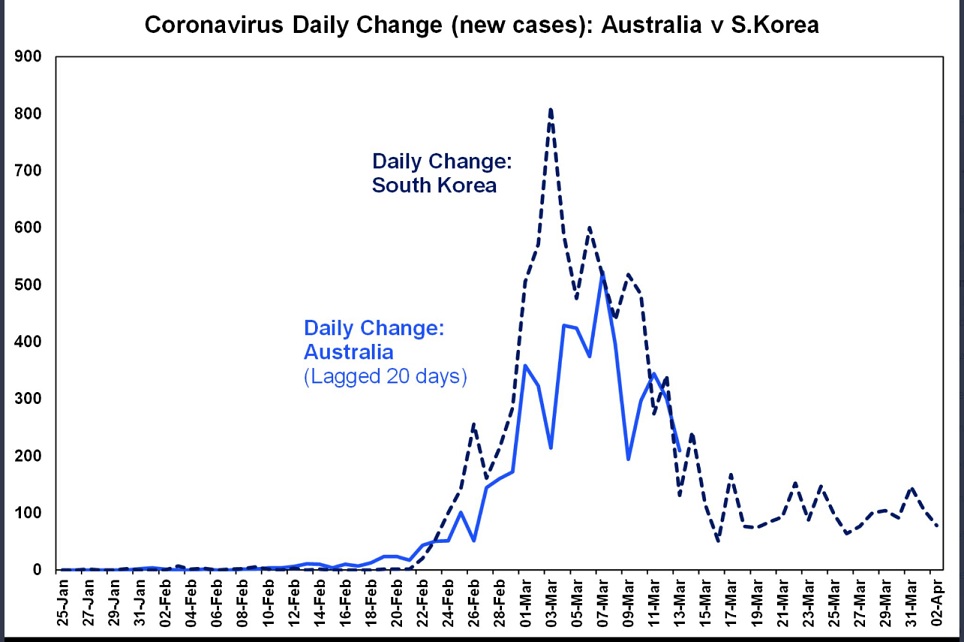

Summary: The Australian Dollar starred in the FX world despite a cut by ratings agency S&P on Australia’s sovereign outlook. Traders shrugged off the downgrade, preferring to focus on the RBA’s recent QE remarks as on the verge of tapering. AUD/USD rocketed to 0.62449 overnight and 3-week high after initially dropping to 0.61158 following the S&P ratings announcement. The Aussie Battler closed at 0.6235, up 1.23%. Australia’s coronavirus daily change appeared to be tapering, following that of South Korea. The FOMC meeting minutes revealed that the Fed would keep rates near zero until the country has weathered the coronavirus impact. The Euro extended its retreat, dipping to 1.0855 (1.0895) after European Union finance ministers failed to agree on further support measures for their economies. The Eurogroup meetings were suspended until later today (European time). Against the Yen the US Dollar advanced modestly to 108.90 from 108.75. Sterling was up 0.3% to 1.2370 from 1.2340. USD/CAD edged up to 1.4017 from 1.3997 despite higher oil prices. Wall Street stocks ended higher as the US appeared to be getting on top of the Covid-19 curve, with the possibility of more government stimulus measures. In late New York, the DOW was up 3.9% to 23,420 (22,550) while the S&P 500 gained 3.85% to 2,750 (2,647). The benchmark US 10-year treasury yield climbed 6 basis points to 0.77%. Other global bond yields were little changed.

There were limited data releases yesterday. Japan’s Core Machinery Orders (March) beat forecasts, climbing to +2.3% (-2.9%). Japanese Economic Watcher’s Sentiment Index dropped to 14.2, missing expectations of 22.2. Canada’s Housing Starts were up to 195,000, bettering expectations of 173,000 while the country’s Building Permits slumped to -7.3%, worse than the -4.0% forecast.

On the Lookout: Today is the last full trading day with many markets closed for the Good Friday observation tomorrow. Hence liquidity will be at a premium. The spotlight will continue to be on coronavirus developments and its impact on the global economy.

Data today sees Japanese Machine Tool Orders (March). European reports follow with Italy’s Industrial Production. The UK sees Construction Output, RICS House Price Balance, Manufacturing Production, and Goods Trade Balance.

