Summary: The Dollar Index (USD/DXY), a popular gauge of the Greenback’s value against a basket of foreign currencies dipped while Wall Street stocks rose for the 4th straight day to hit record highs. The trade deal between the US and China, which was agreed over the weekend saw risk appetite soar. Top US Economic Advisor, Larry Kudlow, said that US exports to China would double with the current deal. US bond yields moved up with the 10-year rate settling at 1.89% (1.83%). FX though, was indecisive and cautious, which depressed the Dollar Index (USD/DXY) 0.15% lower to 97.025. The Euro advanced to 1.1147 (1.1120) despite a stagnation in Euro area Manufacturing activity. Sterling settled at 1.3348, (1.3335 yesterday) with the Brexit uncertainty out of the way. The Australian Dollar rallied against the cautious Greenback to 0.6892 (0.6877). The Dollar lifted against the Yen to 109.62 (109.38) on the higher risk appetite and US bond yields. The latest Commitment of Traders report (week ended December 10) saw speculative long US Dollar bets fell for the first time in 5 weeks. The driver was short covering in the Pound, Yen, Euro, New Zealand Dollar and Swiss Franc.

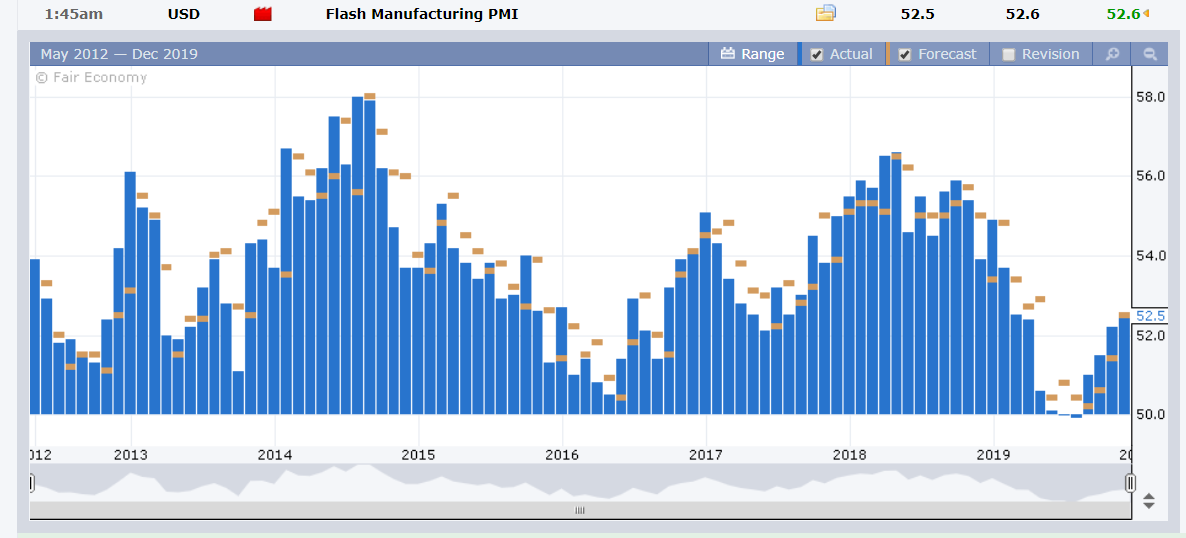

Against these currencies, total long Dollar positions fell by USD 1.7 billion to a total of USD 20.5 billion. Data released yesterday was China’s Industrial Production climb to 6.2%, beating forecasts of a 5.1% gain. Chinese November Retail Sales rose to 8.0% from 7.2% in October. Euro area Flash Manufacturing PMI’s (France, Germany and the Eurozone) were all lower than median forecasts while their Services PMI’s mostly beat expectations. UK Flash Manufacturing PMI underwhelmed with a 47.4 print, missing forecasts of 49.1. Services PMI in the UK was also lower than expected at 49.0 against 49.6. US Flash Manufacturing PMI steadied with a 52.5 print against median forecasts of 52.6 while Services rose to 52.2 beating estimates of 52.0.

- EUR/USD – The Euro finished up 0.27% at 1.1147 (1.1120) with short covering supporting the shared currency against a tentative Greenback. EUR/USD trading was confined to a relatively tight 1.1123-1.1158 range.

- GBP/USD – Sterling closed at 1.3348 from 1.3335 after the British currency touched a high at 1.35111 immediately following the election results. The Pound kept its bullish tone even as speculative GBP shorts continued to cover.

