Asian stocks finished in a mixed state on Friday, as investors kept their eye on a key meeting between Donald Trump and Chinese Vice Premier Liu He. While in the UK, PM Theresa May said she would seek another Brexit extension, voicing her opposition to a no-deal Brexit and calling for urgent talks with Labour leader Jeremy Corbyn to break the deadlock. In Japan, the Nikkei225 main index added 0,38 percent to 21,807 and in Singapore, the FTSE Straits Times index gained 0.19 percent higher at 3,322. Australian equities pressure has continued for a second consecutive day with the ASX 200 firmly in the red, but finishing off its lows for the day. The index fell 51.5 points or 0.83% to 6181.3. The losses over the last two sessions have wiped out the gains over the first three days as the index finished the week flat.

In commodities markets, Light Crude Oil consolidates to five-month highs at 62.10, holding the 200-day moving average as the United States is considering additional sanction on Iran and shrugs off the bearish US inventory report released yesterday. The near-term upside target is at 63.43. Brent oil trades lower at $69.20/barrel. Gold is getting offers for one more day and trades three dollars lower at $1288. XAUUSD technical picture is neutral, and now immediate support stands at 100-day moving average at $1277, which can accelerate the downward move down to new YTD lows at the 200-day moving average at $1247. Strong resistance now stands at the $1300 round figure and then at the 50-day moving average. Expect the bears to defend $1307 with full force.

Cautious vibes spill over to European session mirroring mixed Asian equities markets as investors are waiting for the US employment figures and closely watching the developments surrounding Brexit. DAX30 is 0.17 percent lower to 11,982. CAC40 is 0.07 percent higher at 5,467 while FTSE100 in London is flat at 7,403 and the FTSE MIB in Milan trading 0.17 percent higher at 21,741.

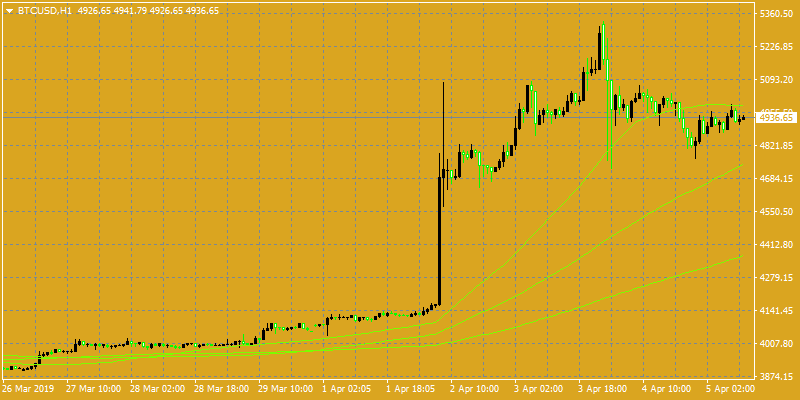

In cryptocurrencies, Bitcoin (BTCUSD) consolidates at recent highs and trades at 4,926 making the daily high at 4987, and it is now facing the key 200-day moving average resistance at $5,233. Bitcoin will find support at the 50-hour moving average at 4,514. The rally in BTC triggered bids across the industry with Ethereum (ETHUSD) trading now at 162 and Litecoin (LTCUSD) outperforms today jumping to 86.80.

On the Lookout: Prime Minister Theresa May is due to hold another round of talks with Labour following four and a half hours of discussions on Thursday, in a bid to break the Brexit deadlock.

Yesterday, one more macro figure disappointed investors as the German factory orders fell a sharp 4.2% m/m in February, largely on the back of weak foreign orders (-6%), likely reflecting weaker demand from Asia due to the Chinese New Year.

In the US macro calendar, the highly anticipated US employment figures are released along with consumer credit figures. The consensus estimate for payrolls is 170,000, which would be a huge improvement on the 25,000 increase reported in February.

Trading Perspective: Forex markets started in a cautious mood as traders are waiting for the US employment figures before the US trading session opening. AUDUSD is trading 0.18 percent higher at 0.7125 while Kiwi is slightly lower at 0.67.62. US dollar index trades in just 10 pips in the early European morning at 96.82.

GBPUSD is trading 0.20 percent higher to 1.3101, as investors follow the news that EU’s Donald Tusk suggested a flexible 12-month delay to Article 50, with an option to leave the EU once the UK parliament ratifies the Withdrawal Agreement. On the downside, major support will be found at 1.2977 at the 200-day moving average while solid protection can be found at the 100-day moving average around 1.2929. On the flipside, immediate resistance stands at 1.3195 the high from yesterday session, and from there, major resistance can be found at 1.3232 while 1.3382, the yearly high, will be met with strong supply.

In GBP futures markets, traders added more than 3K contracts to their open interest positions on Thursday from the previous session. Volume, instead, shrunk by nearly 56K contracts, reversing the prior build.

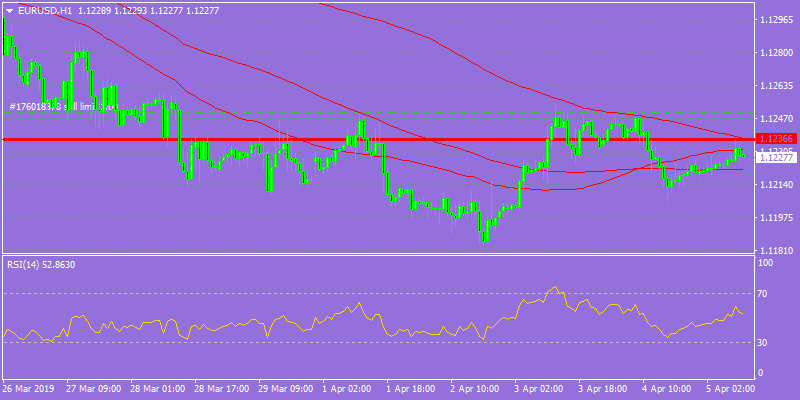

EURUSD holds above 1.12 trading 0.06 percent higher at 1.1229 but below the horizontal support line of the three-month range. The pair needs to break above 1.13 to give bulls a breath and then approach the 50-day moving average at 1.1329 to establish short term bullish momentum. Immediate support can be found at the 100-hour moving average around 1.1215.

EURO remains in negative mood following poor figures in Eurozone. In fact, recent disappointing readings in the region somehow confirm that the slowdown in the bloc and the ‘patient-for-longer’ stance from the ECB could be among us for longer than expected.

In Euro futures markets, traders scaled back their open interest positions by more than 2K contracts on Wednesday from Thursday’s final 497,717 contracts. Volume, instead rose for the first time after four consecutive daily drops, this time by around 14.4K contracts.

USDJPY is down 0.01 percent lower to 111,66 having hit the low at 111.59. Major support for the pair stands at 111 round figure if the pair manages to break below the 100-day simple moving average at 111.10. Immediate resistance for the pair stands at 112.06, the March 2019 high.

Open interest in JPY futures markets rose for the second straight session, this time by around 3.4K contracts on Thursday. On the other hand, volume reversed the previous build and decreased by around 19.2K contracts.