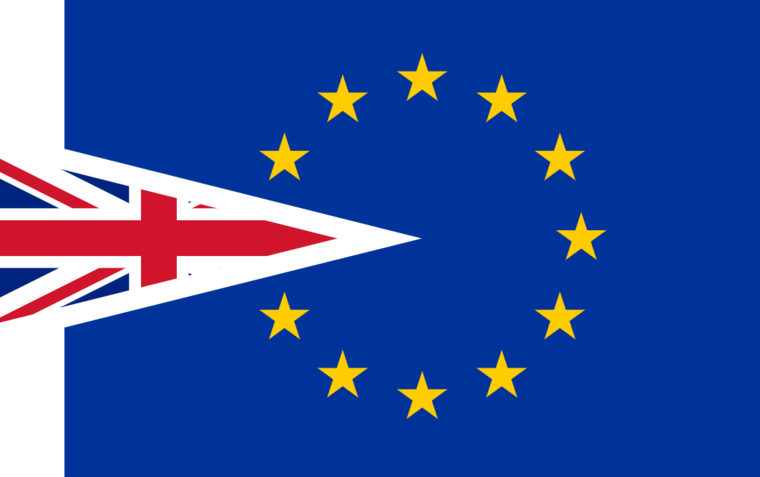

In a week that is once again likely to have Brexit as a dominant theme, Asian indices were mixed on quiet trading day with ASX 200 down by 0.2 but managed to hold above 6000pts and near four-month highs. The Shanghai Composite index finished 1.36 percent higher to 2,653 the Hong Kong’s Hang Seng HSI, rose 0.2% and The Kospi in South Korea lost 0.1%. The U.S. dollar index started with small gains 0.07 percent to 96.71. The Sino-US trade talks is a major event-driven risk-off. Uncertainty concerning Brexit and global growth concerns can add weakness in the stocks unless any positive news emerges.

European indices were set to kick the week off on the front foot on Monday as traders eyed a slew of key UK data, trade relations between the US and China and any Brexit-related headlines. DAX currently adding 0.95 percent to 11,010, CAC40 is 0.96 percent higher at 5,010 while in London the FTSE gains 0.88 percent to 7,133.

On the Lookout: The Ifo World Economic Climate deteriorated for the fourth time in a row. In the Q1 2019, the indicator dropped from -2.2 points to -13.1 points. Expectations and assessments of the current economic activity dropped significantly, although analysts’ overall view is still slightly positive. The global economy is slowing down more and more.

Eurozone GDP is now expected to grow 1.3% versus a previous forecast of 1.9%. The revision is significant and reflects, amongst other factors, trade tensions, slower international growth, from China, and Brexit uncertainty.

In the economic calendar, the Canadian trade data will be reported at 13:30 GMT amid a lack of macro news from the US, as the risk trends will continue to drive the market sentiment in the session ahead.

Tuesday we see Aussie home loans data and NAB business confidence and Japanese machine tool orders. Wednesday it’s the RBNZ rate decision and monetary policy statement, UK CPI and PPI, Eurozone industrial production, and US CPI.

Trading Perspective: The Forex markets witnessed some volatile moves in the Swiss Franc in thin and slow early Asian trading, with the USDCHF having rallied hard nearly one big figure to test the 1.01 handle before reversing the entire spike to revert to parity. No major catalyst was seen behind the upsurge, except for the stops triggering on a breach of the 1.0030 strong upside barrier. The safe-haven Swiss Franc managed to regain the lost ground amid risk-off action in the Asian session.

EURUSD: The pair trades 0.10 percent lower to 1.1315 and looks vulnerable amid falling German bond yields and a bearish weekly close. The yield on the 10-year Bund fell to 0.07 percent the lowest level since the end of October 2016 — and could slide further toward zero levels on further growth concerns. Last week, the European Commission revised lower its 2019 German growth forecast to 1.1 percent from a previous forecast of 1.8 percent. The pair is sliding lower to the last five sessions but finds support at the 1.13 figure. A break below can drive prices to the yearly low at 1.1282, while bulls can gain momentum if the pair can cross the 50-day moving average at 1.1396. Euro traders will monitor the German and Eurozone first quarter GDP, scheduled for release this Thursday.

The GBPUSD is 0.17 percent lower at 1.2921 as Theresa May continues in search of a Brexit deal that will appease the majority of parliament members. The recent bearish move can find support at 1.29 while more solid demand will emerge at the 50-day moving average at 1.2830. On the upside, immediate resistance will be met at yesterday high at 1.2976 while a break above can force the price to weekly highs at 1.3103.

Open interest in GBP futures markets shrunk by nearly 1.7k contracts on Friday vs. Thursday’s final 196,320 contracts. In the same direction, volume decreased by around 48.6K contracts, prolonging the choppy performance.