Summary: The Dollar traded within well-worn ranges with differing FX outcomes. A risk-off stance pervaded at the close of US markets on Friday, pushing Wall Street stocks and US yields lower. A Chinese trade delegation cancelled scheduled visits to farms in the states of Montana and Nebraska, following 2 days of trade talks in Washington. Markets concluded that both protagonists in the trade war were no closer to a comprehensive agreement. A late breaking Bloomberg report said a Chinese official shrugged off the farm tour cancellation saw risk come back a touch. Geopolitics remained shaky after Saudi Arabia warned Iran that any strike would amount to war following last week’s oil field attacks. The US Dollar fell against the Yen (107.70 from 108.05) and Swiss Franc (0.9915 from 0.9932). Against the Offshore Chinese Yuan, the Dollar was initially higher (7.12 against 7.10). The latest news saw USD/CNH fall back to 1.10. The Australian Dollar fell 0.47% to 0.6762 from 6792. It’s smaller cousin, the Kiwi slumped 0.7% to 0.6260 (0.6300), fresh 4-year lows. New Zealand’s RBNZ meets on interest rates this week. The Euro dipped to 1.1015 from 1.1040 while Sterling fell back to 1.2472 (1.2522). Equities were sold at the New York close while futures rose in Sydney. US bond yields dropped. The benchmark US 10-year rate finished at 1.72% (1.78%).

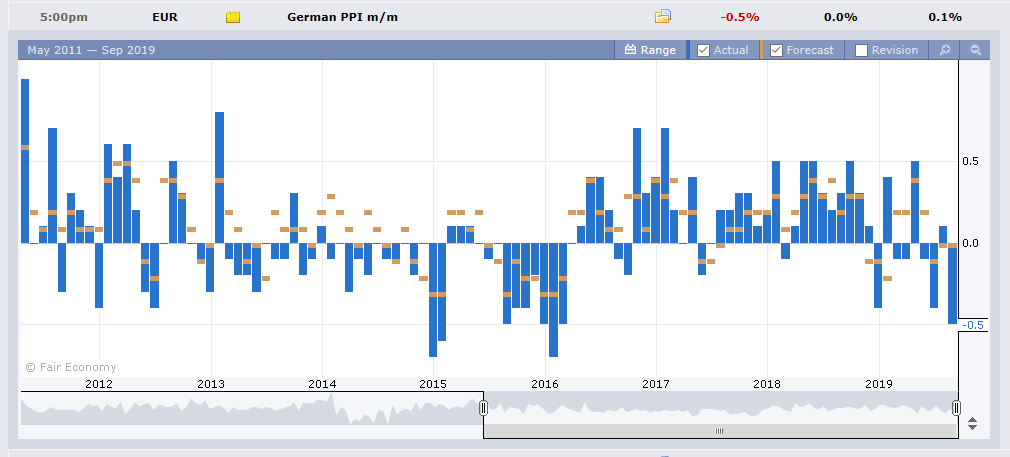

Germany’s Producer Prices fell to -0.5% in August, missing forecasts at 0.0%.

Tokyo markets are closed today in observance of its Autumnal Equinox Day.

- USD/JPY – The Dollar slumped at the New York close at 107.52, from 108.05 as risk aversion crept into the markets on Friday. In early Sydney, USD/JPY steadied in early Sydney as Chinese officials shrugged off the US farm tour cancellation, saying it had “no effect” on trade talks.

- EUR/USD – The shared currency drifted lower within well established ranges to 1.1015 from 1.1040. Worse than expected German Producer Prices and risk-off from lack of trade talk progress between China and the US weighed on the Euro.

- NZD/USD – The Kiwi plunged to overnight and fresh 4-year lows at 0.62549, settling at 0.6265 in early Sydney, and 0.6300 Friday. The RBNZ holds its policy meeting this week (Wednesday) with 25% chance of a rate cut.

