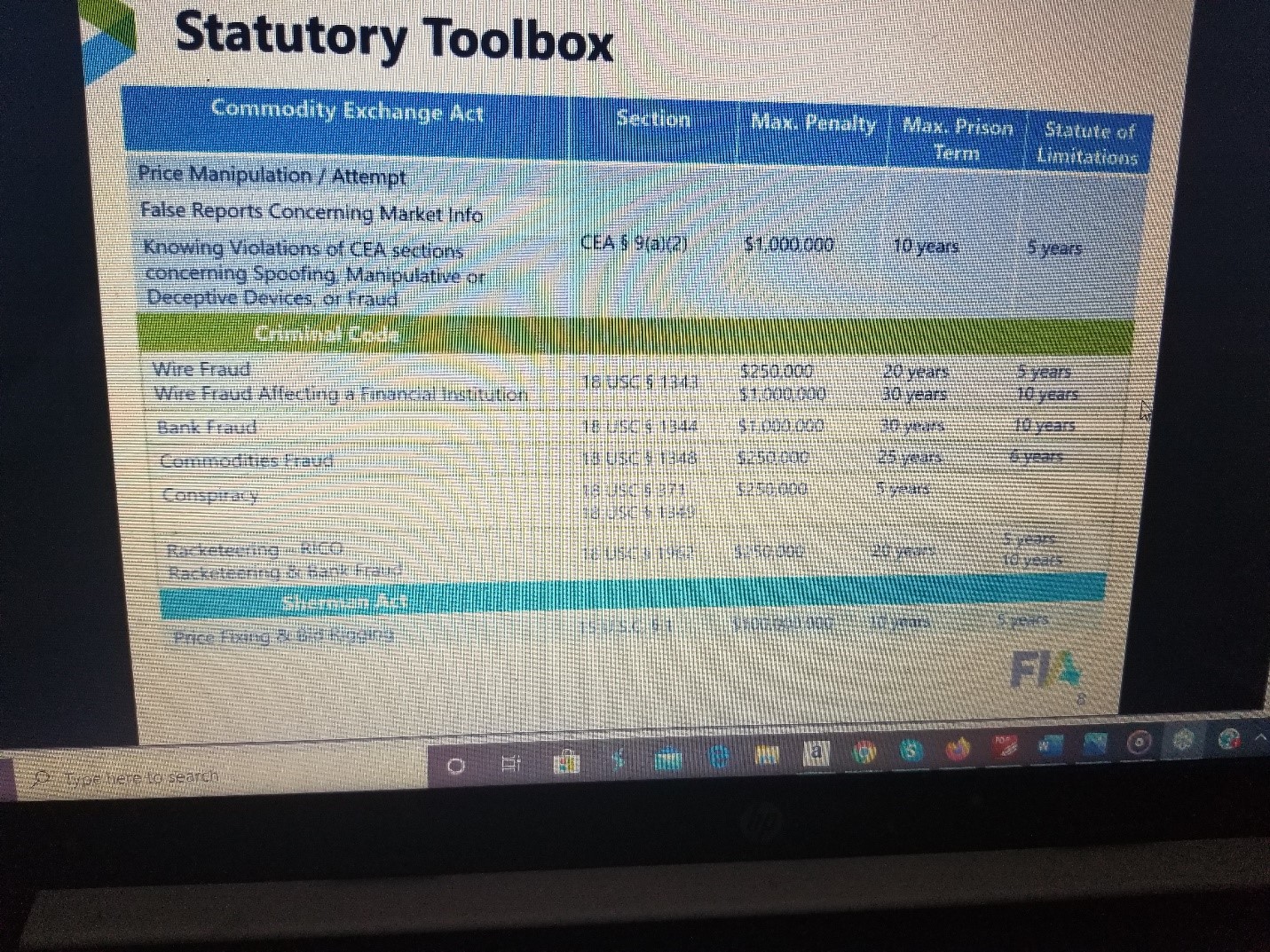

The US Department of Justice (DOJ) has several tools to prosecute derivatives fraud, and they aren’t only interested in spoofing.

The Futures Industry Association (FIA) Law & Compliance Division recently put on its most recent webinar entitled, “DOJ’s foray into the CFTC’s enforcement world: spoofing, commodities fraud, wire fraud and even RICO.”

