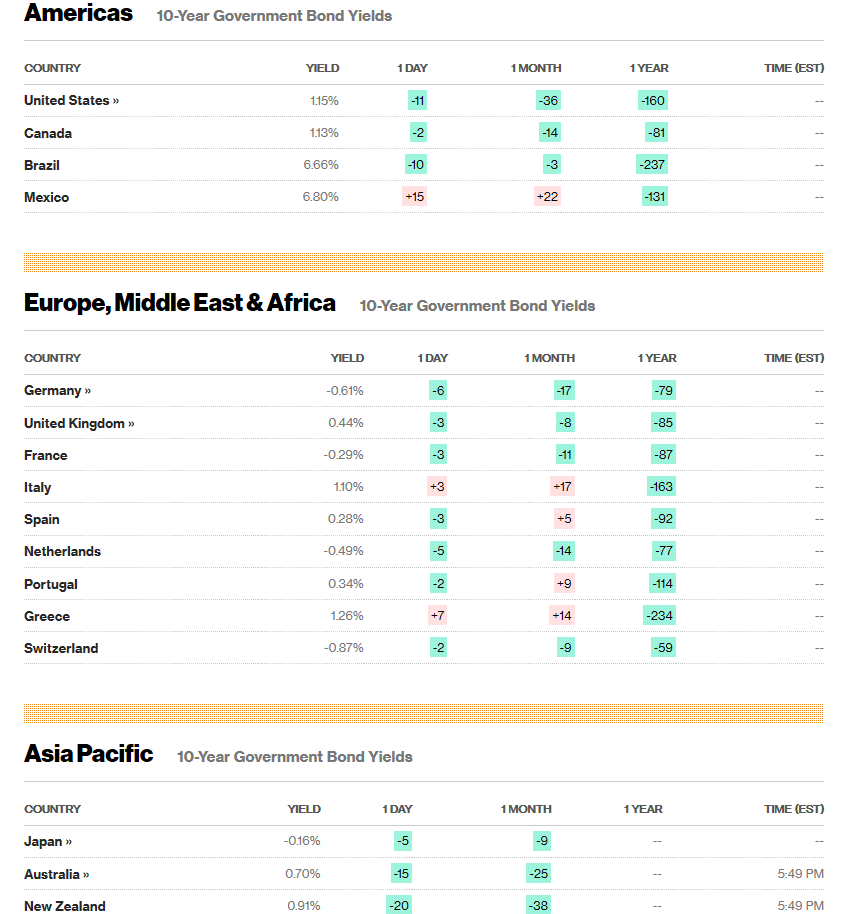

Summary: The Dollar Index (USD/DXY), a popular measure of the Greenback’s value relative to a basket of foreign currencies slid 0.4% to 98.12 (98.51) in late New York trade on Friday weighed down by comments by Jerome Powell. The Federal Reserve chairman said that the coronavirus “poses evolving risks to economic activity and “we will use our tools and act as appropriate to support the economy.” Earlier, President Trump called for the Fed to act and lower rates. China’s economy took a big hit from COVID-19. US bond yields took another hit, the benchmark 10-year rate slumping 11 basis points to 1.15%. Data on Saturday saw Chinese Manufacturing PMI plunged 35.7, against an expected 45.1 the lowest recorded. Non-manufacturing contracted to 29.6, the deepest ever, against forecasts of 51. The USD/JPY pair nosedived to an overnight and near 4-month low at 107.510 before rallying to settle at 108.05 at the NY close. The Australian Dollar dropped to 0.64338, overnight and fresh 11-year depths before rebounding to close at 0.6505 (0.6585 Friday). The Euro advanced 0.26% against the US Dollar to 1.1030 (1.1000 Friday). Sterling declined 0.6% against the Greenback to 1.2825 (1.2892). The British Pound lost ground against the Yen and Euro. GBP/JPY slumped 2.11% to 138.60 from 141.70 Friday.

Wall Street stocks recovered from their lows at the close after Powell’s comments and weekend position adjustments. The DOW ended flat at 25,550 while the S&P 500 bounced to 2,975.

