Asian indices finished lower today as investors turn cautious after the U.S. agreed last weekend to halt additional tariffs on China and to start the negotiations again. The Nikkei225 finished 0.53 percent lower at 21,638; the Hang Seng slipped 0.07 percent at 28,855. The Shanghai Composite finished 0.94 percent lower to 3,015, while in Singapore, the FTSE Straits Times index finished 0.12 percent lower to 3,366. Australian equities rose for a third consecutive day with the ASX200 inching 0.50 percent higher at 6,685.

European equities are trading higher today mirroring positive close in Wall Street. DAX30 is adding 0.80 percent to 12,626, CAC40 is 0.67 percent higher at 5,614 while the FTSE MIB in Milan is trading 1.36 percent higher at 21,682. The London Stock Exchange is 0,67 percent higher to 7,609 amid improved investors sentiment.

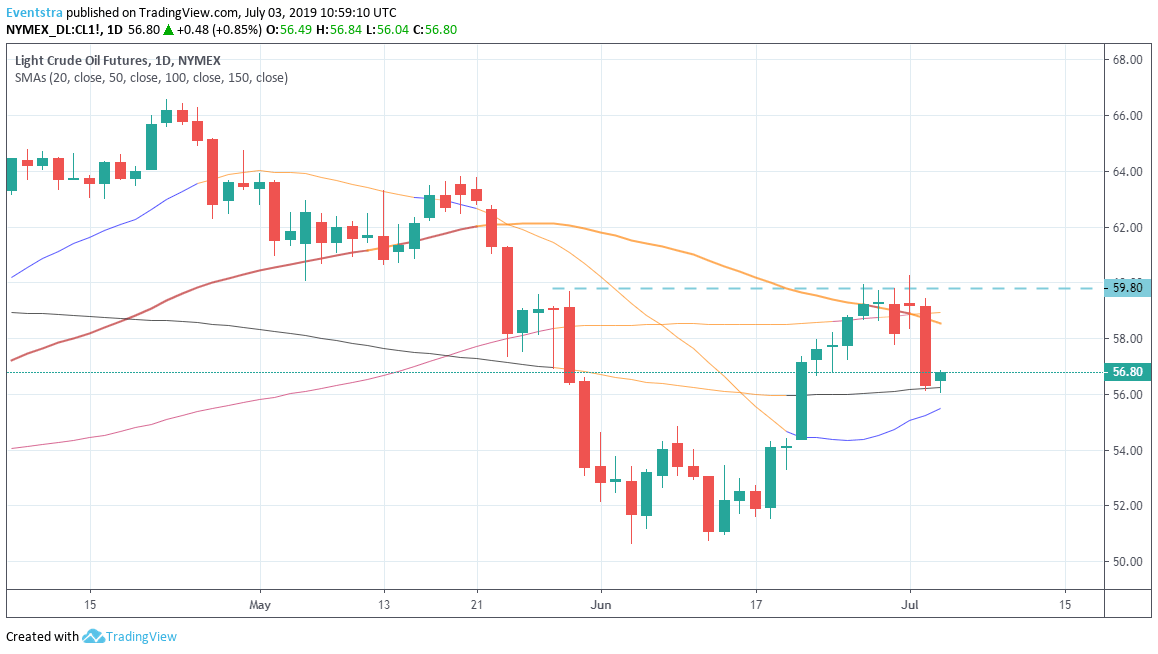

In commodities markets, crude oil rebounds from yesterday’s sharp selloff and trades at $56.70 as traders turn cautious on trade war headlines. Brent oil also trades lower at $62,93 per barrel despite major oil producers have agreed to cut output. Gold today continues the impressive rebound from yesterday above 1,425 and keeps the bullish momentum as the price holds above all the major daily moving averages. On the upside, strong resistance will be met at 1,437 the daily high.

In cryptocurrencies market, Bitcoin (BTCUSD) regains the 11,000 mark hitting the daily low at 10,556 and the daily high at 11,558. Immediate support for BTC stands now at $10,434 the Friday low while next support stands at 10,000. On the upside, strong resistance now stands at 11,658 and then at 11,000 round figure. Ethereum (ETHUSD) also trades higher adding 16 dollars at 296 with capitalization now to 31.60 billion, on the upside the immediate resistance stands at 300 round figure while the support stands at 235 the 50-day moving average, Litecoin (LTCUSD) also trades lower at 119. The crypto market cap now stands above $325.0 billion.

