Asian stocks finished lower on Thursday after the rebound from recent sell-off, as investors await the Initial jobless claims from the USA for the first evaluation of the coronavirus outbreak impact on the real economy. Governments stepped in with emergency relief measures around the globe in an attempt to off-set the coronavirus crisis impact. Coronavirus confirmed cases top 430,000 while the death toll rises to 17,500.

Nikkei 225 ended 4.51% lower at 18664; the Shanghai Composite index closed 0.60% lower at 2764. The Singapore FTSE Straits Times is 0.71% lower at 2487. Hang Seng was 0.74% lower at 23352. The ASX 200 index ended higher for the third consecutive session adding 2.3% higher at 5113.

European indices retreat today. The German DAX is 1.83% lower at 9,704. CAC 40 index is 1.41% lower at 4,369, while the FTSE MIB in Milan is 0.55% lower at 17,147. In London, the FTSE 100 is 1.81% lower at 5,586.

In commodities markets, crude oil gives up yesterday’s gains. WTI crude oil is 2.17% lower at $23.98 while the Brent oil is 1.77% lower at $26.99 per barrel.

The gold price is 0.08% lower at 1614. The gold initial resistance stands at $1,703 the monthly high, while the initial support stands at $1,451 the low from March 16 trading session. Silver (XAGUSD) is 0.20% lower at $14.35.

Cryptocurrencies retreat for the second consecutive day. Bitcoin (BTCUSD) price is 0.58% lower at $6,634, hitting the daily low at $6,556 and the daily high at $6,785. Bitcoin’s technical picture is bearish as the cryptocurrency trading below all the major daily moving averages. The first support for Bitcoin stands now at $4,431 the low from March 14th. On the flip side, immediate resistance stands at $6,843, Tuesday’s high. Strong resistance will be met at 10,495, the yearly top.

Ethereum is 0.77% lower, at 135.37 with capitalization at 15.01 billion. The initial resistance for Ethereum stands at 144.05 the weekly high, while the support stands at $102.00 the low from March 16. Ripple – XRPUSD is 0.58% lower at 0.1612. Litecoin (LTCUSD) is 0.28% lower at 39.14. The crypto market capitalization stands now at $184.51 billion.

In the Lookout: United Kingdom Retail Sales came in at -0.3% below forecasts of 0.2% in February. Retail Sales year-on-year came in at 0.2% below the expectations of 0.2%. The Germany Gfk Consumer Confidence Survey came in at 2.7, below the forecasts of 7.1 in April. The France Business Climate came in at 95, topping the estimates of 93 in March.

Trading Perspective: In the foreign exchange markets, EURUSD is 0.62% higher at 1.0949, the Australian dollar is 1.01% higher at 0.6017 against the U.S. greenback. The Yen is higher against the US Dollar, the USDJPY is 1.37% lower at 109.59. The U.S. dollar index is 0.59% lower at 100.25. NZDUSD trades 0.77% higher at 0.5892.

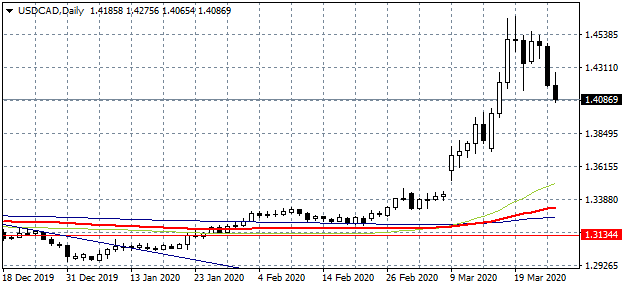

USDCAD Retreat On Weak U.S. Economic Data

USDCAD trades 0.38% lower at 1.4138 after the worse than expected initial jobless claims from the USA. The Initial Jobless Claims for March 20, came in at 3283K, topping the expectations of 1000K. The Initial Jobless Claims 4-week average came in at 998.25K topping the previous reading of 232.25K. The U.S. Gross Domestic Product came in at 2.1% in line with expectations for the fourth quarter. The Core Personal Consumption Expenditures quarterly reading came in at 1.3% topping the forecasts of 1.2% in the fourth quarter. The United States Goods Trade Balance rose from the previous $-65.5B to $-59.89B in February.

On the technical side, the pair today retreat from the recent highs as central banks’ intervention managed to ease investors’ worries on the coronavirus outbreak impact on the global economy. Support for the pair seen at 1.4107 the daily low. More bids might emerge at 1.3965 the low from March 17. On the other side, the first resistance for the pair will be met at 1.4275. The next supply zone stands at 1.4475 the high from yesterday’s trading session, while a break above might test the resistance at 1.4557 the high from March 23.