely range today of 1.3380-1.3440. Prefer to sell USDCAD rallies. The US Dollar still has room to move lower in the medium term, and the Loonie should benefit.