Summary: The disconnect between a strong Dollar and stocks broke as both assets rose in choppy trade. The catalyst was a record monthly rebound in May US Retail Sales which suggested that the US economy could bounce back sooner than expected. It was a busy day on the news front. Concerns of a second wave of coronavirus remained elevated after Beijing upgraded its emergency response. US Federal Reserve Chair Jerome Powell maintained his cautious stance on the economy, telling US lawmakers that a full recovery will not occur until Americans are certain Covid-19 has been brought under control. Fresh geopolitical concerns rose following reports that North Korea blew up a South Korean liaison office, which was used as an embassy between the two nations. Tensions between China and India surged with the reported deaths of at least 20 Indian soldiers amid a dispute in the Kashmir region. Meantime the latest Commitment of Traders/CFTC report saw a total increase in US Dollar shorts during the week to June 9. The Euro fell 0.66% to 1.1265 from 1.1325 yesterday after hitting a fresh weekly high in European trade. Sterling dropped to 1.2572 from 1.2602 on a mixed UK Employment report.

The Australian Dollar slumped to 0.6887 from 0.6930 against the backdrop of a broadly stronger US Dollar. Against the Yen, the Dollar was little changed at 107.32 (107.35) after the BOJ left rates unchanged as widely expected. The USD/CAD pair climbed to 1.3560 from 1.3535. US treasury yields climbed. The key 10-year bond rate rose 3 basis points to 0.75%. Germany’s 10-Year Bund finished at -0.43% from -0.45% yesterday. Japanese 10-year JGB yields closed at -0.01% from 0.00% yesterday.

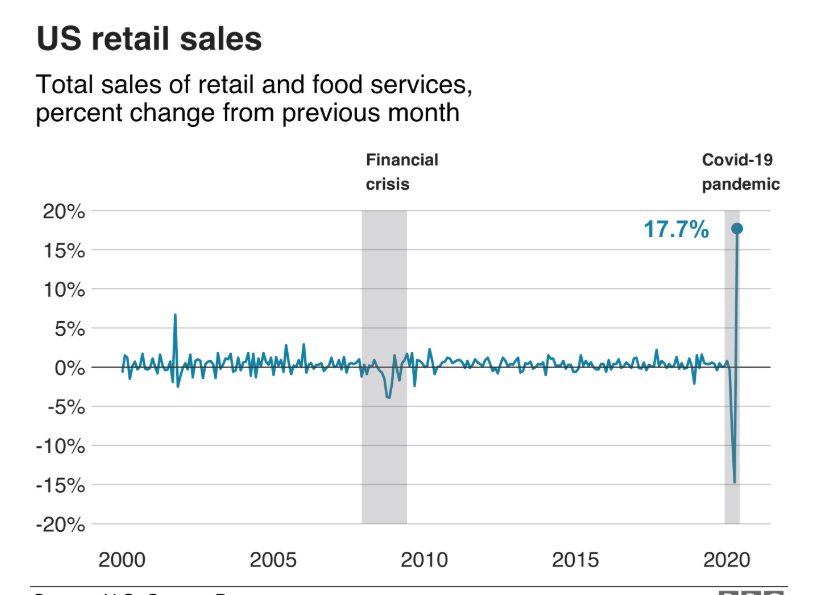

Data released yesterday saw UK Claimant Count Change (Jobless Claims) climb to 528,900 against expectations of 405,300. Britain’s Unemployment Rate beat forecasts at 3.9% against 4.1%. Average Weekly Earnings (Wages) rose to 1%, missing expectations of a 1.4% rise. Germany’s ZEW Economic Sentiment Index climbed to 63.4, beating forecasts at 60.0. US Retail Sales in May rose to 17.7% in May, a record monthly rebound. Core Retail Sales was up 12.4% beating expectations of 5.5%. Both sales reports saw upwards adjustments to April’s sales data. US Industrial Production was up 1.4% in May, lower than forecasts of 3.0%.

On the Lookout: Fresh coronavirus outbreaks amidst growing fears of a second wave and geopolitical tensions in the region will dominate Asian markets today. Today’s economic and events calendar is light compared to that of yesterday.

Data kicks off with New Zealand’s Current Account, just released, which showed the surplus at NZD 1.56 billion, in line with expectations of a surplus of NZD 1.59 billion. Japan’s Trade Balance follows. Australia’s Melbourne Institute’s Leading Index follows which ends Asia’s reports.

The UK sees its Headline and Core CPI was well as PPI Input and Output. The Eurozone reports its Headline and Core inflation numbers. Canada comes next with its Headline, Core, Trimmed, and Median CPI data. The US rounds up the day’s reports with its Building Permits and Housing Starts.