On the Lookout:

The China’s Caixin services PMI for June came in at 52.0 worst than analyst’s expectations of 53.0, the previous figure was 52.7, the Composite Output Index dropped to 50.6 in June from 51.5 that was in May’s. The German Markit PMI Composite came in line with markets forecasts at 52.6 for June, while German Markit Services PMI came in at 55.8, beating analysts’ expectations of 55.6 for the same month. In France, Markit Services PMI came in at 52.9, worst than market consensus of 53.1 for June, while the Markit PMI Composite came in at 52.7, again below analysts’ estimates of 52.9 in June.

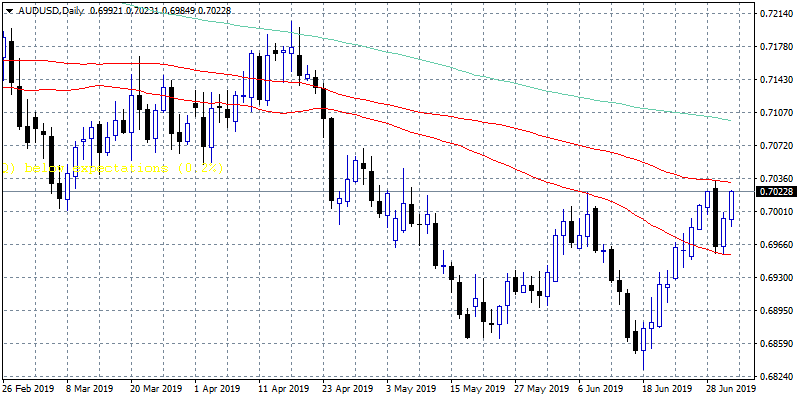

The Australia Trade Balance came in at 5745M, beating expectations of 5250M in May while Aussie Building Permits, Year over Year, was up to -19.6% in May from the previous reading of -24.2%.

In the American economic calendar, we await the US ADP Employment Change report to be released at 12:15GMT followed by the US Trade Balance, Jobless Claims, and the Canadian Trade Report

Trading Perspective: In forex markets, USD trades flat at 96.77 after the positive outcome from G20 summit that calm the markets, the Aussie dollar brakes higher above 0.7010 despite RBA cut interest rates earlier, while Kiwi trades lower at 0.6685.

GBPUSD is trading close to daily low at 1.2568 as traders are still cautious around the Brexit developments. Major support now stands at 1.2550 which if broken might accelerate the slide further towards 1.25 round figure. On the upside immediate resistance now stands at 1.2684 the 50-hour moving average while more offers will emerge at 1.27 round figure.

In Sterling futures markets the open interest increased by 2,100 contracts while volume decreased by 1,000 contracts.

EURUSD trades flat around 1.1285 after the German Markit PMI Composite came in line with markets forecasts at 52.6 for June, while German Markit Services PMI came in at 55.8, beating analysts’ expectations of 55.6 for the same month. In France, Markit Services PMI came in at 52.9, worst than market consensus of 53.1 for June, while the Markit PMI Composite came in at 52.7, again below analysts’ estimates of 52.9 in June. Immediate resistance for the pair stands at 1.13 round figure. A convincing close above 1.13 can lead prices to 1.1337 the 200-day moving average. Support now stands at 1.1260 the 100-day moving average, while more bids will emerge at 1.12 round figure.

In euro futures markets, the open interest shrunk by 1,900 contracts, while volume also shrunk by 74.000 contracts.

USDJPY is trading 0.21 percent lower at 107.66 having hit the daily low at 107.52 and the daily high at 107.91. USDJPY pair will find support around 107.50 round figure and then at 107.00. On the upside, immediate resistance for the pair now stands at 108.52 the high from yesterday’s session.

USDCAD breaks below the 1.31 having hit earlier the low at 1.3090 while the daily high was at 1.3118, as the crude oil prices retreat, Canada’s main export item seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at 1.3060 the low from February 1st while extra support stands at 1.30 round figure. The pair has reached oversold levels so a rebound can’t be ruled out. On the upside, immediate resistance now stands at the 1.32 zone before an attempt to 1.3450 recent high from 31st May.