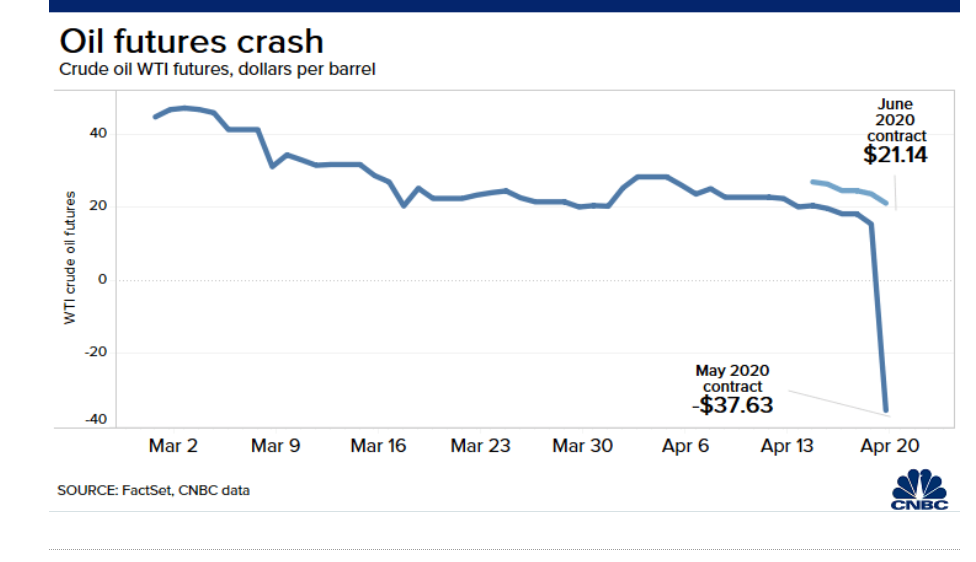

Summary: FX took a breather, enthralled by the Oil price crash in spectacular fashion to unprecedented levels. A futures contract for US crude prices dropped more than 100%, turning negative for the first time in history. West Texas Intermediate (WTI) crude for May delivery plunged to settle at negative -$37.63 per barrel, unprecedented levels. Which meant that producers would pay traders to take the oil off their hands. The collapse in demand was directly due to the coronavirus pandemic which has enforced strict lockdown in the country, creating a supply glut. Brent Crude Oil prices, the international benchmark, settled 7.4% lower at USD 28.60. Markets went into risk-off mode. Wall Street stocks declined in the dying minutes of trade. The DOW settled at 23,630 from 24,267, down 2.59%. The S&P 500 declined 1.96% to 2,820. The Dollar Index (USD/DXY), a favoured gauge of the USD’s value against a basket of 6 foreign currencies rose 0.17% to 99.966 (99.716). Against the oil sensitive Canadian Loonie, the Dollar jumped to finish at 1.4135 from 1.4010, up 1.1%. The Euro was modestly lower at 1.0865 (1.0875) after the latest Commitment of Traders report (week ended 14 April) saw speculators accumulate more of the shared currency, taking it to the largest levels since 2018. Sterling slipped 0.3% to 1.2433 (1.2507) as the UK’s Covid-19 death toll climbed by 449 in the last 24 hours. The Australian Dollar ended 0.34% lower at 0.6335 (0.6365) ahead of today’s release of the RBA’s latest Meeting Minutes. USD/JPY rose to 107.70 from 107.55 on the broadly stronger Greenback. Global bond yields were mixed. The benchmark US 10-year bond yield slipped to 0.61% from 0.64%. Germany’s 10-Year Bund yield climbed to -0.45% from -0.48%. The People’s Bank of China trimmed its interest rate (Loan Prime Rate) by 20 basis points to 3.85%.

Data released yesterday saw New Zealand’s Q1 CPI climb 0.8% from 0.5% in Q4, beating forecasts at 0.4%. Germanys Producer Price Index fell to -0.8%, lower than expectations of -0.7%. The Eurozone’s Trade Surplus rose to +EUR 40.2 billion, bettering forecasts at +36.3 billion.

On the Lookout: It was all about the oil price crash as US markets closed and Asia began its day. In early Sydney trade, US President Trump said the Oil producers need to do more by the market in terms of production cuts. OPEC nations and Russia agreed to cut production by 9.7 million barrels/day beginning in May, which markets considered not enough. Saudi Arabia said it was considering applying the oil production cuts as soon as possible. Trump said the US is looking into putting 75 million barrels into its strategic petroleum reserves.

In the FX space, today’s main event is the release of the RBA’s latest Monetary Policy Meeting Minutes (11.30 am Sydney) which will be followed by a speech from Governor Philip Lowe in Sydney (3 pm Sydney). Lowe is scheduled to deliver a speech entitled: “Economic and Financial Update” at the RBA headquarters in Sydney.

Other date released today sees Swiss Trade Balance, UK Employment data: Claimant Count Change (number of people claiming unemployment related benefits), Average Earnings Index (Wages), and Unemployment Rate. Germany reports its ZEW Economic Sentiment Index. This is followed by the Eurozone ZEW Economic Sentiment Index. Canada reports its Headline and Core CPI data for March.

