Summary: The US Dollar, Wall Street stocks and bond yields eased in high volatile trade ahead of the Federal Reserve’s June meeting and outcome (4 am, Sydney, 11 June; 2 pm NY, 10 June). The Fed is expected to release its economic and interest rate forecasts, which it did not do at its March meeting at the height of the crisis. Most economists are expecting US policymakers to remain on the side of being accommodative. Which saw the Dollar finish mostly lower after initially spiking higher on profit-taking in high volatile trade. Risk-on went out the window and volatility entered. The Euro bounced back from an overnight low at 1.1241 to finish at 1.1336 in late New York. The Australian Dollar ended its 8-day winning streak, plunging initially to 0.68985 overnight lows from its 0.7020 open yesterday, eventually settling at 0.6962. Against the Japanese Yen, the Dollar dropped anew to 107.75 (108.43 yesterday). Sterling had a see-saw session between 1.2618 and 1.2756, settling at 1.2730 in late NY trade, little changed from 1.2725 yesterday. The USD/CAD pair was 0.3% higher to 1.3415 (1.3378). The Kiwi ended at 0.6515 in NY from 0.6560 yesterday. Against the Offshore Chinese Yuan, the Dollar (USD/CNH) climbed back to 7.0790 from 7.0575.

Wall Street stocks eased. The DOW closed at 27,280 (27,545). The S&P 500 was at 3,207 (3,229).

The benchmark US 10-year Treasury yield dropped 5 basis points to 0.83%. Germany’s 10-year Bund yield was up one basis point to-0.31%. Japanese 10-year JGBs yielded 0.01% from 0.04%.

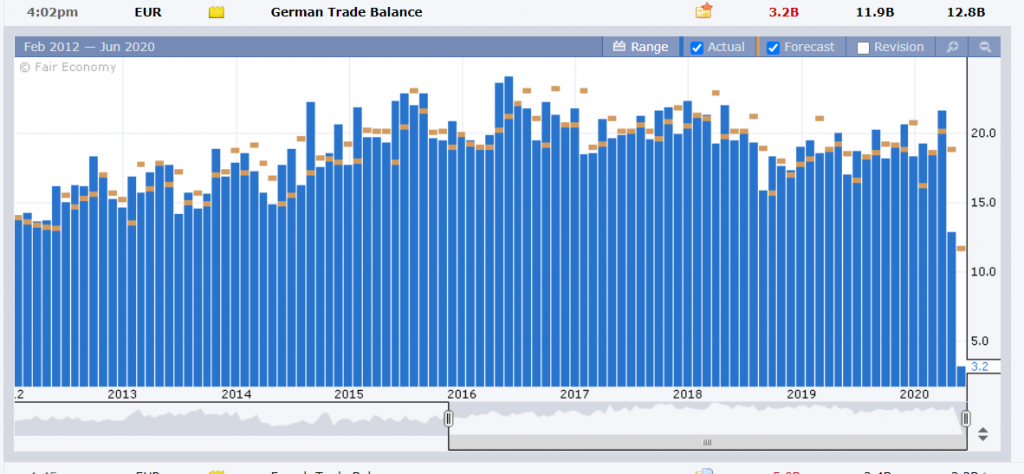

Germany’s Trade Surplus slumped to +EUR 3.2 billion in May from April’s +EUR 12.8 billion, and missing forecasts at +EUR 11.9 billion. US JOLTS Job Openings fell to 5.05 million, missing expectations at 5.75 million and a previous downwardly revised 6.01 million.

On the Lookout: All eyes on the Fed today. Most economists think that the US central bank will keep leaning on the side of being accommodative. The FOMC is not expected to change interest rates or increase Quantitative Easing (QE). The spotlight will be on the Fed’s interest rate (dot plot) and economic projections. Rather than risk a “taper tantrum”, most traders expect the Fed to stay dovish. Any diversion from this leaning would see the Greenback rebound strongly. Federal Reserve Chair Jerome Powell follows the meeting (30 minutes later) with his press conference. Powell could be less downbeat instead pointing to recent signs of a recovery.

