Summary: The Dollar Index (USD/DXY), a measure of the value of the US Dollar relative to a basket of foreign currencies, recovered from a 3-week low following a better-than-forecast USQ4 Advance GDP reading. USD/DXY was up 0.04% to 96.18 after hitting a low of 95.824 and an opening of 96.15 yesterday. The delayed report (due to the government shutdown) beat median estimates by 0.4% to 2.6% from Q3’s downward revised read of 3.4%. Enough to alleviate investor fears about marked slowdown in the US economy due to trade ties. Global yields climbed. The benchmark US 10-year bond yield ended up 4 basis points at 2.73%. Germany’s 10-year Bund yield rose 3 basis points to 0.18% while Japanese 10-year JGB’s yielded -0.03% from -0.04% yesterday.

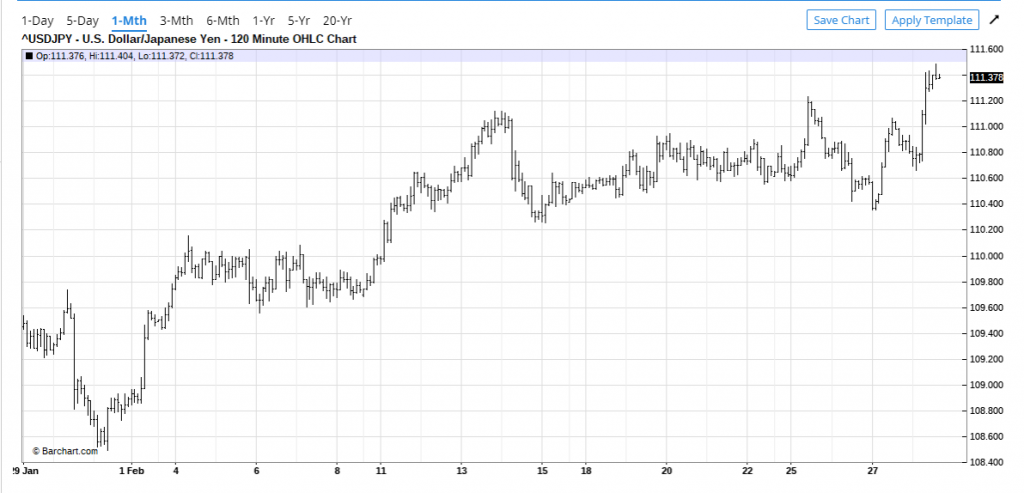

Elsewhere, inflation data out of the Euro area were in line with forecasts. The Euro ended flat at 1.1380. Sterling slipped off its highs, finishing down 0.4% at 1.3270 on position adjustment following its surge yesterday. USD/JPY rallied 0.4% to 10-week highs at 111.44 before settling at 111.35.

The much-touted Trump-Kim Hanoi nuclear summit ended abruptly without an agreement. Wall Street stocks slipped. The DOW finished down 0.4% at 25,931.

- USD/JPY – The Dollar Yen which is the most sensitive to movements in the US 10-year yield (2.73% from 2.69%) was true-to-form rallying to an overnight and 10-week high of 111.44 before easing to 111.35. Emerging Market and Asian currencies also traded lower versus the Greenback.

- GBP/USD – The British Pound edged lower to 1.3270 from 1.3319 as uncertainty as to when and how the UK would leave the European Union crept back into the markets. While markets have lowered their expectations of a NO-DEAL Brexit, a high degree of uncertainty remains with all the delays.

- EUR/USD – finished virtually flat at 1.1378 (1.1370 yesterday). Euro area inflation data was mostly in line with expectations. Today sees Euro area Manufacturing PMI data. Overall range traded for the Euro was 1.13595 – 1.14195, a riveting 60 points!

- AUD/USD – The Aussie fell as a result of weaker-than-expected Chinese Manufacturing PMI data (49.2 vs 49.5 forecast). AUD/USD closed 0.7% lower at 0.7095 from 0.7137 yesterday. Weaker EM and Asian currencies also weighed on the Aussie Battler.

On the Lookout: The week ends with more primary data releases from all the major economies. Japan starts off with Tokyo Core CPI, Unemployment, Capital Spending and Manufacturing PMI data. China follows with its Caixin Manufacturing February PMI. Euro area Final Manufacturing PMI’s from Spain, Italy, Germany, France and the EU follow. Eurozone Flash Headline and Core CPI are next. The UK reports on Net Lending to Individuals (which is a gauge of consumer spending) and Manufacturing PMI. Finally, US Core PCE Personal Income and Spending and Final and ISM Manufacturing data round off today’s plethora of data.

Fed Chair Jerome Powell addresses the Citizens Budget Commission Awards Dinner in New York later today (12.30 pm Sydney time) with a speech entitled: “Recent Economic Developments and Longer-Term Challenges”.

A potentially, and hopefully market-moving day to start March.

Trading Outlook: The Dollar Index (USD/DXY) had a good recovery off it’s overnight and 3-week lows at 95.824 last night. USD/DXY closed at 96.180 boosted by the climb in US bond yields. That said the Dollar’s recovery was not broad-based. While the Greenback saw gains versus the Yen, Sterling, Aussie and Kiwi, it fell against the Euro, Swiss Franc and Canadian Dollar. The difference may be that the EM and Asian currencies extended their weakness against the Dollar for the 3rd day running. The Economic data releases today and market positioning will tell. On balance, the Dollar may grind higher first up. Powell’s speech will be closely monitored by traders. Caution followed the upbeat China-US trade negotiations after comments from some US officials. Markets will be on the lookout for any developments on this front. Enough to keep traders busy for Friday, the first day of March.

- USD/JPY – The rally in the Dollar Yen was the result of the four-basis point move up in the US 10-year bond yield to 2.73% from 2.69%. Risk appetite was slightly lower but did not impact the haven Yen. USD/JPY has immediate resistance at 111.40/50 where it peaked. The next resistance level is at 111.80 followed by 112.20. Immediate support can be found at 111.10 and 110.80. Prefer to sell rallies with a likely range today of 110.85-111.45.

- AUD/USD – The Aussie got whacked by a double-whammy of weaker Chinese PMI data, risk appetite and Emerging Market Asian Currencies. The Aussie Battler finished 0.73% lower at 0.7093 from 0.7137 yesterday. AUD/USD has immediate support at 0.7070/80 (lows last week). The next support level can be found at 0.7040. Immediate resistance lies at 0.7120 and 0.7140. Look to buy dips with a likely range today of 0.7085-0.7145.

- GBP/USD – Sterling slid to 1.3270 after its strong rise to 1.3350 yesterday. Overnight high traded this time was 1.3320. There is still much uncertainty as to the timing and conditions regarding Brexit. Postponing the vote may lessen the chances of a NO-VOTE but it does not negate it. The Pound’s powerful move higher may have been the result of a combination of short-covering and establishing fresh long positions. It will be interesting to see what the actual market positioning is when the data is released early next week. The US government shutdown has delayed the CFTC’s Commitment of Traders reports. Immediate resistance for the Pound lies at 1.3300 followed by 1.3320. Immediate support can be found at 1.3250 and 1.3210. Look to sell rallies with a likely range of 1.3240-1.3290.

Happy Friday and trading all.