Interactive Brokers Group, Inc., a US-based electronic brokerage firm founded by Thomas Peterffy, has published its Electronic Brokerage monthly performance metrics for February, indicating a 50% increase YoY in Daily Average Revenue Trades (DARTs).

With 1,020 thousand DARTs in February, Interactive Brokers registered a +13% QoQ improvement and a +50% jump year-on-year. Ending client equity rose by 40% YoY and 3% QoQ to $130.5 billion. Ending client margin loan balances increased 44% year-on-year and 7% quarter-on-quarter to $28.0 billion. With ending client credit balances of $47.5 billion, Interactive Brokers accomplished 10% higher metrics than the prior year, while registering a 1% drop QoQ.

With 1,020 thousand DARTs in February, Interactive Brokers registered a +13% QoQ improvement and a +50% jump year-on-year. Ending client equity rose by 40% YoY and 3% QoQ to $130.5 billion. Ending client margin loan balances increased 44% year-on-year and 7% quarter-on-quarter to $28.0 billion. With ending client credit balances of $47.5 billion, Interactive Brokers accomplished 10% higher metrics than the prior year, while registering a 1% drop QoQ.

Additionally, the company’s client accounts rose by 28% from February 2017 -while being up 2% since January- with 476 annualized average cleared DARTs per client account. Average commission per cleared client order was $4.05 including exchange, clearing and regulatory fees.

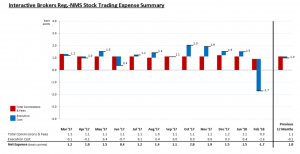

In February 2018, the average order in size for Stocks was of 2,218 shares (average commission per cleared client order of $2.50), while for Equity Options the number being 9.1 contracts (average commission per cleared client order of $6.14), and for Futures being 3.4 contracts (average commission per cleared client order of $5.92).

Futures include options on futures. The company estimates exchange, clearing and regulatory fees to be 58% of the futures commissions.

In late 2017, Interactive Brokers paid ASIC (Australian Securities and Investments Commission) a penalty of $250,000 to comply with an infringement notice given to it by the Markets Disciplinary Panel (‘the MDP’). The panel found that the broker had breached the ASIC Market Integrity Rules 2011 for irregular trading practices. Interactive Brokers was unaware of the suspicious trading by its client until ASIC detected it.

Founded in 1978 and headquartered in Connecticut, Interactive Brokers has over a thousand employees in a total of 24 offices in 12 countries. More than half of the company’s customers reside outside the United States, in approximately 190 countries. Approximately 16.6 percent of the company is publicly held, while the remainder is held by employees and their affiliates.