Summary: After rocketing a total of 3.7% in 2 sessions on fierce short-covering, Sterling slipped 40 points from its NY close at 1.2645 to 1.2605 in pre-Sydney open. Britain and the EU on Sunday said that a lot more work would be needed to secure a Brexit agreement. Elsewhere the Dollar eased after China and the US made progress on their trade talks. China agreed to buy more US agricultural products while President Trump suspended a threatened tariff hike. The Dollar Index (USD/DXY) retreated 0.37% to 98.332 (98.715 Friday). The Greenback eased against Major currencies with the notable exceptions the Japanese Yen and Swiss Franc. The Euro was up 0.19% to 1.1035 (1.1005). Optimism on the partial trade China-US deal lifted the Australian Dollar to a 0.6795 finish, up 0.35%. The Dollar climbed 0.47% against the Japanese Yen. Stronger-than-expected Jobs growth propelled the Canadian Dollar 0.3% against its US counterpart (USD/CAD 1.3295 from 1.3335).

Wall Street stocks finished with gains while global bond yields extended their rally. The Dow was up 0.8% to 26,815. (26,505). The S&P 500 gained 0.7% to 2,972 (2,940).

Canada’s Payrolls created 53,700 jobs in September, beating median forecasts for a gain of 11,200.

Canada’s Unemployment Rate dipped to 5.5% from 5.7 % in August.

- EUR/USD – The Euro closed at 1.1035, above the 1.1010 for the first time since September 29. Broad-based US Dollar weakness and higher Euro area bond yields have buoyed the shared currency.

- GBP/USD – Sterling rocketed a total of 3.7% in two sessions, from 1.2212 to 1.2645 (Friday close) on fierce short covering on growing prospects for a less disruptive Brexit. The Pound dipped to 1.2605 from 1.2645 in pre-Sydney trading after weekend headlines suggested a lot more work needs to be done in Brexit talks. GBP/USD currently sits at 1.2630.

- USD/JPY – The Japanese Yen was one of two major currencies that weakened against the Dollar as risk appetite remained healthy. The partial trade deal between China and the US lifted USD/JPY to a 108.45 finish (107.95 Friday).

- USD/DXY – The Dollar Index, a popular gauge of the Greenback’s value against a basket of 5 major currencies, retreated to 98.332 from 98.715 Friday.

- AUD/USD – The Aussie extended its rally versus the Greenback to 0.6795, up 0.34% (0.6760). Overnight high traded for the Aussie was 0.6810. The Aussie Battler’s recovery remains tepid despite progress on China-US trade talks due to a weak domestic economy caused by the drought and housing slowdown.

On the Lookout: China returns after its week-long National Day celebrations with its Trade Balance report in Yuan and US Dollar terms. Meantime Japanese markets will be closed in observance of its national Health/Sports Day. US and Canadian markets are closed today in observance of Columbus Day and Thanksgiving Day respectively.

Data releases for today are few with Chinese trade numbers the highlight. Euro area reports see Germany’s Wholesale Price Index and Eurozone Industrial Production.

The week ahead sees the US Earnings Season begin. While this will affect stock trading more than FX, traders will keep an eye out for earnings from US companies affected by the strong US Dollar and trade war.

On the trade front, FX will keep an eye out for any official Chinese reaction to the trade deal initiated by President Trump. All eyes will also be on Trump’s trade tweets on Twitter.

Trading Perspective: FX will consolidate at current levels in Asia today. The Dollar is struggling with key levels against the currencies approaching. The week ahead will determine if this corrective downtrend can be sustained.

