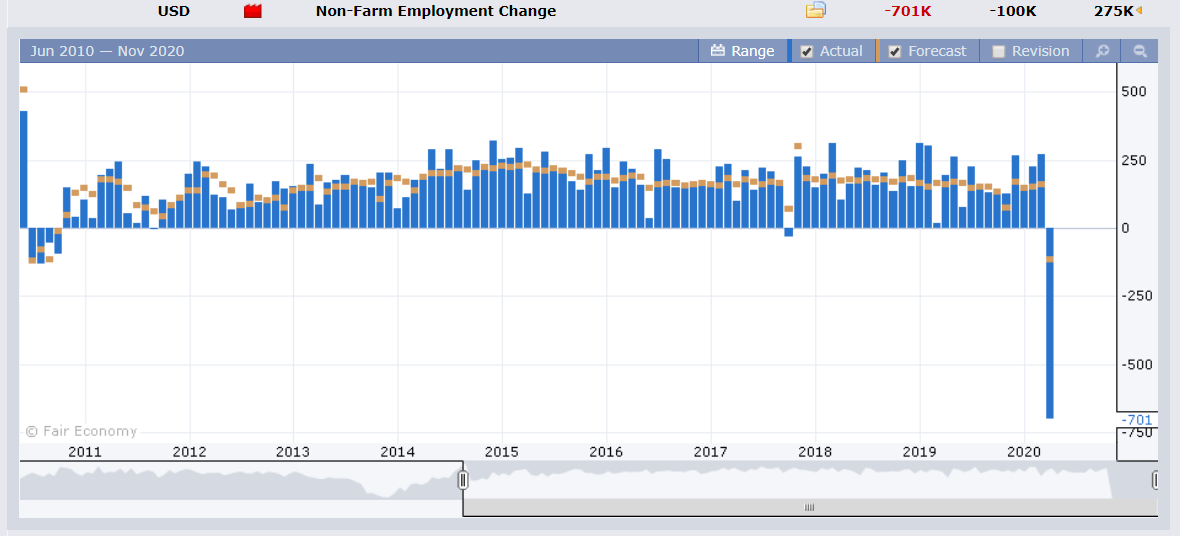

Summary: The Dollar Index (USD/DXY), a favoured gauge of the Greenback’s value against a basket of major currencies, extended it’s 3-day rally as the coronavirus spread continuing to take its toll on global economic developments. A risk-off theme pervaded which supported the US Dollar despite a massive -701,000 Payrolls drop for the first two weeks of March. Economists were looking for a fall of -100,000. The Unemployment rate jumped to 4.4% from 3.5%, higher than forecasts of 3.8%. The Euro extended its fall for the fifth day to 1.0815 (1.0850) on downwardly revised Euro area PMI’s and the overall stronger US Dollar. The Australian Dollar slid 1.3% to end at 0.5995 in late New York, leading all risk currencies lower. Against the Canadian Loonie, the Dollar advanced 0.45% to 1.4205 (1.4178) despite a 15% bounce in Brent Crude Oil prices to USD 35.10. Sterling dropped to 1.2270 from 1.2390. The Dollar was higher against the Yen to 108.45 from 107.95. Stocks slipped. The Dow fell 1.5% to 21,060 while the S&P 500 was 1.4% lower to 2, 492. The 10-year US bond yield fell two basis points to 0.59%. In early Asia the Dollar eased modestly as the latest health developments saw New York fatalities fall for the first time, Italy had the fewest deaths in over two weeks, Spain’s tally fell for the 3rd day running, and France reported the lowest number in 5 days. Meantime UK Prime Minister Boris Johnson has been hospitalised following ten days of self-isolation after he tested positive for Covid-19. BBC reported that Johnson “continues to have persistent symptoms of coronavirus.” Other data on Friday saw German Services PMI fall to 31.7, missing forecasts at 34.3. The Eurozone Final Services PMI slipped to 26.4, lower than expectations of 28.2. China’s Caixin Services PMI rose to 43.0 in March from 26.5 February, beating forecasts at 39.6.

On the Lookout: The massive fall in US Payrolls will only get worse in April as the U.S. did not go into full lockdown until the middle of March. While the European services PMI’s were lower and all of them missed forecasts, the extent of their fall was nowhere near the magnitude of the US data. Looking ahead, US economic reports should be negative for the US Dollar.

