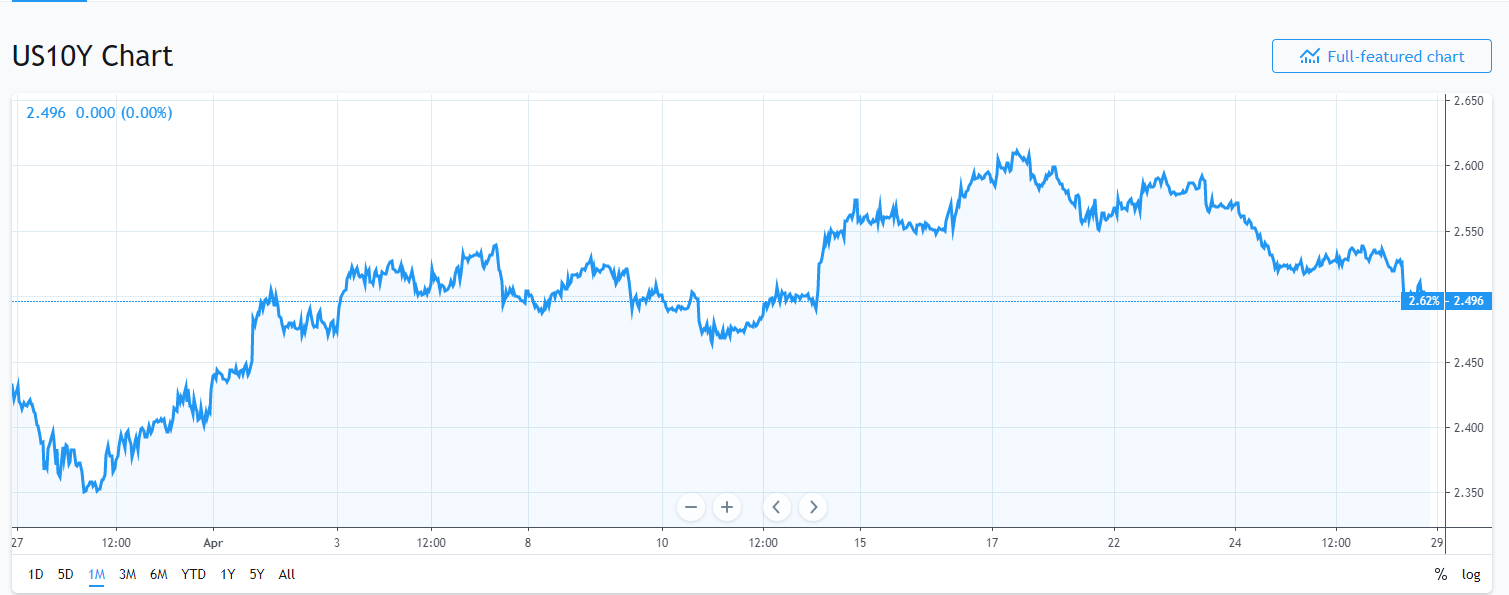

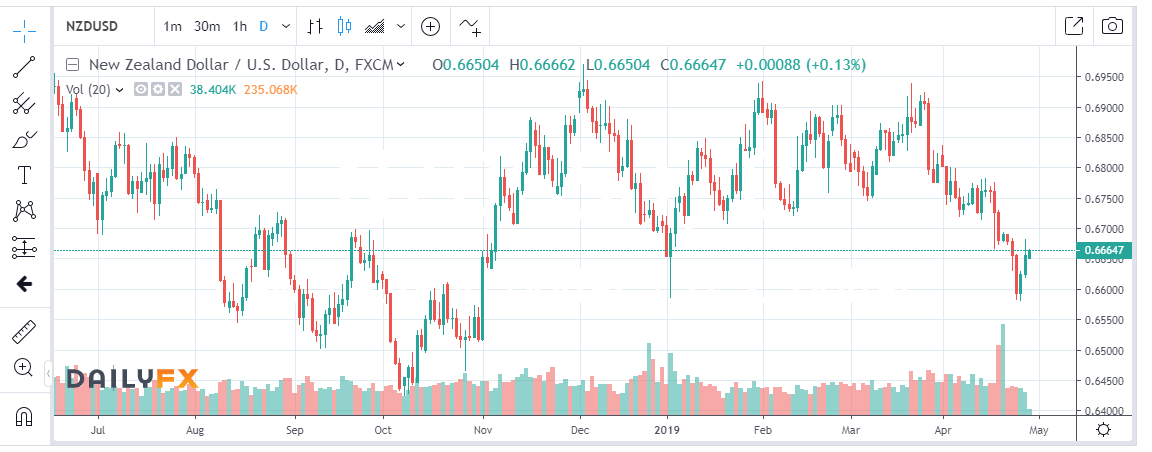

Summary: The US Dollar slipped against it’s Rivals despite a climb in US Q1 Annual GDP to 3.2% (against forecasts of 2.3%). Private sector consumption slowed sharply in the first quarter of 2019. Annual Core PCE Deflator, which is the Fed’s favoured inflation measure, rose 1.2% against 2.5% from the previous quarter. US Bond yields fell. The 2-year yield closed 5 basis points lower to 2.28% while the benchmark 10-year yield lost 3 basis points to 2.50%. The Dollar Index (USD/DXY), a measure of the Greenback’s against its 6 Major currencies slipped to 98.051 (98.173). EUR/USD, hovering on Friday near 24-month lows, climbed 0.1% to 1.1148 (1.1133). The Australian Dollar advanced further from the psychological 0.70 cent level to 0.7045, up 0.15%. Japan’s Yen was little-changed against the Greenback (USD/JPY 111.60) as the country prepares for its annual Golden Week holidays today. Upbeat New Zealand trade data which saw record exports boosted the Kiwi 0.6% higher to 0.6660 from 0.6590.

