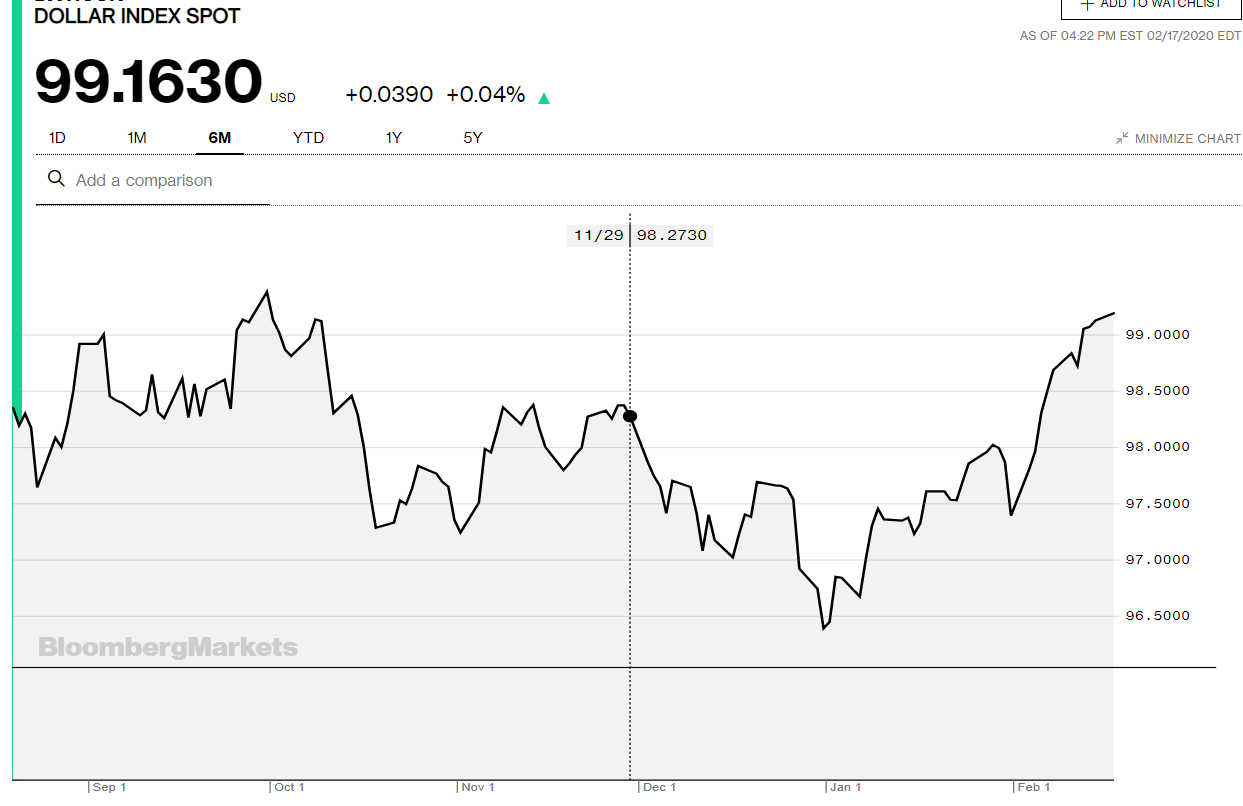

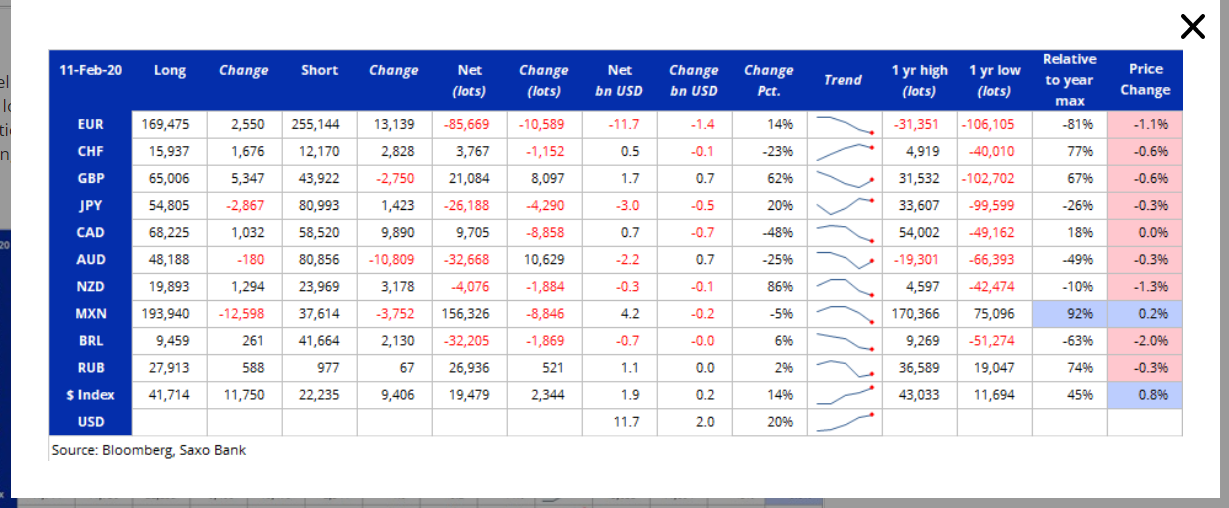

Summary: Steady buying in slow trade amidst a holiday in the US lifted the Dollar Index (USD/DXY) 0.04% to 99.17 (99.15 yesterday), its highest finish in 2020. The Euro ended little changed at 1.0835 not far off its lows (1.0829) as bearish sentiment continued to weigh on the shared currency. The Dollar rebounded against the Yen to 109.95 (109.78) after data revealed that Japan’s economy shrank at the fastest pace in almost six years in Q4 2019. Sterling slipped 0.33% in thin trading to 1.3000 (1.3045) on growing uncertainty on the upcoming budget and the future of the UK/EU relationship. The Australian Dollar closed at 0.6717 from 0.6713 ahead of today’s release of the RBA’s latest meeting minutes. FX positioning as revealed by the latest Commitment of Traders/CFTC report (week ended 11 Feb) saw net speculative Euro short bets climb to -EUR 85,669 lots, the equivalent of -EUR 10.7 billion. Steady Dollar buying was notable against the Yen, Swiss Franc, New Zealand and Canadian Dollar. Sterling and the Australian Dollar were exceptions.

China moved to calm investors of the economic hit from the coronavirus outbreak by adding monetary stimulus with the promise of more to come. Equities rose. The DOW gained 0.2% to 29,470. The S&P 500 closed higher to 3,390, up 0.23%.

Japanese Preliminary Q4 2019 GDP fell by 1.6%, more than the 1.0% expected.

- EUR/USD – the shared currency languished near its overnight lows, closing at 1.0834 (1.0832 yesterday). Sentiment on the Euro remains decidedly bearish with the currency not far from its 2020 low of 1.0826.

- USD/JPY – The Dollar reversed its drop after the Japanese economy shrunk more than expected in the December quarter. Concerns that the coronavirus effects will hurt output and tourism weighed on the Yen.

- GBP/USD – Sterling slipped to the 1.3000 support level after holding steady since late last week following the resignation of Javid as Chancellor or the Exchequer. Which opened the door to and increase in fiscal spending. Over the weekend, France’s foreign minister Le Drian warned that the UK and EU would “rip each other apart” in the trade talks due to begin next month.

On the Lookout: Events and economic data reports pick up today as US markets return from their holiday. The RBA’s latest meeting minutes are revealed in Sydney (11.30 am Sydney time). Euro area reports begin with the UK’s Average Earnings Index (Wages), Claimant Count Change (Unemployment Claims) and Unemployment Rate. Germany reports on its ZEW Economic Sentiment. Canadian Manufacturing Sales open the reports for North America. The US rounds up the day with its Empire State Manufacturing Index, NAHB (National Association of Homebuilders) Index and TICS (US Treasury Net Long-Term Securities Transactions) Long Term Purchases.

