Axioma has announced the most recent update to the firm’s next-generation Equity Factor Risk Model suite, which includes APAC (AP4) and APAC ex-Japan (APexJP4) Risk Models.

Axioma has announced the most recent update to the firm’s next-generation Equity Factor Risk Model suite, which includes APAC (AP4) and APAC ex-Japan (APexJP4) Risk Models.

The leading global provider of enterprise risk management, portfolio management and regulatory reporting solutions has updated APAC (and APAC ex-Japan) Risk Models to allow for even greater risk attribution precision covering over 26,000 active securities across 17 markets in the Asia Pacific with long-term historical pricing data.

Joel Coverdale, Managing Director, Asia Pacific, at Axioma, said:

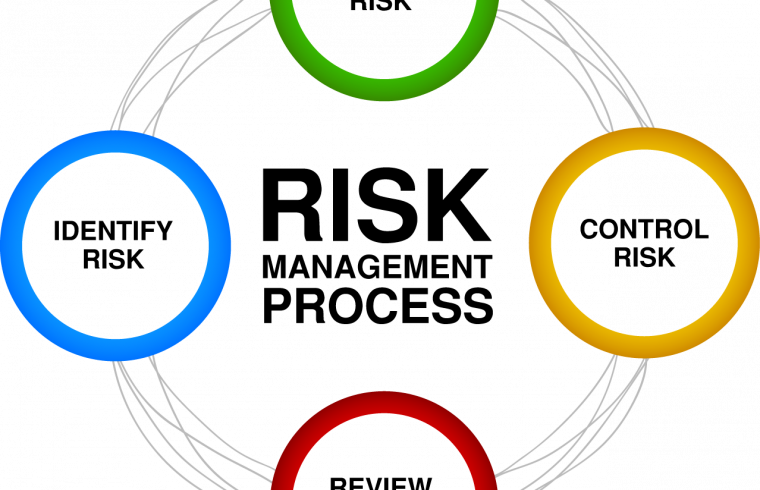

“2018 was a wake-up call for Asian focused investors, with the impact of risk-on/risk-off behaviour in an uncertain global environment a significant headwind to return expectations. We want to provide every investor with the best possible insights to know where they both stand and where they might be headed. A best-in-class risk management approach is critical for success.”

The new risk models include several new fundamental factors such as Market Sensitivity, Profitability, Dividend Yield and Earnings Yield, and improved factors with more stable exposures, enhanced definitions and IPO exposures. Axioma also improved its methodology, including a precise treatment of extreme and missing data, new currency model, as well as a new returns timing model. For greater granularity in the industry structure with well-tuned attribution of risk and return for both sector and industry-focused ETFs, the 4th generation models include 2018 GICS® based industry factors.

Olivier d’Assier, Head of Applied Research APAC at Axioma, commented:

Olivier d’Assier, Head of Applied Research APAC at Axioma, commented:

“Asian markets are maturing, and new smart beta strategies have emerged. Axioma is responding by adding new style factors to its Asian models allowing investors to more accurately control the risks they take in those strategies.”

The launch of the updated APAC models follows recent releases of Axioma’s Emerging Market (AXEM4) and China (AXCN4) Risk Models, which provide equity investors with deep, actionable insights into how to best manage risk and returns across major global growth markets. These enhancements support the firm’s overall aim to bring flexible, seamless investment risk management solutions to portfolio managers and risk professionals across global markets.