On the Lookout: Risk-off, risk-on, and the market’s initial reactions said it all this morning. Bloomberg reported that Chinese Business News reported that Vice Agricultural Minister Han Jun said that their withdrawal from a planned US farm tour visit “had nothing to do with trade talks”. Wall Street stock futures rose on the news, while the Dollar edged back to 107.72 Yen from 107.52. USD/CNH fell back to 7.10 after spiking to 7.12. On Friday the Dollar was changing hands at 7.1030 Offshore Chinese Yuan.

Seems like many of us have experienced this scene from China before. Markets will stay alert, remaining on edge. At the end of the day, the Dollar traded within well-worn ranges with FX subdued.

Today sees Japanese Flash Manufacturing data (despite the Tokyo holiday). Euro area Flash Manufacturing and Service data follow with Germany, France and the Eurozone reports. ECB President Mario Draghi addresses the European Parliament’s Economic and Monetary Affairs Committee in Brussels. The UK releases its Conference Board Industrial Orders Expectations (August). US Flash Manufacturing and Services reports round up the day’s data release. FOMC officials Williams and Bullard have speaking engagements.

Trading Perspective: While the Dollar Index (USD/DXY) ended up 0.19% to 98.462 (98.369 Friday), its overall performance was mixed against FX rivals. The US 10-year bond yield dropped 6 basis points to 1.72% (1.78% Friday). Rival note yields were mostly unchanged. This will keep the Dollar’s topside limited despite the market’s general risk-off stance.

The Kiwi was Friday’s biggest mover amongst the majors. NZD/USD plunged to fresh 4-year lows at 0.62549 before recovering to 0.6265 in Sydney. This time it was the Kiwi that dragged the Aussie lower. The RBNZ meets this week with interest rate traders seeing a 25% likelihood of a rate cut. Last week’s Commitment of Traders/ CFTC report saw speculative Kiwi shorts total -NZD 29,790 contracts which is 84% of the year’s highest short contracts. It is in a similar position to where the Aussie was a few months ago. The risk therefore is north for the Kiwi. Particularly if US bond yields continue to slide.

- NZD/USD – Having slumped to fresh 4-year lows on the overall bearish sentiment ahead of this week’s RBNZ policy meeting and the market’s general risk aversion, the Kiwi settled at 0.6267, currently. NZD/USD traded to a low at 0.62549 in New York. Immediate support lies at 0.6250 followed by 0.6220. Immediate resistance can be found at 0.6290 and 0.6320. With the speculative market positioned short near yearly highs, prefer to buy dips in a likely 0.6250-0.6300 range.

- EUR/USD – The Euro dipped to 1.1019 from1.1040, down 0.3%. The worse-than-forecast drop in German producer prices and overall risk aversion weigh on the shared currency. EUR/USD traded to an overnight low at 1.09962 before climbing to settle at 1.1019, where it currently sits. EUR/USD has immediate support at 1.1000 followed by 1.1080. Immediate resistance lies at 1.1040 and 1.1070 (overnight high at 1.1070). Today sees Euro area PMI’s. ECB outgoing President Mario Draghi address the European Parliament on Economic and Monetary Policy in a speech in Brussels. Look for a likely trading range today of 1.0995-1.1055. Prefer to buy dips.

- USD/JPY – With Tokyo out today, expect subdued trading in the Dollar. However Japanese banks operating in Asia will have access to their head-office order books, which can be huge. USD/JPY has immediate resistance at 107.80 followed by 108.10 (overnight high 108.08). Immediate support can be found at 107.50 (overnight low 107.526) followed by 107.20. With US 10-year yields lower and the general risk aversion, look to sell USD/JPY rallies in a likely 107.30-107.80 range.

- AUD/USD – The Aussie fell in tandem with the Kiwi, ending down 0.47% at 0.6765 (0.6795). The statement from China’s Agricultural Minister on the cancelled US farm visits saw stock futures and the USD/JPY rally. However, the Aussie didn’t move much, currently sitting at 0.6768 from 0.6765. AUD/USD traded to an overnight low at 0.6760, which is immediate support. The next support level comes in at 0.6730. Immediate resistance lies at 0.6790 followed by 0.6810 (overnight high 0.6809). Look to buy dips in a likely 0.6760-10 range.

Have a good week ahead all, happy trading.