Australia’s Private Sector Credit grew 0.3%, beating forecasts of 0.2%. Japan’s Housing Starts slumped -10.1% missing expectations of -5.8%. US Core PCE Price fell to 0.1%, missing forecasts at 0.2%. US Personal Spending fell to 0.2% in February from January’s 0.4%, and expectations of 0.3%.

Trading Perspective: The COVID-19 fallout continues to drive the markets. This time, however, the US Dollar is the likely victim. The odds have spiked for the Federal Reserve to cut interest rates which would weaken the Greenback with the US growth picture in focus. The plunge in US bond yields point to a March Fed rate cut. US President Trump in his address to the nation on the coronavirus update took a swipe at the Fed for “creating a very strong Dollar.” Lastly speculative long US Dollar market positioning has yet to see a meaningful correction. Which will worry Dollar bulls.

After Powell’s announcement, the week ahead will see further responses from global central banks.

The RBA policy meeting is scheduled for tomorrow and will be a crucial factor for the Aussie. Lastly speculative long US Dollar market positioning has yet to see a meaningful correction.

Today’s economic reports see a data dump with global and US Manufacturing PMI’s. China’s Caixin Manufacturing PMI will be closely monitored at its release today (12.45 pm Sydney time). This week ends with the US Employment report. Expect more fireworks ahead in FX.

EUR/USD – The shared currency advanced 0.26% to 1.1030 from 1.1000. Expect the Euro to continue its climb against the Greenback and Pound. EUR/USD hit an overnight high at 1.10531. Immediate resistance lies at 1.1050 followed by 1.1080 and then 1.1110. Immediate support can be found at 1.1000 and 1.0980. Look for the Euro to consolidate with a likely range of 1.1000-1.1050. Preference is to buy dips.

USD/JPY – The Dollar nosedived against the Yen to near 4-month lows at 107.51 before bouncing back to close at 108.05 in New York. USD/JPY opens at 107.75 in early Sydney. MNI news via Forex Factory reported just now that the BOJ may announce measures to stabilise markets ahead of Tokyo’s open. Measures include expanding special loans to support bank lending to companies and injecting fresh liquidity to the system. This will stabilise USD/JPY pair. Immediate support can be found at 107.50 followed by 107.20. Immediate resistance lies at 108.20 followed by 108.70. Look to trade a likely range of 107.50-109.00. Prefer to buy dips.

AUD/USD – The Aussie rallied to 0.6505 in late NY mostly on position squaring. This morning the Australian Dollar opens at 0.6485 after China’s dismal Composite PMI reports. The RBA is not comfortable with the Aussie’s slide on the dumping of global risk assets. Which may prevent them from cutting interest rates at their meeting tomorrow. An overall lower US Dollar will provide the support that the Aussie Battler needs in the current environment. Immediate support lies at 0.6460 and 0.6430. Immediate resistance can be found at 0.6510 followed by 0.6540. Look to trade a likely 0.6450-0.6550 range today. Prefer to buy dips.

GBP/USD – Sterling was sold off amid the selling frenzy ahead of the weekend to an overnight and mid-October low at 1.27258 before settling at 1.2824 in NY. GBP/USD opens at 1.2805 in early Sydney. Much of the pressure on the GBP/USD came from selling pressure on the Pound against the Eur. EUR/GBP soared to 0.8602 from 0.8525 on Friday. GBP/USD has immediate support at 1.2790 followed by 1.2750. Immediate resistance lies at 1.2850 and 1.2880. Look to trade a likely range of 1.2770-1.2870. Just trade the range shag on this one.

EUR/GBP – EUR/GBP soared to 0.8602 from 0.8525 on Friday. The trend remains higher on this cross although in the short term we can expect some consolidation first. EUR/GBP hit an overnight high at .86418. Immediate resistance lies at 0.8650 followed by 0.8680. Immediate support can be found at 0.8560 and then 0.8520. Look to trade a likely range today of 0.8550-0.8650.

GBP/JPY – Sterling plummeted a whopping 2.11% against the soaring Japanese Yen to 138.50 from 141.75 on Friday. GBP/JPY opens this morning in early Sydney at 137.80. There is immediate support at 137.50 which is the overnight low. The next support level lies at 137.00. Immediate resistance can be found at 138.70 and 139.30. Look to trade a likely range today of 137.50-139.00. Prefer to buy dips from current levels.

Have a good week ahead, happy trading all.