Summary: The Dollar ended on a mixed note with flow dictated by month-end fixing requirements, down against the Euro, up versus the Yen. Flow driven trading lifted the Euro 0.65% against the US Dollar to 1.0952 (1.0879). The ECB kept interest rates unchanged as expected and announced that there would be no QE expansion, disappointing Euro bears. Against the Yen, the Greenback rallied to 107.20 from 106.60, a gain of 0.45%. Commodity and Emerging Market currencies gave back their recent gains led by the Aussie which slumped 0.7% to 0.6510 after hitting 7-week highs at 0.65697 overnight. USD/CAD lifted to 1.3942 from 1.3885 despite another rise in Oil prices. Sterling soared to two-week highs at 1.2643 before easing to settle at 1.2590 (1.2470 yesterday).

US stocks slipped after the Labour Department reported that 3.84 million Americans filed for unemployment benefits last week, worse than forecasts of 3.5 million. Bloomberg reported that “while filings remain at levels unseen before the crisis, it’s the fourth week that the pace has decelerated, suggesting that the worst of the labour market hit may have already occurred.” Still a total of 30.3 million US workers have filed for benefits in the past 6 weeks. At the end of the trading day, President Trump said that the US trade deal with China has been “upset very badly” by the coronavirus. This saw risk appetite sour and lift the Dollar.

The DOW was 2.24% lower to 24,245 (24,745) while the S&P 500 lost 2.57% to 2,892 (2,959) at the New York close. The S&P 500 still had its best month since 1987, capping a remarkable run on expectations that the economy will start recovering soon. Global bond yields were mixed. The benchmark US 10-year rate was up one basis point to 0.64%. Germany’s 10-year Bund yield lost 9 basis points to -0.59%.

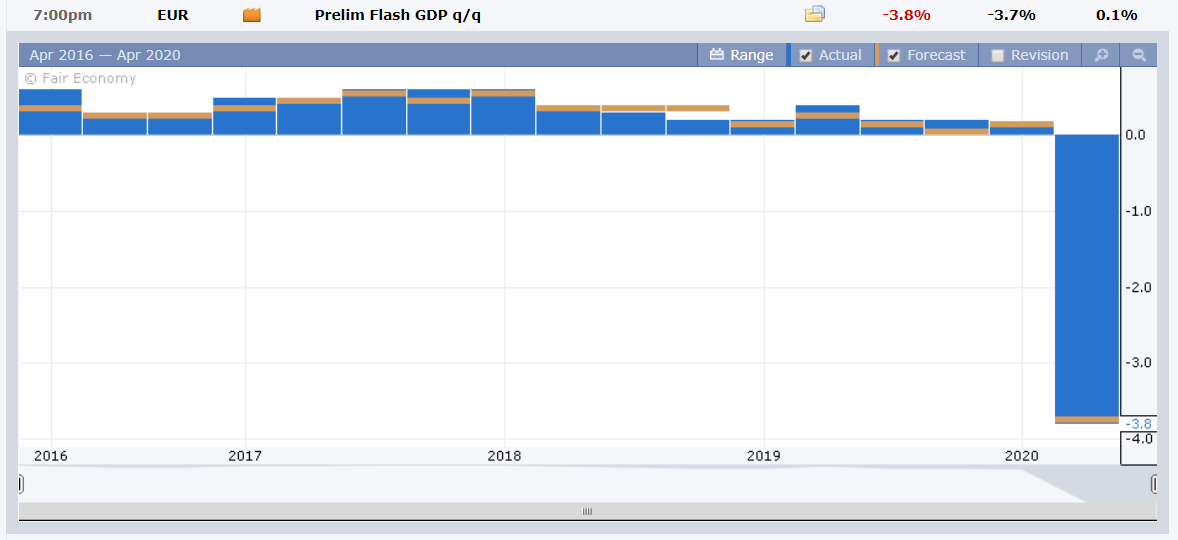

Other data released yesterday saw China’s Manufacturing PMI ease to 50.8 from 52.0, against forecasts at 51.0. Japanese Consumer Confidence slid to 21.6 from 30.9, missing expectations at 27.8. The Eurozone Preliminary Flash Q1 GDP slumped to -3.8% from 0.1% the previous quarter, worse than expectations at -3.7%. Canada’s February GDP dipped to 0.0% from 0.1%, missing forecasts at 0.2%. US Personal Spending fell to -7.5% from the previous month’s 0.2% and forecasts at -4.8%.

On the Lookout: The spotlight remains on the global efforts to ease restrictions and reopen their economies. The coronavirus epidemic forced governments to shut down in an effort to contain the spread. Markets though were optimistic and risk appetite stayed strong, resulting in a slide for the US Dollar. The Dollar Index (USD/DXY) a favoured gauge of the Greenback’s value against a basket of 5 major foreign currencies slipped from March highs at 102.95 to 99.03 yesterday.

Chinese and European centres are closed today to celebrate their May Labour Day holiday. Data releases kick off today with Australia’s AIG and Commonwealth Manufacturing Index’s, Commodity Prices, New Home Sales and Q1 PPI reports. Japan follows with its Tokyo Core CPI and Final Manufacturing PMI data. European data begin with the UK reports on its Final Manufacturing PMI, Mortgage Approvals, and Net Lending to Individuals. Canada reports on its Manufacturing PMI. Finally, US Final and ISM Manufacturing PMI, Construction Spending and its Wards Total Vehicle Sales round up the day’s reports.

Trading Perspective: Today should see further consolidation in Asia as we enter a new month. President Trump’s comments that he could use tariffs to respond to China has put a bid on the Dollar. The souring of risk appetite will weigh on the Commodity and Emerging Market currencies.