US Existing Home Sales round up the days data releases.

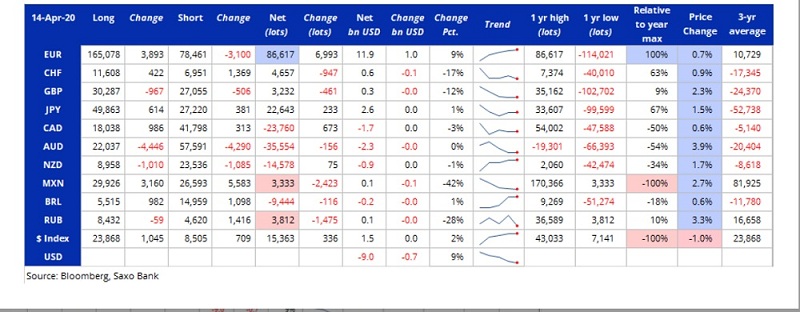

Trading Perspective: The souring risk sentiment that resulted from the oil price crash saw a modest lift to the US Dollar against most of its rivals. The latest Commitment of Traders/CFTC report (week ended 14 March (which covers the long Easter weekend) saw large speculators and hedge funds sell Dollars, mostly to buy Euros. Speculative net Euro long bets increased by 7,000 lots to total +EUR 86,617, levels not seen since 2018 according to Saxo Bank. Elsewhere the movements were light against the other currencies. Apart from the Euro, speculators were short USD/long currency in GBP, JPY, CHF and MXN. Against the AUD, NZD, CAD speculators were long of USD, short of these currencies. This should result in modest USD support.

AUD/USD – Dips on Risk-Off, Static Ahead of RBA Minutes – 0.6270-0.6440

The Australian Dollar dipped to 0.6337 in late New York from yesterday’s opening at 0.6365 on the drop in risk sentiment following the oil price plunge. The big event today is the release of the RBA’s latest Monetary Policy Meeting Minutes (11.30 am Sydney). RBA Governor Philip Lowe speaks at the Australian Central Bank’s headquarters in Sydney with an economic and financial update.

Meantime, the latest Commitment of Traders/CFTC report saw a mild increase in net speculative AUD short bets by -AUD 156 contracts to total -AUD 35,554 (week ended 14 April). All this says to this writer, as he puts his trading cap on, is that the Aussie short bets have yet to see a decent clean-out. Which is supportive of the Battler.

On the day, AUD/USD has immediate support at 0.6330 and 0.6300. This is followed by 0.6270. AUD/USD hit its lows in late New York trade following the collapse in the WTI Oil Futures contract. Immediate resistance lies at 0.6370 followed by 0.6400 and then 0.6440. While trading has been subdued, or less volatile of late, I don’t expect it to stay this way. It’s too soon for volatility to ease and the current conditions should see a pick-up again. Look to buy dips in a likely range today of 0.6285-0.6425.

EUR/USD – Spec Long Build Limits Topside, Risks Lower; 1.0770-1.0920

The Euro eased modestly to 1.0865 from 1.0875 yesterday. Trading was more subdued with the overnight range between 1.08411 and 1.08967. The shared currency was sidelined with more of the FX action on the commodity and resource currencies. Germany’s Finance Ministry, in its monthly report, predicted that its March Industrial Output was likely to plunge due to effects of the coronavirus on the services and retail sector.

The Commitment of Traders/CFTC report for the week ended March 14 saw net speculative Euro long bets increase by EUR 6,993 to total +EUR 86,617, the biggest number of shorts since 2018. Total net speculative long Euro bets were 80% relative to the year’s maximum. This will continue to constrain any meaningful Euro rallies.

EUR/USD has immediate resistance at 1.0890 followed by 1.0920 and 1.0950. Major resistance can be found at 1.1000. Immediate support lies at 1.0840 (overnight low 1.08411). This is followed by 1.0810 and 1.0780. Look to sell rallies in a likely 1.0780-1.0900 range today.

USD/CAD – Lifts on Oil Crash, 1.4150 Caps for Now, 1.4000-1.4300 Likely

The slump in West Texas International Oil futures pushed the Loonie down by 1.1% against the US Dollar. USD/CAD closed at 1.4135 from yesterday’s opening at 1.4010. The USD/CAD was capped overnight at 1.41368, easing to 1.4120 before trading around its New York highs. Given the plunge in WTI futures to unprecedented negative levels, USD/CAD should be higher.

The latest Commitment of Traders/CFTC report for the week ended April 14 saw total speculative CAD short bets mainly unchanged at -CAD 23,760. The net change was +CAD 673. This has seen the USD/CAD dip strongly when the Dollar had a broad-based fall against its rivals. While this may be a limiting factor for further USD/CAD topside, I don’t expect this to last long.

USD/CAD has immediate resistance at 1.4150 followed by 1.4200. Immediate support can be found at 1.4120 followed by 1.4080 and 1.4040. Look to buy USD dips with volatility to pick up in a likely range of 1.4050-1.4250. Tin helmets on, we are going for a roller coaster ride.