One of the slides presented showed that the DOJ had laws from three different parts of the legal spectrum to choose from, including the Sherman Anti-Trust Act, which was passed in 1890.

RICO

One of the laws in the criminal code is RICO, the Racketeer Influenced and Corrupt Organizations Act.

RICO was designed to go after organized crime; John Gotti was prosecuted under RICO.

If the government can prove that an ongoing criminal enterprise existed and the defendant or defendants committed a certain number of crimes in support of that enterprise, a case can get a conviction under RICO.

Enhanced sentencing guidelines could turn a relatively light prison sentence for a crime like bookmaking into something more significant- as many as twenty years for each count.

RICO was passed in 1970 and one derivatives case cited in the webinar was from the 1980s.

The New York Times wrote about the case in an article entitled, 46 Commodities Traders Indicted After a 2-Year F.B.I. Investigation.

“If convicted, those indicted could face jail terms of up to 20 years and fines of up to $250,000, he said.” The article stated, “They may also face confiscation of assets under the Racketeer Influenced and Corrupt Organizations Act; loss of their exchange membership, and a temporary prohibition on their trading.

“At least 16 of the exchange members were charged with racketeering under the RICO statute. Most of them were brokers accused of failing to fulfill their obligations to their customers.”

More recently, a precious metals scam was being prosecuted under RICO, according to a September 2019 press release from the DOJ.

“The superseding indictment alleges that between approximately March 2008 and August 2016, Ruffo along with the other defendants and co-conspirators were members of Bank A’s global precious metals desk in New York, London and Singapore, with varying degrees of seniority and supervisory responsibility over others on the desk. Ruffo, who joined Bank A in May 2008, worked there until August 2017. During that time, he was an executive director and a salesperson on Bank A’s precious metals desk in New York, specializing in hedge fund sales.

“Ruffo’s clients included hedge funds that were global investment management firms that invested in precious metals. As it relates to the RICO conspiracy, the defendants and their co-conspirators were allegedly members of an enterprise—namely, the precious metals desk at Bank A—and conducted the affairs of the desk through a pattern of racketeering activity, specifically, wire fraud affecting a financial institution and bank fraud.

“The superseding indictment alleges that the defendants engaged in widespread spoofing, market manipulation and fraud while working on the precious metals desk at Bank A through the placement of orders they intended to cancel before execution (Deceptive Orders) in an effort to create liquidity and drive prices toward orders they wanted to execute on the opposite side of the market.”

Spoofing occurs when a trader places a series of orders which they intend to cancel, hoping their mere presence prior to cancellation drives an underlying security or derivative in a certain direction.

While there has been a lot of attention placed on spoofing since it was defined in Dodd/Frank in 2010, that is not the only fraud the DOJ is interested in.

Frontrunning

In the webinar, frontrunning was mentioned as another scheme on the DOJ’s radar.

Frontrunning is, “when a broker or other entity enters into a trade because they have foreknowledge of a big non-publicized transaction that will influence the price of the asset, resulting in a likely financial gain for the broker. It also occurs when a broker or analyst buys or sells shares for their account ahead of their firm’s buy or sell recommendation to clients,” according to the website Investopedia.

The webinar cited one success and one failure.

US V Johnson

This case was a success for the US DOJ.

This case was brought in 2016 in the Eastern District of New York.

“Johnson was a trader at HSBC and they were providing foreign currency services to a large company that needed to convert for $4 billion into sterling and the parties negotiated kind of a couple different ways in which they could execute this trade,” an attorney hosting the webinar noted.

The webinar was hosted by Washington, D.C. derivatives of counsel Jonathan Marcus and counsel Theodore Kneller from the law firm of Skadden Arps.

The attorneys explained that Johnson and his team would be given two hours advanced notice “that they could be trading, and that they wanted to trade at the VIX in two hours from the four billion US dollars. That would HSBC time to go into the market, acquire the Sterling and then do the trade and offer the fixed price to the counterparty.”

Another part of the agreement was, “Johnson said that he would quietly purchase Sterling without quote ‘ramping up the fixed price and Johnson also apparently suggested that he would profit by a few PIps, which is a few ticks or small increments of price between where he was able to acquire the sterling versus sell it to the counterparty, but through the trial, the Department of Justice offered a significant amount of evidence suggesting the HSBC traders were a lot more aggressive than what Johnson’s representations to the counterparty suggested, trading very heavily potential violating offers in order to ramp up the fix substantially and ultimately acquiring a $7 million profit on the trade.”

