By Giles Coghlan, Chief Currency Analyst, HYCM

The more time you spend observing markets, the more you’re forced to accept that events can be similar in kind but completely different in degree. How many times did we encounter and indeed use the words “risk-off” last year to describe what was more or less a repeated gyration between lockdown and reopening? In that particular regime, “risk-off” saw US equity investors selling tops and waiting for dip-buying opportunities down at the 20-, 50-, and finally, the 100-day moving averages. It’s becoming clear that in this first half of 2022, risk-off refers to an entirely different set of concerns.

This relates to another keyword also used to describe underlying conditions that vary widely in degree. That word is uncertainty. Who would disagree that the uncertainty of 2021 was markedly different from the uncertainty of 2020? And thus far in 2022, we’re again being forced to accept that these designations mean radically different things now than they did even six months ago.

Current issues include rising inflation, a harsh winter as energy prices spiral, commodity backwardation almost across the board, a hawkish turn globally among central banks, bond yields surging, and now a conflict between Russia and Ukraine that appears to be moving from rhetorical to kinetic.

These are just some of the issues currently weighing on investor sentiment as the playbook from the past couple of years gets consigned to the history books. Why say all of this? Because it’s important to remind ourselves that as individual human beings we tend to adjust our ideas very slowly. Meanwhile, markets are unequivocally signalling that perhaps what worked yesterday won’t work today.

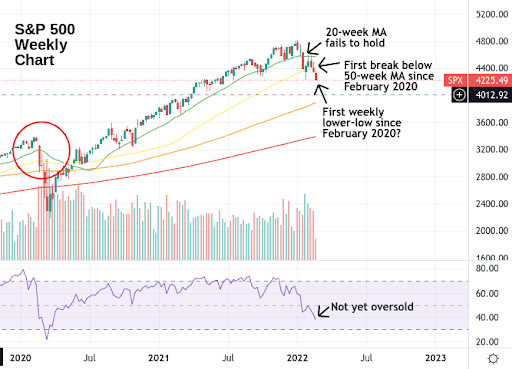

US equities

Let’s start with US equities as we’ve already mentioned their trajectory throughout 2021. Zooming out from the daily to the weekly, we see new weekly lower-lows on the verge of being set. On the week of January 18th, the S&P 500 set its first weekly close below the 20-week moving average since the end of September (the previous one was in October of 2020). Since then it has also plummeted through the 50-week moving average. If it remains at these levels by the end of the week, then the S&P 500 will have set its first weekly lower-low since February of 2020.

Narrowing in on individual sectors, we see that the worst-hit areas of the US economy have been technology, communications and consumer discretionary, with communications leading the rout, down almost 25% from all-time highs in August (technology is down almost 17% and consumer discretionary almost 22%). Even these numbers do not reveal the true extent of the sell-off when pandemic top-performers like Zoom are currently down nearly 80% from their highs.

For those looking for dips, it may be useful to keep in mind that while individual names are currently extremely oversold, the broader measures like the S&P 500 and the Nasdaq are yet to enter oversold territory. Currently, the Metals & Mining sector is one of the only places for investors to retreat to, having recently broken to levels last seen in April of 2012.

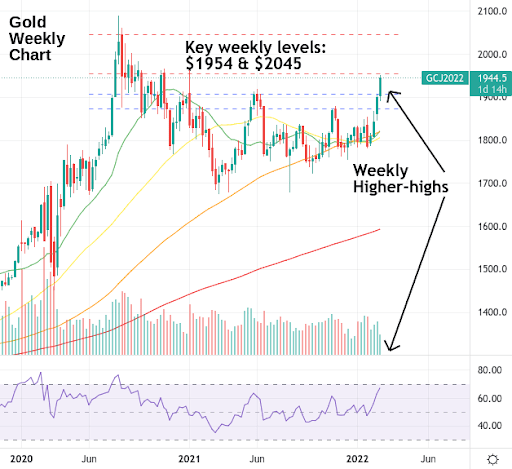

Gold

Gold has baffled investors for the better part of two years now. It received a boost during the early days of the pandemic, managing to beat its 2011 all-time highs by around 9%. However, it has failed to act as an inflation hedge since then, was completely overshadowed by surging crypto asset prices in 2021, and a shift in narrative saw bitcoin regarded as a new kind of digital gold.

However, narratives can be as self-serving and as self-reinforcing as individual investor beliefs, especially when they provide outsized returns. The obvious question was, (and still is) how can crypto be the uncorrelated inflation hedge and option against the status quo when its performance has been so correlated with the riskiest of US risk assets?

Perhaps it’s the true extent of inflationary pressures that are causing gold to receive a bid once again, or perhaps it’s the highly undesirable prospect of an Eastern European armed conflict that seems to be reminding investors just what gold’s true role is in a portfolio.

Whatever the case may be, it recently set its first weekly higher-highs since it topped out at over $2000 in August of 2020. In mid-February, it surpassed November’s high at around $1880, and this week it broke above June’s $1920 level. This is without a weekly overbought reading and only one significant level (November 2020’s $1954 level) standing between the current price and gold’s all-time highs.

Unknown unknowns

As investors have learned in recent years, the speed with which one market regime gets superseded by another can be astounding, so it’s always worth being aware of what could unexpectedly change. The hawkish stance of the Federal Reserve has caused markets to price in around seven rate hikes. If for whatever reason, investors get an inkling that these hikes are not to materialise then there will have to be a re-pricing.

Similarly, it may seem untimely to mention a de-escalation between Russia and Ukraine as one invasion headline after another floods our feeds, but this too represents a massive unknown (hence the move to gold). With investor sentiment skewed so heavily towards pessimism, and as more and more securities enter into highly oversold territory, any easing of tensions could contribute to outsized market reactions as we saw during the pandemic and risk-positive currencies like the AUJPY and NZDJPY could see a sudden upside.

The S&P 500 and gold CFDs are available to trade with an established and multi-regulated global broker, HYCM, as well as 300+ instruments in commodities, forex, indices, stocks, and more.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation founded in 1977, operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.