Summary: The US Dollar ended mixed with the Greenback stronger against the Euro, British Pound, and New Zealand Kiwi, but weaker versus the Aussie, Yen, Canadian Loonie and some EM Currencies (Thai Baht, South African Rand, Russian Rouble). The Euro was the worst performing major, falling 0.59% against the Dollar, at 1.0902 (1.0980). Euro area data released yesterday did not impress overall with marked falls in Spanish Manufacturing PMI and the Eurozone Sentix Investor Confidence Index. Spain’s factory output slumped to its lowest since 2009. The Australian Dollar held above 0.64 cents, slipping to 0.63726 overnight before ending little changed at 0.6425 (0.6422 yesterday). The main focus today is on the RBA rate decision and policy announcement. The Australian central bank is expected to maintain its benchmark interest rate at a record low 0.25%. Sterling remained under pressure, dipping to 1.2445 from 1.2490 as the UK has the worst coronavirus death toll in Europe. USD/JPY eased to 106.73 from 106.92 as trading slowed due to the Golden Week holidays in Japan. A 7.3% rebound in West Texas Intermediate Oil prices to US$22.55 (US$21.20) saw the USD/CAD pair drop to 1.4098 from 1.4125. Wall Street stocks gained modestly on the Oil price rally which offset the escalating tensions between the US and China. President Trump has accused China of covering up and suppressing the coronavirus and said that additional tariffs would be the ultimate punishment. The DOW was up 0.2 % to 23,730 (23,710) while the S&P 500 added 0.24% to 2,838 (2,828).

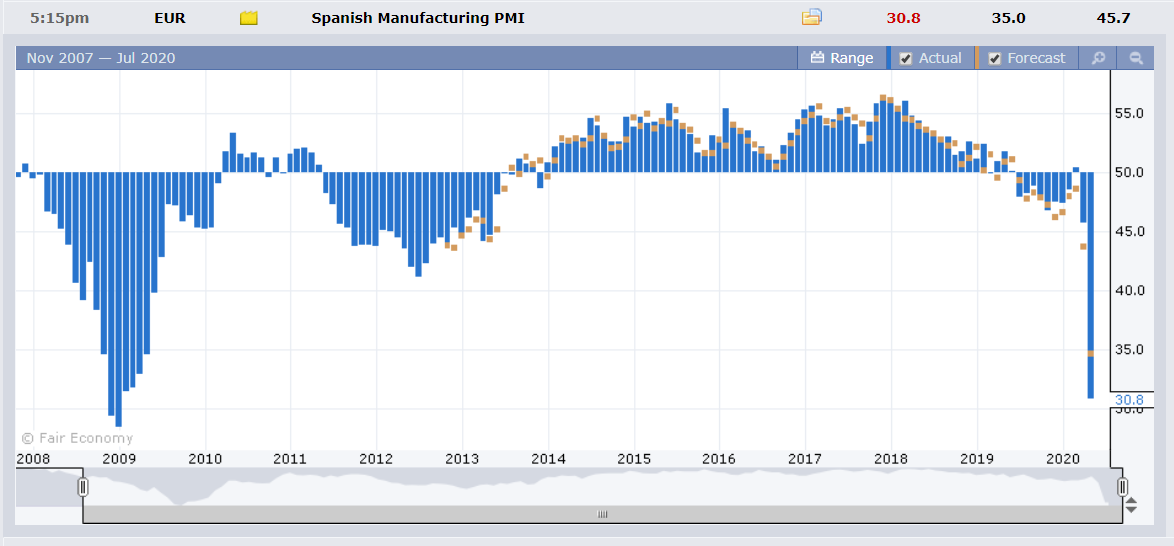

Data released yesterday saw Australia’s Building Approvals in April beat forecasts with a -4.0% print against -15%. Spain’s Manufacturing PMI plunged in April to 30.8 from 45.7 the previous month, below forecasts of 35.0. The Eurozone Sentix Investor Confidence Index fell to -41.8 slightly better than the previous -42.9, but worse off than expectations of -25.9. US April Factory Orders slumped to -10.3% from -0.1% in March, underwhelming forecasts at -9.2%.

On the Lookout: The market’s focus today will be on the RBA, expected to keep policy unchanged and maintain its Official Cash Rate at an all-time low of 0.25%. The RBA is also expected to maintain its current QE platform. Traders will remain cautious ahead of the accompanying statement. Other data released today include New Zealand’s Building Consents and ANZ Commodity Prices reports. Euro area reports begin with Swiss SECO Consumer Climate and CPI. France releases its Government Budget. Spain reports on its Employment Change which is followed by the Eurozone PPI (April).

The UK reports on its Final Services PMI. US data round up the day’s reports with US Trade Balance, Final Services PMI and the ISM Non-Manufacturing PMI.