Johnson was found guilty of one count of conspiracy to commit wire fraud and eight counts of wire fraud in 2017.

After the case was appealed to the 2nd Circuit US Court of Appeals, the verdict was upheld.

According to the webinar, a standard was enshrined into case law with the decision.

“A defendant who executes a fixing transactions engages in criminal fraud if he intentional misrepresents to the victim how he will trade ahead of the fix, thereby deceiving the victim as to how the price of the transaction will be determined,” a slide noted.

The New York Fed provided further analysis of this case in a white paper found here.

A fuller explanation from the webinar of the case is here.

US Vs Bogucki

This was a loss for the DOJ.

This case is from the Northern District of California.

The case has some similarities including: involving foreign exchanges markets, arms length relationship, and a principle to principle counterparty.

The law firm, Cleary Gottlieb, on their blog, Cleary Enforcement Watch, provided an outline of the case.

“In January 2018, Bogucki was indicted on allegations that he had engaged in ‘front-running,’ a trading practice where traders place orders on behalf of their firms in advance of an anticipated client transaction. The DOJ accused Bogucki of misusing his knowledge of an upcoming large trade by one of Barclays’ corporate clients, Hewlett-Packard (‘HP’), to make millions of dollars for the bank.

“According to the indictment, in 2011, HP hired Barclays to execute a complex FX options transaction in connection with HP’s anticipated acquisition of Autonomy, a UK-based software company.[3] In consultation with Barclays, HP agreed to purchase 6 billion British pounds worth of cable options from Barclays, to ensure that HP had access to sufficient British pounds to make the acquisition. HP later decided it no longer needed the options to fund its acquisition, and decided to ‘unwind’ them by selling them back to the FX market incrementally.

“However, the indictment alleges that Bogucki conspired to manipulate the price of ‘volatility,’ a metric that affects the value of FX options. Specifically, over the course of about a week and a half in September and October 2011, Bogucki sold FX options to ensure that Barclays maintained a ‘short’ position, and by doing so, depressed the value of HP’s options. During this time, Barclays FX traders were purchasing HP’s cable options as part of HP’s unwind.”

This case was decided before it reached a jury, U.S. District Judge Charles Breyer in San Francisco ruled that no reasonable jury could find that Bogucki owed HP a duty of trust and confidence.

According to a Reuters story, Judge Breyer wrote this, “The government has pursued a criminal prosecution on the basis of conduct that violated no clear rule or regulation, was not prohibited by the agreements between the parties, and indeed was consistent with the parties’ understanding of the arms-length relationship in which they operated.”

The judge was responding to what was called a Rule 29 motion to dismiss the case.

The Reuters story stated the motion is granted rarely in such situations.

The webinar explained why Judge Breyer rejected the theory.

“As for the misappropriation theory, Judge Breyer ruled that the only agreement covering the deal was an ISDA, which expressly stated that each party acted as a principle and not as an agent or a fiduciary. Thus, the court concluded there was no basis for a jury to conclude that Barclay’s owed HP a duty of trust or confidence.

“On the second misrepresentation theory, Judge Breyer that none of Bogucki’s statements could have been materially misleading.”

The webinar stated that the nature of the relationship here is key to the decision.

“The court explained that because they were in an arm’s length relationship, it wouldn’t be reasonable for HP to expect for Barclay’s would be entirely forthright and honest, and the court noted that this reality was reinforced by HP’s primary point of contact for the transaction who testified that he understand that some of what Barclay’s told him was posturing and that he himself was bluffing during the transaction.” An attorney noted during the webinar.

Find a fuller explanation of the case from the webinar here.

Skadden Arps

Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates which is most often referred to as Skadden Arps is one of the premier law firms in the world.

Its lawyers ran the webinar.

It has twenty-two offices in more than ten countries.

“Skadden advises corporations, financial institutions and government entities around the world on their most complex, high-profile matters. Close collaboration by our 1,700 attorneys in 50-plus practices across 22 offices has been key to helping clients succeed in today’s business environment. We aspire for our clients to find the experience of working with us to be as satisfying as the outcomes we generate.”

Its work runs the gamut- from criminal law to contracts- however, their securities division is second to none.

In fact, according to ratings from Vault.com, Skadden Arps was ranked number one for securities law practices for 2020.