Vancouver – The British Columbia Securities Commission (BCSC) has reached a settlement with Genus Capital Management Inc. for misusing client brokerage commissions.

Vancouver – The British Columbia Securities Commission (BCSC) has reached a settlement with Genus Capital Management Inc. for misusing client brokerage commissions.

As part of the settlement, Genus, an investment management firm based in Vancouver, agreed to repay $1.67 million to current and former clients. All current clients will be repaid in the form of management fee credits; former clients will receive cash refunds. The firm also will pay $350,000 to the BCSC.

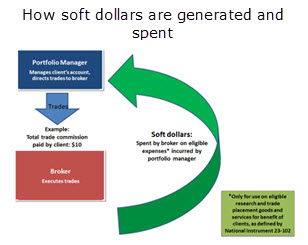

The misuse of commissions involved “soft dollars” – credits provided by a broker to an investment manager, like Genus, in return for executing trades on behalf of the manager’s clients. The credits are part of the brokerage commission paid by the investment manager’s clients. If appropriately disclosed, the investment manager may use the credits for eligible expenses, such as research services that benefit clients.

Genus admitted that between 2009 and 2016 it used $1.67 million in soft dollars to pay for the development of in-house software, and then transferred the software to a company in exchange for part-ownership of that company and a permanent license to use it.

A relative of a member of the Genus leadership team was involved with the two companies that Genus paid with soft dollars to develop the software, and the third company that bought the software from Genus.

Although soft dollars can be used to buy existing software for placing orders and research, the development of software is not a permitted use. Transferring the software to another company in exchange for part-ownership of the company was a failure to deal fairly with clients. The involvement of a relative of Genus’s leadership team in the software development and subsequent transfer represented conflicts of interest that should have been disclosed to clients. All of these were violations of securities laws.

Genus has paid the BCSC the first installment of $87,500 and agreed to pay the remainder within four years. The clients and former clients must also be paid over the next four years.

In addition to those payments, Genus must disclose the compliance failures to its current and former clients, and hire an independent compliance monitor for at least one year to review their soft dollar and conflicts of interest practices.

Genus has a history of compliance failures. In 2012, it agreed to a settlement with the BCSC over its failure to file exempt distribution reports, and in 2016, the BCSC required the firm to hire an external compliance monitor for a year after finding several violations during a review.

About the British Columbia Securities Commission (www.bcsc.bc.ca)

The British Columbia Securities Commission is the independent provincial government agency responsible for regulating capital markets in British Columbia through the administration of the Securities Act. Our mission is to protect and promote the public interest by fostering:

- A securities market that is fair and warrants public confidence

- A dynamic and competitive securities industry that provides investment opportunities and access to capital