The Eurogroup meeting of Eurozone finance ministers resumes today. OPEC meetings also start today (European time). Canada reports its Employment Change (March) and Unemployment rate. Traders will focus on the US Weekly Unemployment Claims, where median forecasts are between 5,000K and 5,250K from last week’s 6,648K. Anything outside of these forecasts could see some violent FX moves. US Headline and Core PPI, and Preliminary University of Michigan Consumer sentiment follows. Finally, Jerome Powell is scheduled to speak on the US economy to the Brookings Institution in Washington DC via satellite.

Trading Perspective: As we approach the Easter long weekend, the main thing to remember if, and when you trade is that liquidity is at a premium. This is not the time to have any strong views or fall in love with a view. Look for extremes, get in and out quickly and stay flexible. Take smaller bets (position size) so you can fine tune your stop loss and take profit levels. Otherwise, take time out to commemorate the events of the season. Another saying that many traders said in the day was “when in doubt, stay out.” Still holds for today. That said, there are some good levels to monitor in the currencies today.

Today’s main event will be the US Weekly Jobless Claims and Powell’s speech.

EUR/USD – Heavy After Eurogroup Fail to Agree Stimulus – 1.0750-1.0900

The Euro underperformed after European finance ministers failed to agree on further support for their economies, hit hard by the Covid-19. The talks were suspended until later today (European time). The Netherlands and Italy were battling over conditions that should be attached to Eurozone credit for governments. Market positioning, which we highlighted earlier this week, saw a large build in speculative long Euro bets to the biggest total since June 2018.

EUR/USD finished at 1.0852 in New York from 1.0895. The shared currency has struggled all week to rally much beyond 1.0930. The long bets are getting nervous and a break lower in illiquid conditions could see further downside in the Euro. Overnight low traded was 1.0830 which is today’s immediate support. The next support lies at 1.0780 followed by 1.0730. Immediate resistance can be found at 1.0880 and 1.0930. Look to trade a likely range today of 1.0780-1.0900. Prefer to sell into strength.