The only major US economic reports this week will be Thursday’s US CPI. The FOMC meeting minutes are due early Thursday morning (Sydney time). The week ahead sees the RBA (tomorrow) and ECB rate policy meetings (early Thursday morning). Today’s calendar is light. New Zealand kicks off with its ANZ Commodity Prices while Australia releases its ANZ Job Ads. Germany reports on its Factory Orders. Eurozone Sentix Investor Confidence data follow. UK Construction PMI’s round up the day’s reports.

Trading Perspective: The Dollar continues to strengthen despite the abysmal US Payrolls report and a weaker cross-currency swap loan demand. While the Greenback keeps drawing much of its strength from risk aversion, let’s not forget that the market’s positioning had turned short of US Dollars from the latest Commitment of Traders report. FX volatility remains elevated which is the one constant regardless of the Dollar’s direction. Marc Chandler, writer of Marc to Market, who has been covering global capital markets for more than 30 years wrote over the weekend while volatility remains high, we need to appreciate the change in the level of volatility over the past two months. Higher volatility requires lower confidence in demand (support) or resistance (supply). Nothing is obvious, which makes management difficult. One needs to be more flexible, and aware of levels.

The Bloomberg chart attached shows the change in implied volatility of the G10 currencies.

EUR/USD – Bearish Start, as More Longs Bail; 1.0750-1.09 Likely

The Euro extended its five-day slide as more speculative long bets bailed against the overall stronger US Dollar. The risk aversion theme once again supported the Greenback against most of its rivals, in the majors, risk and EM currencies. The abysmal US Payrolls report was offset by weaker Euro area Services PMI’s (Spain, Italy, France and Germany) as well as the Eurozone itself.

The week ahead sees the ECB rate policy meeting (early Thursday morning, Sydney). Today sees German Factory Orders and the Eurozone Sentix Investor Confidence report. Last week we highlighted the speculative market positioning saw a large increase in net Euro long bets to +EUR 61,290 contracts from -EUR 32,495. This accounted for the bulk of net speculative USD shorts. This is another reason why the Euro could not sustain its upticks.

EUR/USD has immediate support at 1.0770 (overnight low 1.07727) followed by 1.0750. A clean break of 1.0750 could see 1.0700 and 1.0650. Immediate resistance lies at 1.0850 followed by 1.0900. Look for a likely range today of 1.0750-1.0900 first up.

USD/JPY – Lifts on Nikkei Outflows, 10-Year US Yield Caps; 107.50-109.

Despite the market’s risk-off stance the USD/JPY pair has rallied in the past two trading days off last week’s low at 106.92. April saw a new fiscal year for Japanese investors who have sold massive amounts of stocks and bonds since the March 31 fiscal year end. USD/JPY closed at 108.45 in New York, trading to a high at 108.68, March 31 highs. Overnight low traded was 107.801.

The Commitment of Traders report (week ended 24 March) saw speculative JPY long bets cut to +JPY 23,863 from +JPY 32,935 the previous week. The relative smaller size of positioning in the JPY explains why it’s the 6th in terms of implied volatility change in the chart at 10.45. In the past, USD/JPY has shown more extreme volatility. Its likely that we will see more volatile times ahead for this currency pair.

USD/JPY has immediate resistance at 108.70 followed by 109.00. The next resistance level can be found at 109.30. Immediate support lies at 108.30 and 107.80. Look for a likely range today of 107.80-108.80. Prefer to sell rallies from here.

AUD/USD – Struggling to Hold 0.6000, 0.5970-0.6100 Likely

The Aussie slumped 1.3% to 0.5995 at the close of New York, weighed by the stronger Greenback and risk aversion theme. AUD/USD led the risk currencies (NZD, CAD) lower. Most Emerging Market currencies were also weaker against the Greenback. Upbeat China Caixin Services data failed to lift the Aussie as doubts remain as to the accuracy of Chinese data.

We reported last week the short Aussie speculative bets were trimmed further to -AUD 25,207 from -AUD 28,733 contracts. Trading in the Australian Dollar remains highly volatile. In the Bloomberg Implied Volatility chart, the Australian Dollar is second to the Norwegian Krone at 15.30. Expect more of this ahead as the Aussie has always been a volatile currency.

AUD/USD has immediate support at 0.5970 which is followed by 0.5940. The next support levels lie at 0.5900 and 0.5860. Immediate resistance can be found at 0.6075 followed by 0.6110. Look for a likely range today of 0.5950-0.6100 today. The Battler feels heavy, but then again, it always does near its short-term support levels. Let’s not forget the US Dollar is the other side of the AUD/USD trade, and we can only expect worse US economic data in the weeks ahead.