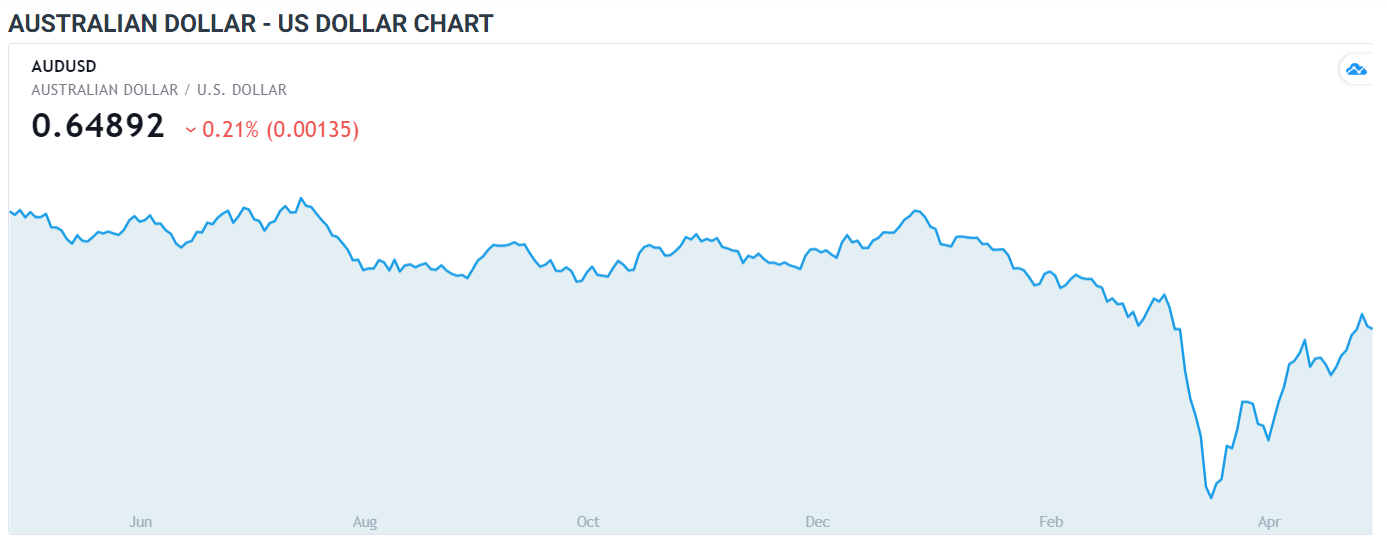

AUD/USD – Losing Its Lustre as Trade Fears Re-emerge, 0.6530 Caps

The Australian Dollar plunged in early Asia to 0.64831 from its 0.6515 New York close after comments from US President Trump that he could use tariffs to respond to China. The Aussie Battler pulled back after trading to fresh 7-week and overnight highs at 0.65697. The Battler’s remarkably run has ended for the time being. The 0.66 cent barrier will remain hard to crack.

Today’s Australian data saw the release of the AIG and Commonwealth Bank Manufacturing PMI’s for April. Both printed lower with AIG’s PMI down to 35.8 from 53.7, while the CBA Manufacturing Index dipped to 44.1 from 49.7. Later today Australia reports on New Home Sales and Q1 PPI. New Home Sales for February were steady at 6.2%. A fall much lower than this will see pressure on the Aussie.

AUD/USD has immediate resistance at 0.6530 followed by 0.6560. The big resistance level is at 0.6600 cents. Immediate support can be found at 0.6470 and 0.6440. Look for a likely range today of 0.6430-0.6530. Prefer to sell rallies toward 0.6530.

EUR/USD – Month-End Flows Provide Lift, Tone Stays Weak, 1.08-1.10

The Euro got a lift on month-end demand flows and the ECB decision to keep its main refinancing rate unchanged while announcing that there would be no QE expansion as some had anticipated. EUR/USD closed at 1.0952 in late New York after trading to an overnight high at 1.09725, just short of the 1.1000 strong resistance level. The ECB said that they were prepared to increase the size and adjust the composition of its pandemic emergency bond purchase program (PELTRO). ECB President Lagarde has expressed her worry that the Eurozone economy see a 12% contraction in 2020.

We highlighted earlier this week that net speculative Euro long bets increased to the biggest since June 2018. This will keep a barrier to any topside moves on the Euro for now. EUR/USD has immediate resistance at 1.0975 followed by 1.1000. The next resistance can be found at 1.1030. Immediate support lies at 1.0900 followed by 1.0870. Look for the Euro to trade in a likely 1.0830-1.0960 range today. Prefer to sell rallies.

USD/CAD – Rebounds Off 1.3850 Despite Strong Oil, 1.4050 Beckons

The US Dollar rallied off an overnight and 6-week low against the Canadian Loonie at 1.38502 to 1.3942 in late New York, a gain of 0.48%. Despite the overnight climb in West Texas Intermediate Oil (WTI) by 28%, the USD/CAD pair followed the lead of other commodity currencies. Canada’s February GDP report was little changed with a 0.0% print (from 0.1%). The report was prior to the country’s lockdown. The key data for the Canadian Loonie is next week’s Canadian Payrolls report.

USD/CAD currently trades slightly higher at 1.3959 in Asia on renewed fears of a trade war between the US and China following President’s Trumps comments. The strong rebound in the US Dollar against the commodity currencies (AUD, NZD) should see the USD/CAD trend higher.

USD/CAD has immediate resistance at 1.3970 followed by 1.4010 and 1.4050. Immediate support can be found at 1.3930 followed by 1.3870. Look for a likely grind higher with a likely range of 1.3920-1.4050 today.