Stronger economic and income growth, lower costs of borrowing and payments, no more litas-euro exchange expenses – these are the benefits brought by the euro which was introduced in Lithuania five years ago. The Bank of Lithuania’s calculations have shown that although the euro introduction involved certain costs, its benefits clearly outweigh all the incurred expenses.

“Thanks to the euro adoption, we entered the top financial league – the euro area – which not only ensures higher financial stability and safety in Lithuania but also provides the country with specific economic advantages. According to our calculations, the adoption of the euro was followed by more robust economic growth that helped both households and businesses generate additional income. Due to lower borrowing costs, the overall savings effect has exceeded €0.5 billion over five years,” said Vitas Vasiliauskas, Chairman of the Board of the Bank of Lithuania.

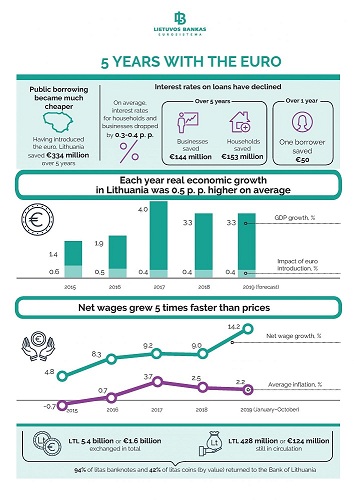

When Lithuania was admitted to the euro area, all major international rating agencies revised up the country’s credit ratings and classified it as a higher-credibility country. Higher ratings and lower risks paved the way for cheaper public borrowing. This factor alone allowed the country to save €334 million – an amount that could cover construction costs of two national stadiums or one year’s public expenditure on medications.

Over this period, interest rates in Lithuania reached historic lows: a third of this decrease resulted from the adoption of the euro, while the remaining share was driven, among other factors, by the ECB’s accommodative monetary policy that helped reduce interest rates across the entire region.

Both households and businesses have benefited from lower interest rates – after the euro introduction, they dropped, on average, by 0.3–0.4 percentage points. As a result, 640,000 households with loans saved more than €30 million each year (almost €50 per household). With the adoption of the euro, the annual corporate interest costs declined by €29 million on average, which allowed households and businesses to save a total of roughly €300 million over five years.

Lithuania’s entry into the euro area has also positively affected the country’s economy as a whole. According to the estimates of Bank of Lithuania economists, after the euro adoption, the real GDP growth rate in Lithuania has each year been 0.4–0.6 p. p. higher compared to the “no-adoption” scenario. Even according to conservative calculations, the euro contributes to an at least €200–350 million rise in the country’s exports every year.

However, there is also another side of the coin, related to certain costs and price increases. According to Eurostat, the euro changeover period only had a minor one-off impact on prices. At the beginning of 2015, the euro introduction led up to a 0.11 p. p. rise in the country’s inflation levels.

“Price increases in Lithuania have been mainly driven by stronger economic growth rather than the euro itself. But, being part of the euro area, we are more effectively approaching the EU average – both in terms of prices and real income,” said Mr Vasiliauskas.

The overall price level in Lithuania still falls behind (accounting for 60%) compared to the euro area average. After the introduction of the euro, the strongest growth in prices was posted by goods and services where wages comprise the major share of costs, namely restaurant, café, hairdressing, recreational and cultural services. Over five years, prices of such services have increased by more than 20%. Moreover, prices of goods subject to excise duties have surged significantly too. For example, prices of alcoholic beverages and tobacco have increased by 26% over the observed period. Inflation of basic food commodities posted a more moderate growth: prices of bread, meat and dairy products have grown by less than 10% over the same period.

On the other hand, price increases have been outpaced by growth in wages and social benefits. Over five years, the average net wage in Lithuania has increased by 50% from €550 to €830, while the average pension – by 40%, i.e. respectively at a fivefold and fourfold rate compared to average inflation.

Although the euro has been a legal tender in Lithuania for half a decade now, LTL 428 million (amounting to €124 million) have not yet been returned to the Bank of Lithuania. Part of the remaining litas banknotes and coins has likely been worn out over the years of circulation, while another part is kept by people as a relic. Litas banknotes and coins can still be exchanged into euro free of charge at the cash offices of the Bank of Lithuania in Vilnius and Kaunas where, on average, 60 exchange transactions are carried out every day. The Bank of Lithuania has undertaken to conduct litas-euro exchange operations for an unlimited period of time.