Summary: Risk appetite rose as positive China-US trade news dominated market sentiment yesterday. The likelihood of a trade agreement between the two protagonists before year-end increased. The Chinese communist Party-backed tabloid, Global Times reported that Beijing and Washington were very close to a “phase-one” trade deal. The Japanese Yen fell to a one-week low against the Greenback, closing at 108.95 from 108.65. Sterling rallied back 0.64% to 1.2905 (1.2835 yesterday) as an opinion poll (ICM/Reuters) pointed to a firm lead for Boris Johnson’s Conservative Party over the opposition. The Dollar Index (USD/DXY) edged up to 98.319 (98.266) for a modest gain of 0.05%. Overall Dollar strength saw the Euro ease 0.06% to 1.1010. The Australian Dollar remained in a tight range, finishing a touch lower at 0.6777 from 0.6785.

Global bond yields were little changed. Wall Street stocks extended gains with the S&P 500 climbing 0.56% to 3,130 (3,113), an all-time high.

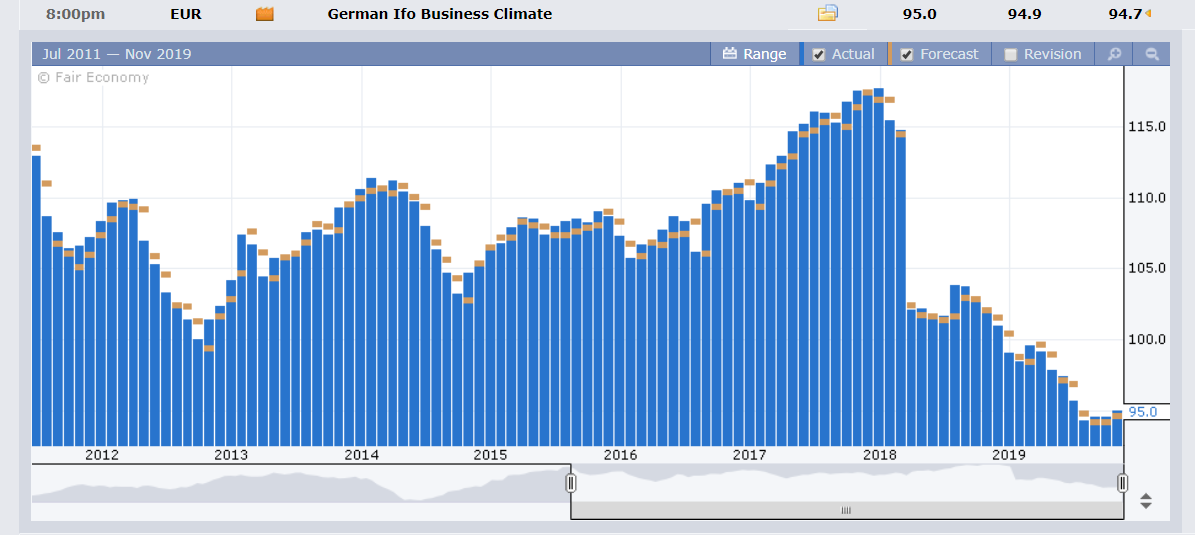

Germany’s IFO Business Climate Index rose to 95.0 in November from 94.6 in October. The UK’s Realised Sales Climate improved falling to -3.0 against a forecast of -10.0. China’s Conference Board’s Leading Index climbed to 1.3% in November after a downward revised October figure of 0.9%.

- USD/JPY – The rally in risk appetite lifted the Dollar to a one-week high at 108.977 before easing a touch to 108.95 in New York. USD/JPY traded in a steady 37-point range with the overnight low recorded at 108.61.

- GBP/USD – Sterling continued its roller coaster ride after failure to break 1.30 convincingly saw the Pound drop to 1.2749 late last week. The British Pound lifted to close at 1.2905, as opinion polls favoured Boris Johnson’s Conservatives and their election manifesto of a quick Brexit and tax cuts.

- EUR/USD – the shared currency eased further to 1.1010 from 1.1020 yesterday even as Germany’s IFO Business Climate improved in November. Still overall business climate remains depressed. And the slowdown in Services activity released over the weekend, was alarming which saw speculators adding to their net Euro shorts.

- AUD/USD – The Aussie eased a touch to 0.6775 from 0.6785 despite the market’s increased risk appetite. Traders were negative into today’s RBA speak with both Governor Philip Lowe and Deputy Governor Guy Debelle speaking at different functions today.

