Summary: FX traded in familiar ranges, the Dollar Index (USD/DXY) closed flat (99.102) although the Greenback was mixed against major Rivals. It was a case of risk-off, risk-on again as hopes for a China-US trade deal rose. Yesterday was risk-off after the US State Department imposed visa restrictions on some Chinese officials it believed were responsible for abusing Muslims in Xiajiang Province. The Financial Times reported that Chinese officials are offering to increase their purchases of US agricultural products. Another headline from Bloomberg reported that Chinese officials are open to agreeing a partial trade deal with the US. The next round of trade talks are due today and Friday. The Dollar rallied 0.51% against the Yen to 107.50 before slumping to 107.10 yet again in early Sydney. The South China Morning Post reported that China and the US are no closer to a trade deal. An anonymous source said that China and the US “have made no progress.”

FOMC meeting minutes revealed Fed officials supported the need for a September rate cut but remain divided on the way ahead for monetary policy. The divide between the hawks and doves saw a neutral response from FX. The Euro advanced 0.12% to 1.0975 (1.0955). Sterling was modestly lower at 1.2912 91.2922) after erasing earlier gains. The Northern Irish party, which supports the British government said it would oppose an EU concession on the Irish backstop. The Australian Dollar ended flat at 0.6729. Emerging Market currencies were mostly up versus the Greenback. Wall Street stocks and global bond yields rose. The US S&P 500 was up 0.77% to 2,920.

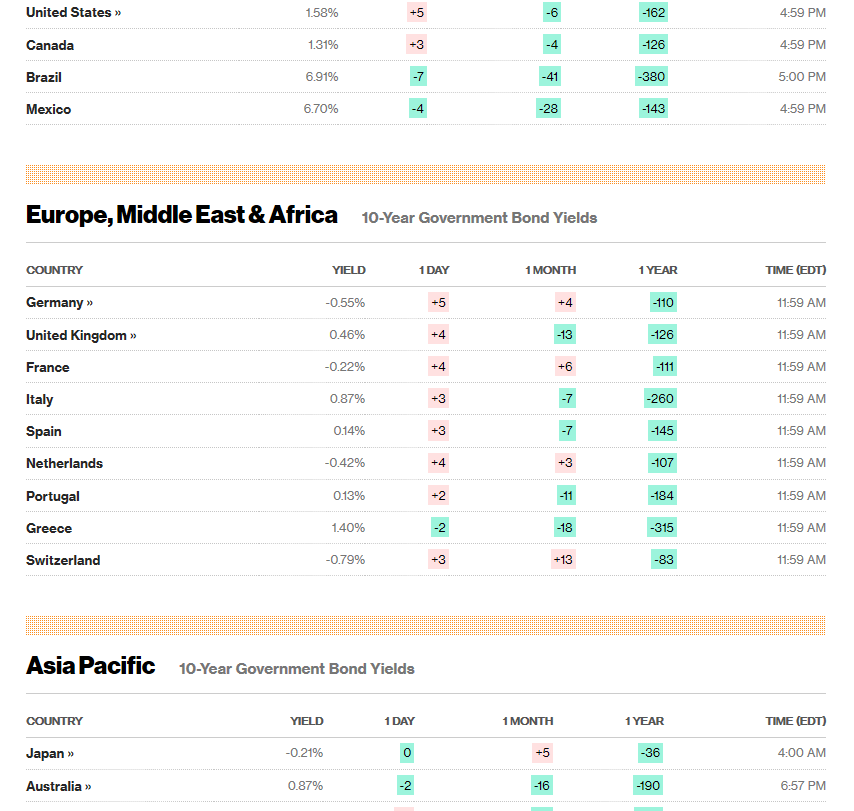

The US 10-year Treasury yield climbed 5 basis points to 1.58%.