Trading Perspective: Bullish USD sentiment due to the economic resilience of the economy has fuelled steady Dollar buying since the start of the year. The latest COT report attests to this. Most of the USD buying has been against the Euro. Despite this fact, the differential between long term US rates and those of its global rivals has in fact narrowed rather than increased. For example: Ten-year US bond yields against German 10-Year Bund rates were 1.87% vs -0.23% on 3 January. Yesterday they were 1.58% vs -0.40%. The differential has narrowed significantly from 1.64 basis points to 1.18 bp. Yet the speculators continue to increase their Euro shorts. Experience tells me as an old-time FX trader that without yield support, the Dollar cannot continue to climb. The risk is for a Greenback correction lower. And a Euro rebound.

- EUR/USD – The Euro closed little changed at 1.0835 after trading to an overnight low of 1.0829, 3 points higher than its 2020 low of 1.0826 seen yesterday. EUR/USD traded to 1.08510 overnight high. Immediate support lies at 1.0825 followed by 1.0800. Immediate resistance can be found at 1.0850 and 1.0880. The latest COT report (week ended 11 Feb) saw net speculative Euro shorts increase to -EUR 85,669 bets, or the equivalent of -EUR 10.7 billion. That’s a 1.1% sell-off in the latest week. The signs are there for a bounce in the Euro. Look to buy dips with a likely range today of 1.0830-1.0880. A bounce is in the making.

- GBP/USD – Sterling slipped after climbing in the past 3 trading days following the resignation of Chancellor Javid. Markets saw this as an opportunity for an increase in fiscal spending in the UK budget. However, the rise of political tensions between the UK and EU undermined the Pound and may continue to do so in the future. Unlike the Euro, the speculators are long of Sterling bets. The latest COT report saw speculative GBP long bets increase to +GBP 21,084 contracts (week ended 11Feb) from the previous week’s +GBP 12,987. GBP/USD has immediate resistance at 1.3040 and 1.3070. Immediate support lies at 1.2990 followed by 1.2960. Look to trade a likely range today of 1.2970-1.3030.

- AUD/USD – The Australian Dollar closed at 0.6716 from 0.6713 yesterday. The Aussie Battler has been supported by short covering this past week. The latest COT report saw net speculative Aussie short bets trimmed to -AUD 32,668 from -AUD 43,297. That’s a bit of a haircut. The RBA releases the minutes of its latest meeting later this morning. Expect the downside to be supported on dips from continuous short covering. AUD/USD has immediate support at 0.6710 followed by 0.6680. Immediate resistance lies at 0.6730 followed by 0.6760. Look to buy dips in a likely trading range of 0.6700-40.

Happy trading all.