Markets will continue to monitor the escalating US China tensions as well as coronavirus updates.

Trading Perspective: Expect Asia to continue with a mixed trade against the Dollar. Data releases today and the events later in the week will provide trading opportunities. Friday’s US Payrolls report will be the biggest potential market mover. The US is forecast to report the worst Payrolls fall ever. Canada also releases its Employment data on Friday. Eurozone Economic forecasts are scheduled for release on Wednesday. Thursday sees the Bank of England monetary policy meeting, report and statement. Market positioning will feature strongly this week.

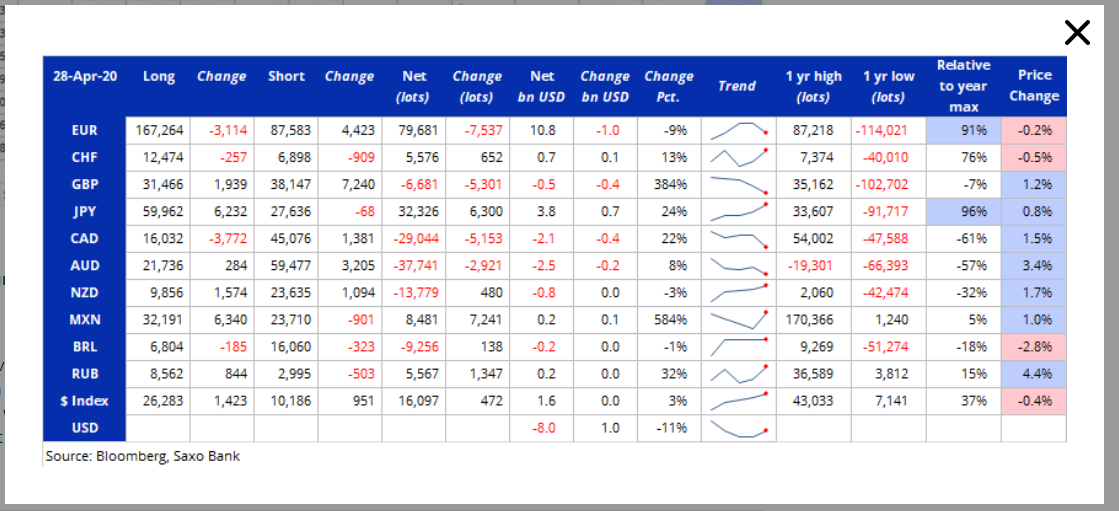

The latest Commitment of Traders report (week ended 28 April) saw speculators turn net buyers of US Dollar for the first time in nine weeks, according to SAXO Bank. Dollar shorts were trimmed for the first time in nine weeks. Net speculative Euro longs decreased although the total remained high.

We look at the breakdown in the currency reports below.

EUR/USD – Dismal Data, Spec Longs Weigh, Soggy US Dollar Supports

EUR/USD slumped 0.59% to finish at 1.0902 after trading to an overnight low at 1.08957. The Euro fell following the release of some dismal Euro area economic reports. The latest Commitment of Traders report saw a trimming of net speculative Euro long bets although the total remains near recent highs. Further Euro area reports are due today which will keep the shared currency under pressure.

The lone supportive factor for the Euro is the US Dollar’s relative weakness of its own. The highlight of this week’s events is the US Payrolls where the job losses are expected to be the worst ever.

Market positioning will continue to be a drag on the shared currency. We may be forming a range that is likely between 1.08-1.10.

EUR/USD has immediate resistance at 1.0935 followed by 1.0985 and 1.1015. Immediate support can be found at 1.0890 and 1.0860. Look to trade a likely range today of 1.0885-1.0985. Just trade the range shag on this one today.

AUD/USD – Holding Firm at 0.6420, RBA, Sino-US Tensions Eyed

The Australian Dollar held its overnight and one-week lows at 0.63726 after yesterday’s risk-off move saw stocks and Asian/EM currencies fall. The Aussie Battler rebounded to finish just under 0.6430, a modest gain from yesterday’s 0.6420. Australia began to slowly ease lockdown restrictions yesterday. The antipodean country is considered among the most successful in its battle against the coronavirus outbreak. This has been a supportive factor for the Battler in the past few weeks.

The RBA is widely expected to keep its key interest unchanged at an all-time low of 0.25%. After cutting rates twice in March the Australian central bank will see that its policy settings are fit as the country starts easing its Covid-19 restrictions. Escalating US-China tensions will be a limiting factor for any strong potential gains.

The latest COT report saw net speculative Aussie shorts increase to -AUD 37,741 from -AUD 34,820. AUD/USD downside support lies initially at 0.6370 followed by 0.6340. Immediate resistance can be found at 0.6460 and 0.6500. Look to trade a likely range today of 0.6385-0.6485. Prefer to buy dips.