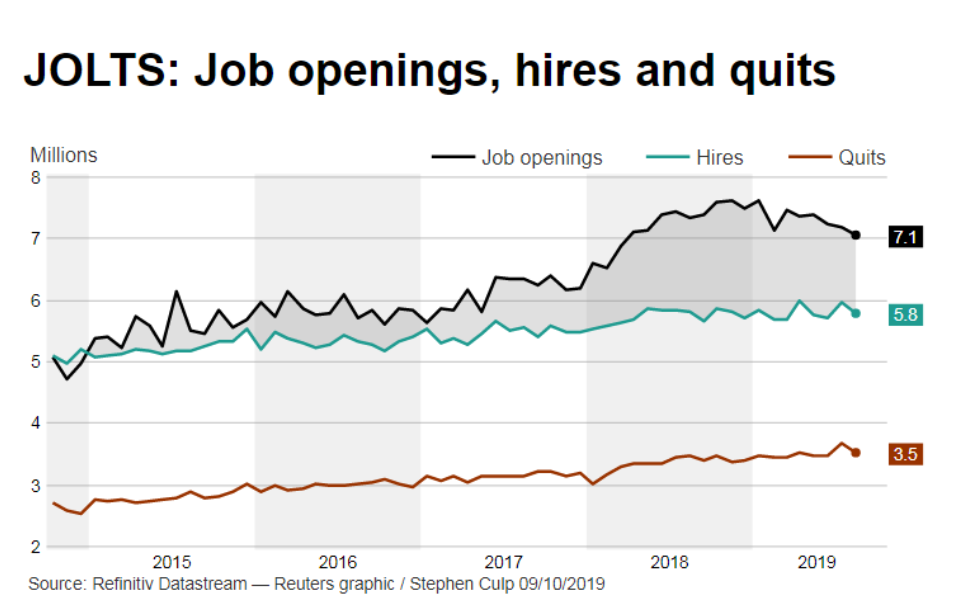

US JOLTS Job Openings, a measure of labour demand, dropped in August to 7.05 million from July’s 7.22 million, and missing forecasts of 7.35 million. While the number of openings is still plenty, it was the third monthly drop. The decrease in hiring fits in with the slowing trend in job growth.

- USD/JPY – The Dollar finished higher against the Yen to 107.51, up 0.51% from 107.10 yesterday. Risk-on sentiment and a higher US 10-year yield boosted the Greenback against its Japanese counterpart. USD/JPY then slumped in early Sydney back to 107.10 on the South China Morning Post report.

- EUR/USD – The Euro advanced against the Dollar to 1.0975 (1.0955) after trading in a familiar 1.0952-1.0990 range. German 10-year Bund yields climbed 5 basis points to -0.55% matching its US counterpart.

- GBP/USD – Sterling erased its gains, slipping to 1.2212 (1.2222 yesterday) after climbing to 1.2291 on a series of Brexit headlines from various media channels.

- AUD/USD – The Australian Dollar ended flat at 0.6728 (0.6730). The market’s risk-on stance failed to benefit the Aussie which continues to hover above recent 10-year lows reached last week.

On the Lookout: Markets will look to tonight’s release of US Headline and Core CPI reports. Ahead of that data is plentiful. The day starts off with the UK RICS House Price balance report. Japanese Core Machinery Orders, PPI, and Bank Lending data follow. Australian Home Loans round up Asia’s reports. Germany reports on it’s Trade Balance followed by French and Italian Industrial Production. The UK follow next with September GDP, Manufacturing Production, Industrial Production and Goods Trade Balance. The ECB releases its Monetary Policy Meeting minutes. Finally, the US Inflation numbers follows was well as US Weekly Unemployment Claims.

FX will continue to monitor trade related headlines from various media outlets.

Trading Perspective: The rally in US bond yields was matched by its rivals which saw the Dollar Index close flat. FOMC meeting minutes saw Fed officials divided evenly between hawks and doves on the way ahead for monetary policy. US JOLTS Job Openings, although its not a primary economic report, missed forecasts. The Dollar is living on borrowed time and tonight’s CPI report could be crucial. The Greenback’s topside is limited. The next move is south.

- USD/JPY – While the Dollar rallied against the Yen on improved risk appetite and higher US bond yields, it’s topside is limited to 108.00. USD/JPY closed at 107.50 after trading to an overnight high at 107.629. Immediate resistance today lies at 107.70 followed by 108.00 Immediate support can be found at 107.20 and 106.80 (overnight low traded was 106.934). Look to trade a likely range today of 106.80-107.80. Just trade the range shag on this one. Media releases will see this roller coaster ride continue.

- EUR/USD – The Euro advanced to finish at 1.0975 after trading to an overnight low at 1.09518. The ECB releases its latest monetary policy account meeting minutes later today. There are also Euro area data reports to digest. The Euro has been trading in a familiar range between 1.0900-1.1000 for just over a week now. Market positioning remains short of Euro bets and the topside is the more vulnerable side. Look for a likely range today of 1.0950-1.1110. Prefer to buy dips.

- AUD/USD – The Australian Dollar finished flat despite improved sentiment on renewed hopes of a trade. This morning’s opening saw the Aussie dip to 0.6715 on the South China Morning Post media release on trade. AUD/USD has immediate support at 0.6700 followed by 0.6680. Immediate resistance can be found at 0.6750 (overnight high 0.6750) followed by 0.6770. Look for a likely range today of 0.6700-50. Prefer to buy dips.

Tin helmets out, we are in for a volatile Asian session. Happy trading all.