The public consultation on Open Banking launched by the Bank of Lithuania drew considerable expert attention and provided constructive feedback. Therefore, the Bank of Lithuania is planning to invite market players for further discussion on specific Open Banking measures that would produce more smart financial services for businesses and citizens.

‘Market participants welcomed the majority of measures proposed by the Bank of Lithuania. All respondents approved the proposal to create a financial sector API register, which will allow developers of digital financial products to find necessary information on available APIs in one source,’ said Algirdas Neciunskas, Director of the Market Infrastructure Department of the Banking Service at the Bank of Lithuania.

Financial sector API register should be established by the end of this year. Payments Council will further consider Open Banking development opportunities. To this end, a dedicated working group, chaired by the Bank of Lithuania and including representatives of consumers, FinTech companies, banks and the Ministry of Finance was set up. Furthermore, the Bank of Lithuania is also planning to offer access to its most viewed data via an API.

In expressing their opinion regarding additional Open Banking data, some financial market participants, especially new market entrants, indicated that they would like to access as much data as possible as this would help them to develop new and innovative Open Banking products and services. Others stated that it might be too early to develop new Open Data APIs as it might introduce implementation complexity for the market, which is only starting to test various functionalities of payment initiation and account information services.

At the end of 2018, the Bank of Lithuania launched a public consultation concerning the introduction of Open Banking measures in Lithuania. Respondents to the consultation included both banks and FinTech businesses established in Lithuania, as well as foreign market participants.

In the course of the public consultation, the Bank of Lithuania met with the representatives of associations of Lithuanian banks, FinTechs and consumers as well as Create Lithuania, commercial banks and other organisations. Experts from the UK’s Open Banking Implementation Entity, which are leaders in Open Banking implementation, have also shared their experience. The results of the consultation are presented in more detail here.

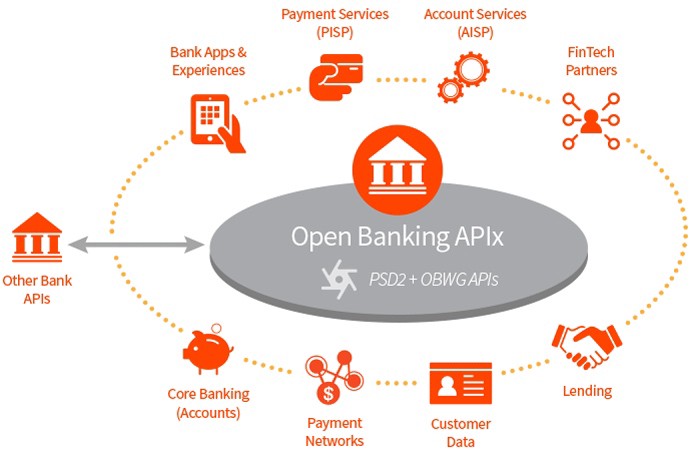

Open Banking is a rapidly advancing field of FinTech: the companies develop various financial and information services by using data of banks and other financial institutions and, in turn, bring additional benefits and improve experience to citizens and businesses. The Government of the Republic of Lithuania approved the action plan for the development of the FinTech sector in Lithuania, which identified Open Banking as one of its key instruments. Enquiries regarding participation in the Payments Council working group dedicated to Open Banking should be sent to tl.bl@abyrat-umijekom.