- EUR/USD – The Single Currency rallied to 1.1148 from 1.1135 on Friday on the overall softer Greenback. Latest results from the Spanish general elections saw the governing Socialist Workers Party claiming victory but failing to achieve a majority in Parliament. EUR/USD opens at 1.1150 in early Sydney.

- USD/JPY – Ahead of Japan’s extended Golden Week, which starts today (Showa Day), the Dollar was little-changed at 111.63 Yen (111.65 Friday). Thin volume in USD/JPY due to the holidays may see some volatile moves ahead of a big data dump for the global economy.

- AUD/USD – The Australian Dollar survived it’s fall toward the psychological 0.70 cent mark, at 0.70043. rallying to 0.7042 at the NY close Friday. An overall weaker Greenback buoyed the Battler. Emerging Market currencies lifted against the Dollar, supporting the Aussie.

- GBP/USD – Sterling hovered above the 1.29 level after slumping to 1.28757 near 6-week lows on Friday. The British Pound bounced off its lows to settle at 1.2915 against the overall weaker Greenback. Brexit uncertainty continues to dog the Pound.

- NZD/USD – The Kiwi was the best performing currency, lifting 0.6% against the Dollar on Friday. NZ’s trade surplus ballooned to 922 million against a forecast of 131 million, bettered by just over 7 times. New Zealand exports jumped to record highs on dairy demand from China. NZD/USD soared to 0.6682 from 0.6628 before settling at 0.6662 in early Sydney.

On the Lookout: The day starts off slowly with little data to feed off, although the picture changes as we head into the week. A data dump from the globe culminating with the FOMC Meeting (Thursday) and US Payrolls (Friday) awaits markets. The week’s risk event will be the FOMC meeting. Traders and investors will be looking to the Fed to see their reaction to recent data improvements against weak inflation and global growth.

The Bank of England holds its interest rate policy meeting, official bank rate votes and Monetary Policy Summary on Thursday. BOE Governor Mark Carney speaks following the meeting.

Data released today sees Eurozone Business Climate (April) and Consumer Confidence reports. The US releases two simultaneous reports on its Headline and Core PCE Price Index and Personal Spending for February (which was skipped last month) and March.

The week will also see lower volume and thin liquidity due to market closures from holidays. Apart from Japan’s week-long national holidays, Wednesday sees Chinese and Europe off for Labour Day.

Trading Perspective: Every picture tells a story and the drop in US bond yields is no different. Despite impressive overall US Q1 growth, both bond and FX traders focused on soft core inflation read. Which saw a fall in US bond yields, not matched by its global rivals. Without yield support, the Dollar will find further gains difficult. Current speculative market positioning remains long US Dollars which will also start to weigh on the Greenback.

- EUR/USD – The Euro survived at test of 1.1100, lifted by the overall softer US Dollar. The subsequent bounce on Friday saw EUR/USD trade to 1.11738 before settling at 1.1148. EUR/USD has immediate resistance at 1.1170/80 followed by 1.1200/10. We look to the release of the latest COT/CFTC report to see the speculative markets position on the Euro. Given the overall bearish sentiment on the Single Currency, we can assume that it hasn’t changed much. EUR/USD has immediate support at 1.1130 followed by 1.1100. Look for the Euro to consolidate with a likely range of 1.1135-1.1175. Prefer to buy dips.

- USD/JPY – the Dollar ended little-changed against the Yen given today’s public holiday and Golden Week. The 3-basis point fall in the US 10-year yield to 2.50% will keep USD/JPY capped. USD/JPY closed at 111.62. Immediate resistance can be found at 112.00 (112.029 overnight high). The next resistance level lies at 112.25. Immediate support can be found at 111.40 followed by 111.10. With low volumes dominating trade, there is a chance for some violent moves. Which will more likely be lower for the Dollar. Likely range today 111.25-111.75. Look to sell rallies.

- AUD/USD – The Aussie was boosted by an overall weaker US Dollar as well as a strong performance from its cuzz, the Kiwi. EM currencies were also up against the Greenback. AUD/USD has immediate resistance at 0.7060 (overnight high 0.70612) followed by 0.7100. Immediate support lies at 0.7025 followed by 0.7005. With no first-tier domestic data releases this week, the Battler will take its cues from Chinese and US data releases. Chinese PMI’s are due tomorrow. Look for a likely trade today in the Aussie of 0.7025-0.7075. Prefer to buy dips.

- NZD/USD – The Kiwi’s outperformance bears monitoring. Often its these minor currencies that give traders a clue on the next big move of the Majors. NZD/USD rallied on the back of impressive trade numbers boosted by a rise in New Zealand’s dairy exports to China. New Zealand releases its Employment report on Wednesday. NZD/USD has immediate resistance at 0.6680 and 0.6910. Immediate support can be found at 0.6640 and 0.6620. Look for a likely range today of 0.6645-0.6685. Look to buy dips.

Have a good week ahead, happy trading all.