On the Lookout: Today’s events and economic reports see a data dump after yesterday’s bare calendar. New Zealand kicks off with its Q3 Headline and Core Retail Sales reports, both expecting improvements from Q2.

RBA Deputy Governor Guy Debelle speaks on “Employment and Wages” at the Australian Social Services National Conference in Canberra. Japan reports on it’s SPPI (consumer inflation) data for November as well as the BOJ’s Annual Core CPI. Federal Reserve Chair Jerome Powell speaks to the Providence Chamber of Commerce in Rhode Island on “Building on the Gains of the Long Expansion.”

Euro area data begin with Germany’s GFK Consumer Climate report. The UK’s High Street Lending report follows shortly.

RBA Governor Philip Lowe addresses the Australian Business Economist’s Dinner meeting with a speech on “Unconventional Monetary Policy” in Sydney. Watch out for this, could be some fireworks for the Aussie Battler.

US reports filter in with Goods Trade Balance (November), Preliminary Wholesale Inventories, HPI (House Price Index) for November, S&P Case-Shiller 20 HPI (House Price Index, y/y), Conference Board Consumer Confidence report, Richmond Manufacturing Index, and New Home Sales.

Trading Perspective: Ahead of this week’s US Thanksgiving holiday weekend which begins on Thursday, today is the biggest day in terms of data and events. We could see some fireworks with bigger ranges later today.

Meantime the latest Commitment of Traders/CFTC report for the week ended November 19 saw speculative US Dollar long bets increase to a 4-week high.

According to Saxo Bank, net US Dollar longs against 10 IMM currencies rose $2.1 billion to total $17.1 billion. Saxo Bank reported that “all but 2 currencies were sold with the Canadian Dollar, Euro and the Aussie seeing the bulk of the activity. The Kiwi also saw a build-up in shorts. We look at the breakdown on 4 currencies below.

- AUD/USD – The markets are obviously bearish heading into the RBA speak today. Normally the positive Sino-US trade news would have boosted the Aussie above 0.68 cents. But traders see dovish speak coming from RBA Governor Philip Lowe and his Deputy Guy Debelle. And they are positioned for it too. AUD/USD closed at 0.6775 from 0.6785 yesterday. Overnight high traded was 0.67992 while the low recorded was 0.67681. The latest COT report for the week ended 19 November saw speculative Aussie shorts increase to -AUD 47,240 from -AUD 40,809, the biggest short since mid-October. “Danger, danger” I echo the robot in Lost in Space on the market’s positioning. Immediate resistance lies at 0.6800 followed by 0.6830. Immediate support can be found at 0.6765 followed by 0.6745. Look to buy dips with a likely 0.6765-0.6835 range today.

- EUR/USD – The Euro once again finds itself slip-sliding away on pure bearish sentiment. The failure to climb back above the 1.1100 resistance level and soft services output has weighed on the shared currency. EUR/USD closed at 1.1010 with the overnight low traded at 1.10036. Immediate support lies at 1.1000 followed by 1.0980. Immediate resistance can be found at 1.1035 (overnight high 1.1032) followed by 1.1055. The latest COT report for the week ended 19 November saw net Euro speculative shorts increase to total -EUR 62,503 contracts, the largest in 4 weeks according to Saxo Bank. Look to buy dips today with a likely range of 1.1000-1.1050.

- GBP/USD – Sterling rallied back above 1.2900 to close at 1.2905. The opinion poll favouring the Conservative Party of Boris Johnson and their political manifesto is Sterling positive. GBP/USD has immediate resistance at 1.2920 (overnight high 1.2912) followed by 1.2960. Immediate support can be found at 1.2870 followed by 1.2840. The latest COT report saw speculative GBP shorts increase to -GBP 31,903 contracts (week ended November 19) from the previous week’s -GBP 28,133. Look to trade a likely range today of 1.2870-1.2970. Prefer to buy dips.

- USD/JPY – The Dollar edged higher against the haven darling Yen to close at 108.95, just under the immediate resistance level of 109.00. The Dollar traded in a relatively tight range of 108.61-108.98. The next resistance level for USD/JPY lies at 109.30. Immediate support can be found at 108.60 followed by 108.30. The latest COT report saw total net speculative JPY shorts virtually unchanged at -JPY 35,031 contracts. Look to sell rallies in a likely 108.50-109.00 range today.

Happy trading all.