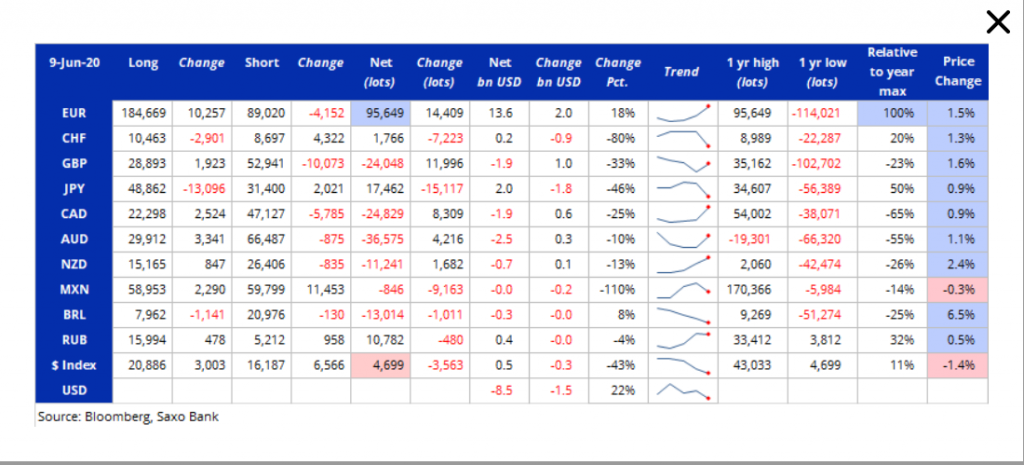

Trading Perspective: The Dollar’s rally amidst a mostly risk-on environment highlights the large net short positioning in the Greenback. The latest Saxo Bank Commitment of Traders/CFTC report for the week ended 9 June saw an increase in net Dollar shorts due to a big rise in EUR longs and more short covering in AUD, CAD, GBP, and NZD. This is becoming a bigger factor which will cushion any US Dollar declines. We look at a few currencies in their individual reports below.

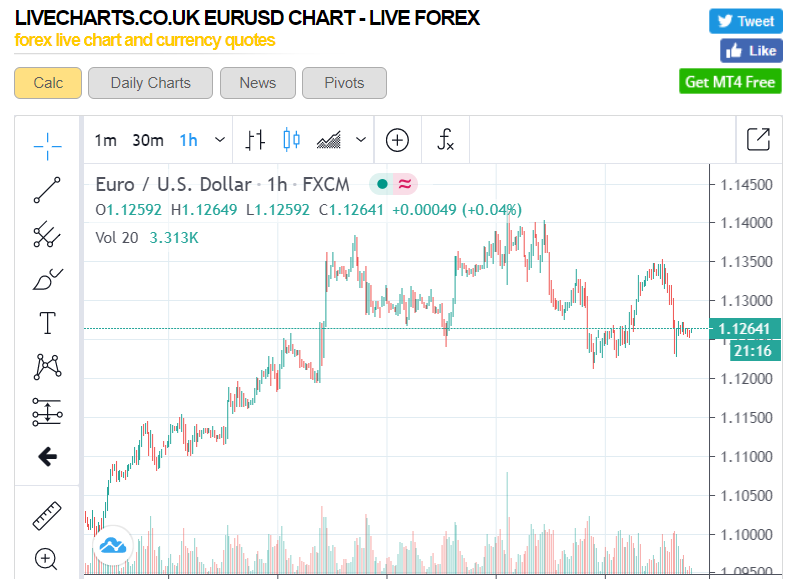

EUR/USD – Retreats on Stronger USD, Net Long Bets Hit 2-Year Highs

The Euro retreated to close at 1.1265 in New York after hitting an overnight high at 1.1353 in European trade. EUR/USD hit an overnight low at 1.12279 before rallying in late trade. Germany’s ZEW Economic Sentiment Index climbed to 63.4, beating median estimates at 60.0. However, it was the robust rebound in US Retail Sales that undid the shared currency.

The latest Commitment of Traders report for the week ended on 9 June saw net speculative Euro long bets jump to +EUR 95,649 contracts from the previous week’s +EUR 81,240. According to Sax Bank, the net total was the most bullish in the shared currency since May 2018.

EUR/USD has immediate support at 1.1230, 1.1200 and then 1.1170. Immediate resistance can be found at 1.1300, 1.1350 and 1.1400. Look for consolidation in a likely trade today between 1.1175-1.1325. Prefer to sell rallies, the Euro will struggle to hold any meaningful gains with the number of long bets around. These need to be unwound.

AUD/USD – Struggling to Climb on Mixed Risk Appetite, 0.68-0.70 Likely

The Australian Dollar closed lower at 0.6892 in New York after another roller coaster trading session between 0.68337 (overnight lows) and 0.69769 (overnight high). Yesterday, Fed-led optimism from its latest move to purchase corporate bonds boosted risk and the Aussie Dollar. The notable rise in US Retail Sales which resulted in broad-based Greenback strength weighed on the Aussie. Meantime coronavirus cases continue to rise amidst reopening efforts which traders will monitor closely. The recent rise in cases in Beijing and Tokyo heightened fears of a second wave.

The next set of first tier Australian economic data is tomorrow’s Employment report. Until then, the Battler will take its cues from the US Dollar moves, Covid-19 developments as well as news on geopolitical tensions in the Asian region.

The latest COT report for the week ended June 9 saw speculators trim their net short Australian Dollar bets to -AUD 36,575 from the previous week’s -AUD 40,791. AUD/USD has immediate support at 0.6860 followed by 0.6830. Immediate resistance can be found at 0.6920 and 0.6970. Look to sell rallies today in a likely range of 0.6830-0.6930.

USD/CAD – Holds Lows Amidst Higher Oil, Greenback Strength Supports

The USD/CAD pair modestly closing at 1.3555 in New York from yesterday’s 1.3575. A rise in Crude Oil prices as well as a steady risk appetite buoyed the Canadian Loonie. Overnight range for the pair was between 1.35048 and 1.36230. The stronger than expected US Retail Sales report lifted Greenback off its lows against the Loonie at 1.35048. Today sees the release of Canada’s CPI reports which are forecast higher in May than April. Traders will continue to monitor news events likely to influence risk appetite.

USD/CAD has immediate resistance at 1.3570 followed by 1.3610 and 1.3640. Immediate support can be found at 1.3530 and 1.3500. The latest Commitment of Traders report saw speculators trim their Canadian Dollar short bets to -CAD24,829 contracts from -CAD 37,128. Look for consolidation today between a likely 1.3520-1.3670 range. Prefer to buy USD/CAD dips.