Markets will also focus on the other economic data releases today. New Zealand kicks off with its Q1 Manufacturing Sales report. Australia reports its Westpac Consumer Sentiment. Japanese Core Machinery Orders, and PPI follow. China releases its CPI and PPI data. The Euro area sees French Industrial Production. Finally, the US reports on its Headline and Core CPI before the Fed meeting outcome, statement, economic projections and FOMC press conference.

Trading Perspective: The Dollar initially rebounded strongly against its rivals as traders took profits and adjusted positions. In choppy trade, the Greenback surrendered it’s advance against the currencies on expectations of bearish interest rate and economic projections from the US Federal Reserve at the conclusion of its meeting today. Fed Chair Jerome Powell will likely be cautiously optimistic in his assessment of the economy.

Markets have ignored US-China tensions which featured heavily last week. US Secretary of State Mike Pompeo in his latest press conference criticised British bank HSBC for backing China’s plan to impose new security legislation on Hong Kong. This is a negative for risk-on and could add to volatility ahead of the Fed meeting.

FX sentiment towards the Greenback remains decidedly bearish. The risk is for further US Dollar upside correction.

USD/CAD – Base at 1.3350, Risks Higher on a Less Dovish Leaning Fed

Against the Canadian Loonie, the US Dollar closed 0.31% higher at 1.3415 from 1.3380 yesterday. While US bond yields eased, Canada’s 10-year rates also declined to 0.63% from 0.67%. Oil prices were mixed. Brent Crude was 0.39% lower to USD 40.85 while WTI finished 0.47% higher to USD 38.55. The USD/CAD pair had its own highly volatile trade between 1.33593 and 1.34882 overnight.

The Loonie’s fate hangs with the Fed, Jerome Powell and the US Dollar.

USD/CAD has immediate resistance at 1.3470 and 1.3520. Immediate support can be found at 1.3380 and 1.3350. A corrective move higher if the Fed is less dovish than most economists expect is a strong possibility for the USD/CAD pair. Prefer to buy dips with a likely range of 1.3370-1.3520 likely.

AUD/USD – Room for Further Downside Correction in Choppy Trade

The Australian Dollar had a highly volatile session, plunging to an overnight low at 0.68985 before bouncing to a New York close at 0.6962 from yesterday’s 0.7020 opening. The Aussie Battler took a breather, consolidating following its 8-day run higher. First up today for the Aussie is China’s CPI and PPI reports. Both inflation numbers are expected to drop.

From here on in, the focus is on the US Dollar and the Federal Reserve. If the Fed’s interest rate and economic projections are less dovish that most economists expect and Jerome Powell is less pessimistic, the Greenback could see a decent bounce. Which would see the Aussie, Kiwi and Canadian Loonie all lower. A grim outlook would see a lower US Dollar with the Australian Dollar leading risk currencies back higher.

AUD/USD has immediate resistance at 0.7000 followed by 0.7040. Strong resistance lies at 0.7080. Immediate support can be found at 0.6930 followed by 0.6900 and 0.6860. Strong support lies at 0.6775. Look to trade a likely 0.6920-0.7020 range first up. Prefer to sell rallies to 0.7020, this Aussie could correct further.

EUR/USD – Stays Firm into Fed Meeting, Long Bets Remain the Risk

The Euro finished up 0.30% to 1.1336 from 1.1295 yesterday. It was the best performing currency against the Greenback overnight. EUR/USD traded to an overnight low at 1.12410 before grinding higher to a peak at 1.13638 before settling lower. The shared currency benefitted from a narrowing of yield differentials between the US and Germany. Ten-Year US treasuries were at 0.83% (0.87%) while Germany’s 10-year Bund yield closed at -0.31% from -0.32%. Market participants are expecting the US Federal Reserve to keep a more dovish stance at the conclusion of its meeting today.

Speculators remain bullish on the Euro which shows in the market positioning. We reported yesterday that speculative long Euro bets increased in the latest COT report (week ended 2 June) to +EUR 81,240 from the previous week’s +EUR 75,222. A less dovish leaning Fed or a less pessimistic Jerome Powell could see the Euro bulls head for the exits.

EUR/USD has immediate resistance at 1.1360 followed by 1.1400. Immediate support lies at 1.1290 followed by 1.1240. Look to sell rallies in a choppy session with a likely range of 1.1200-1.1370.