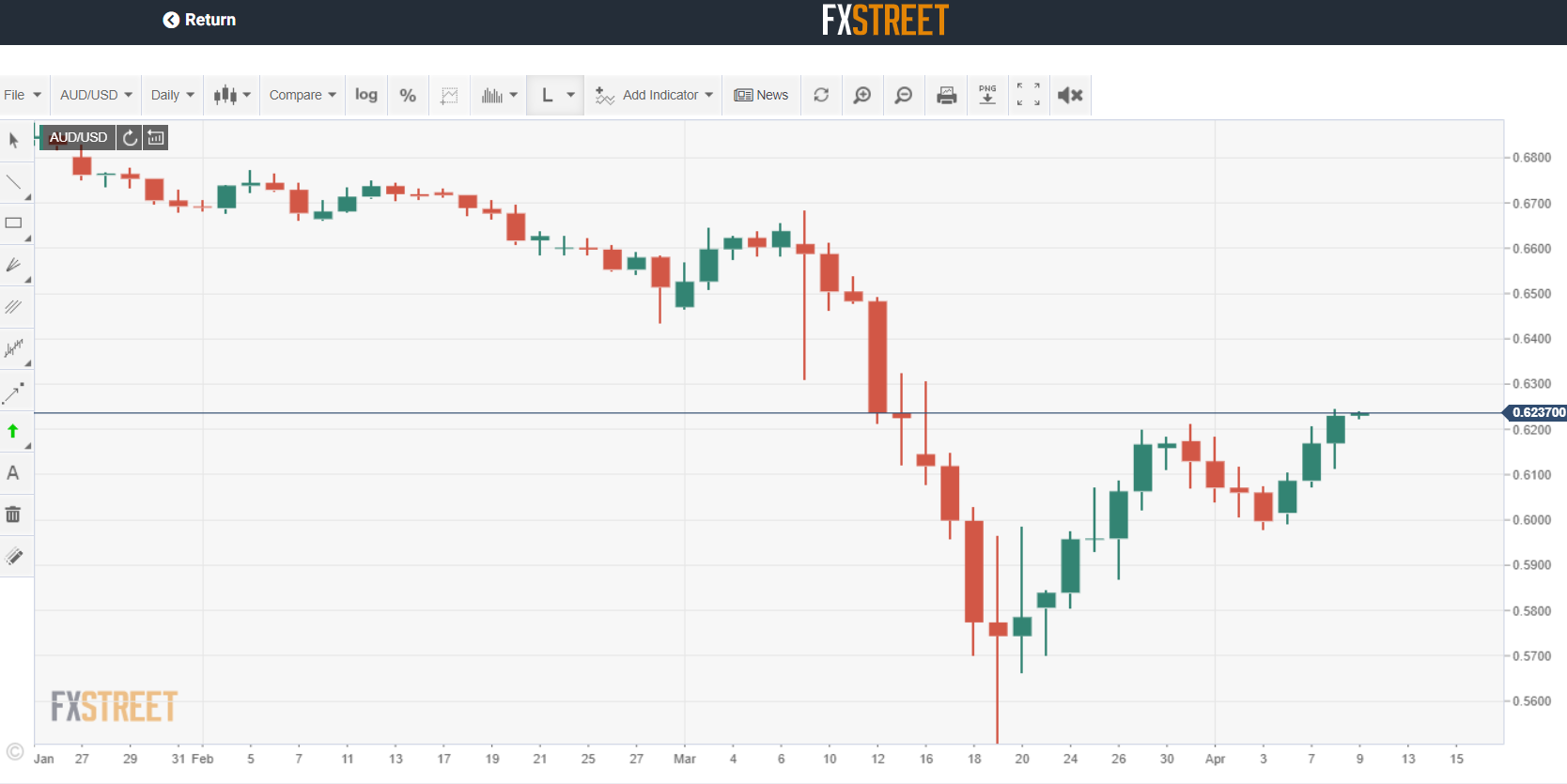

AUD/USD – Battler Battles It’s Way Higher – 0.6250-0.6300 Resists

The Australian Dollar rocketed higher following an overnight drop to 0.61158 in early Europe after ratings agency Standard and Poors cut Australia’s credit rating outlook from AAA stable to negative. AUD/USD hit a fresh 3-week high at 0.62449 before easing to settle at 0.6233 in late New York. Good buying interest entered near the 0.6110 level as speculative shorts ran to cover as the Aussie rallied.

Markets interpreted the RBA’s rhetoric on QE as a likely taper, following the Australian central bank’s decision to keep interest rates unchanged. The Australian government also planned further stimulus to aid jobs. The rise in risk assets also boosted the Aussie Dollar.

AUD/USD has immediate resistance at 0.6250 followed by 0.6290. Immediate support can be found at 0.6200 and 0.6160. Look for a likely range today of 0.6150-0.6250. Just trade the range on this one today, things could turn on a sixpence.

USD/CAD – Loonie Clings, Oil Up, Data Down – 1.3980-1.4130

The USD/CAD pair finished with modest gains to 1.4017 from 1.3997 caught between higher Crude Oil prices and dismal economic data. Canada’s Building Permits fell more than forecasts, and while Housing Starts were up, yesterday’s dire IVEY PMI report precedes today’s Employment report, expected to show a contraction of -350,000 Jobs in March from February’s gain of 30,300. Canada’s Unemployment rate is forecast to climb to between 7.2 and 7.4% in March from the previous month’s 5.6%. That’s huge and the Loonie can only get weaker against the US Dollar from here.

We also highlighted that the latest COT/CFTC report saw speculators turn long Canadian bets to +CAD 7,316 from the previous week’s short -CAD 29,245 contracts. For a relatively smaller currency, that’s a huge turnaround of +CAD 36561. If the data tonight comes out slightly worse than forecast, the USD/CAD pair will rocket higher as the Loonie long bets scramble for the exit.

USD/CAD has immediate support at 1.3980 followed by 1.3940. Immediate resistance can be found at 1.4080 (overnight high 1.40816) and 1.4130. Look to buy dips in a likely 1.3990-1.4130 range today.