- AUD/USD – The Australian Dollar advanced to 0.6892 from 0.6875 supported by the market’s strong risk sentiment.

- USD/JPY – The Dollar closed 0.25% higher against the Yen to 109.65 from 109.37. Japan’s 10-year JGB yield was unchanged at -0.03% while its US counterpart rose 6 basis points.

On the Lookout: Today sees limited economic data with the UK Employment report the main event. While risk appetite is elevated, key details from the “Phase-One” trade deal between the US and China are still unclear. Most of this is on a critical point, agricultural purchases. While US trade representative Robert Lighthizer told reporters that China would buy at least USD 16 billion more US agricultural products while Chinese officials were reluctant to mention any specific target in their press conferences according to a CNBC report. FX will keep an eye on upcoming press releases.

Data released today start with New Zealand’s Westpac Consumer Sentiment, and ANZ Business Confidence Index. In Australia, the RBA releases the minutes of its last policy rate meeting. Australia’s November Home Loans report follows. Europe opens with Italy’s Trade Balance. The UK reports on its Claimant Count Change (number of people claiming unemployment benefits), Average Earnings (Wages) and Unemployment Rate for November.

Trading Perspective: Despite higher US bond yields and a steadying of US business activity (US Manufacturing and Services PMI), the Dollar dipped against most of its Rivals. The Dollar Index (USD/DXY) finished 0.15% lower to 97.025. This is the result of a trimming of net long US Dollar bets against the Pound, Euro, Yen, Kiwi and Swiss Franc. The main FX driver this last week of full trading week of 2019 is market positioning. A breakdown of currencies from the latest Commitment of Traders report (week ended December 10) saw the biggest short covering in the Pound and the Yen. This was followed by the New Zealand Dollar, Euro and Swiss Franc. The Australian Dollar was little changed with a small gain in net Aussie short bets. The Canadian Dollar continues to be the only major currency where the speculators are long.

- EUR/USD – The shared currency finished up 0.27% after falling to a low at 1.11075 over the weekend and 1.11227 overnight. The latest COT report saw speculative Euro short bets trimmed to -EUR 67,643 from -EUR 69,049. The net total short is still hefty and this should support the Euro this week. Immediate support lies at 1.1125 followed by 1.1105. Immediate resistance can be found at 1.1160 (overnight high at 1.11581). Without any major Euro area data today look for a likely range of 1.1130-1.1180. Prefer to buy dips.

- GBP/USD – Sterling settled into a range between 1.33211 and 1.34220 after its big moves into, over and just after the weekend on the election. The British Pound saw the largest reduction of shorts in the latest COT report. Net speculative GBP shorts were cut by a whopping GBP 7,411 contracts to a total of -GBP 22,639 (-GBP 30,050). Sentiment still favours the Pound although this writer would be cautious between 1.35 and 1.37. For today, the immediate resistance can be found at 1.3380 and 1.34230. Immediate support lies at 1.3320 followed by 1.3280. Look to trade a likely range today of 1.3280-1.3410. Just trade the range shag on this one.

- AUD/USD – The Aussie advanced to 0.6892 from 0.6875 on the improved risk sentiment. The latest COT report saw little change in Aussie Dollar positioning. Net short Aussie bets were a touch higher at -AUD 36,808 in the week ended December 10 from -AUD 36,433 the previous week. A weaker US Dollar could see the Aussie gain further above 0.69 cents. Today sees the RBA’s last policy meeting minutes released. FX will look for further clues of any rate cuts in 2020 from the Australian central bank. Immediate resistance on the Aussie lies at 0.6900 followed by 0.6940. Immediate support can be found at 0.6860 (overnight low 0.6863) followed by 0.6830. Look for a likely range today of 0.6860-0.6910. Prefer to buy dips.

- USD/JPY – The Dollar rallied to 109.62 Yen from 109.35 on the markets improved risk sentiment and higher US bond yields. The latest COT report saw net speculative JPY shorts trimmed to -JPY 43,682 contracts from -JPY 47,823, which is a reduction of JPY 4,141 bets, the second largest cut next to Sterling. For today, immediate resistance lies at 109.70 (overnight high 109.675) followed by 110.00. Immediate support can be found at 109.30 (overnight low 109.273) followed by 109.0. Look for a likely trading range today of 109.30-109.70. Prefer to sell rallies.

Happy trading all.