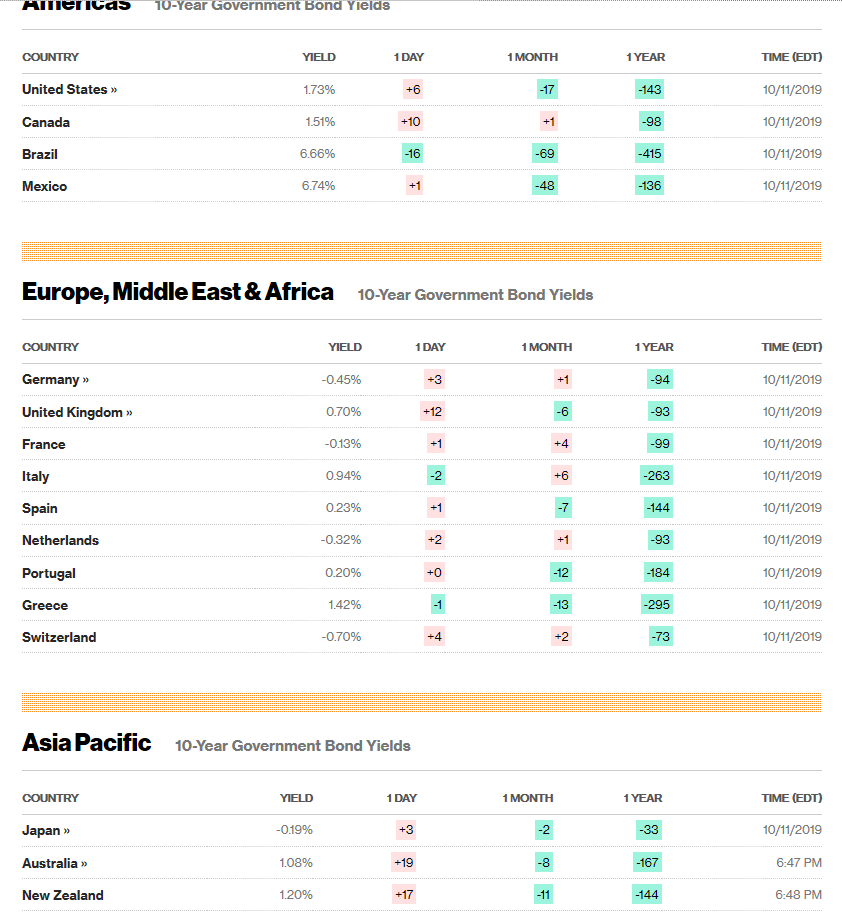

On Friday, US bond yields extended their gains. The US 10-year yield climbed 7 basis points to 1.73%. Rival treasury yields more than matched the gains in US rates, apart from Germany. Ten-year German Bund yields were up 2 basis points to -0.45%. The UK 10-year Gilt yield was up 12 basis points to 0.70%. Australia’s 10-Year bond rate closed at 1.01% from 0.89% on Friday. This will keep the Greenback on the defensive.

- USD/DXY – The Dollar Index traded to an overnight and September 20 low of 98.20 before settling at 98.332 in New York for a 0.37% loss. Overnight high traded was 98.742. Technically the Dollar Index is on a corrective downtrend. Immediate support can be found at 98.20 followed by 98.00. Immediate resistance lies at 98.70 and 99.00. Look for a likely trading ranged today of 98.10-98.50. Prefer to sell rallies.

- EUR/USD – The Euro rallied 0.19% to a 1.1035 finish in New York. The overnight high traded was 1.10627 before the shared currency dipped. The Euro’s topside was constrained by the yield gap between US and German 10-year rates. Trade war optimism and an overall weaker Greenback will keep the Euro supported. Immediate resistance can be found at 1.1060 followed by 1.1090. Immediate support lies at 1.1010 followed by 1.0980. Look to trade a likely range today of 1.1010-1.1060. Prefer to buy dips.

- GBP/USD – The British currency stole the limelight as best performing currency for 2 sessions following its 3.7% spike. Fierce short covering boosted the Pound to a 1.27068 overnight and late June high. GBP/USD settled to close at 1.2645, sliding to 1.2605 in pre-Sydney markets and settling currently at 1.2639. Sterling has immediate resistance at 1.2680 followed by 1.2710. Immediate support can be found at 1.2610 followed by 1.2560. Look to trade a likely range today of 1.2585-1.2715. Just trade the range shag on this one today.

- AUD/USD – The Aussie lifted to an overnight and three-week high at 0.68104 before easing to 0.6795 at the New York close. Immediate resistance lies at 0.6810 followed by 0.6850. Immediate support can be found at 0.6750 (overnight low 0.67533) followed by 0.6730. Look to trade a likely range of 0.6770-0.6820. Prefer to buy dips/

- USD/JPY – The Dollar rallied against the Yen to an overnight and near 2.1/2 month high at 108.628 before easing to 108.42 at the New York close. Japanese 10-year JGB yields were up 3 basis points to -0.19%, while the US 10-year rallied 7 basis points. The wider yield gap and risk-on stance lifted the USD/JPY pair. Immediate resistance lies at 108.70 followed by 109.00. Immediate support can be found at 108.30 followed by 108.10 and 107.80 (overnight low 107.849). Look for a likely trading range today of 108.10-60. Prefer to sell rallies.

Have a good week ahead. Happy trading all.