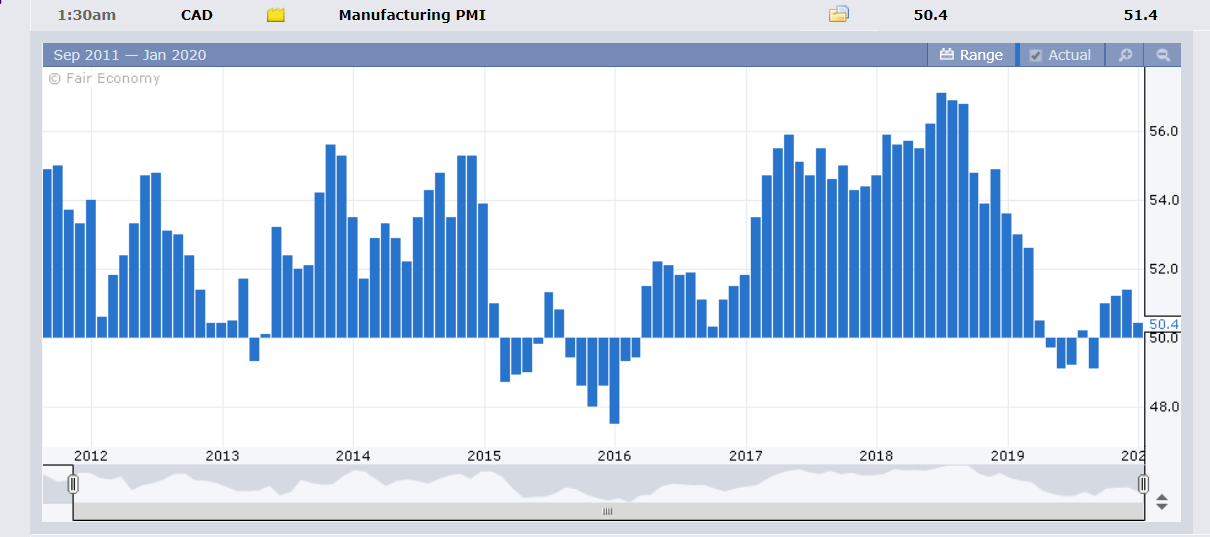

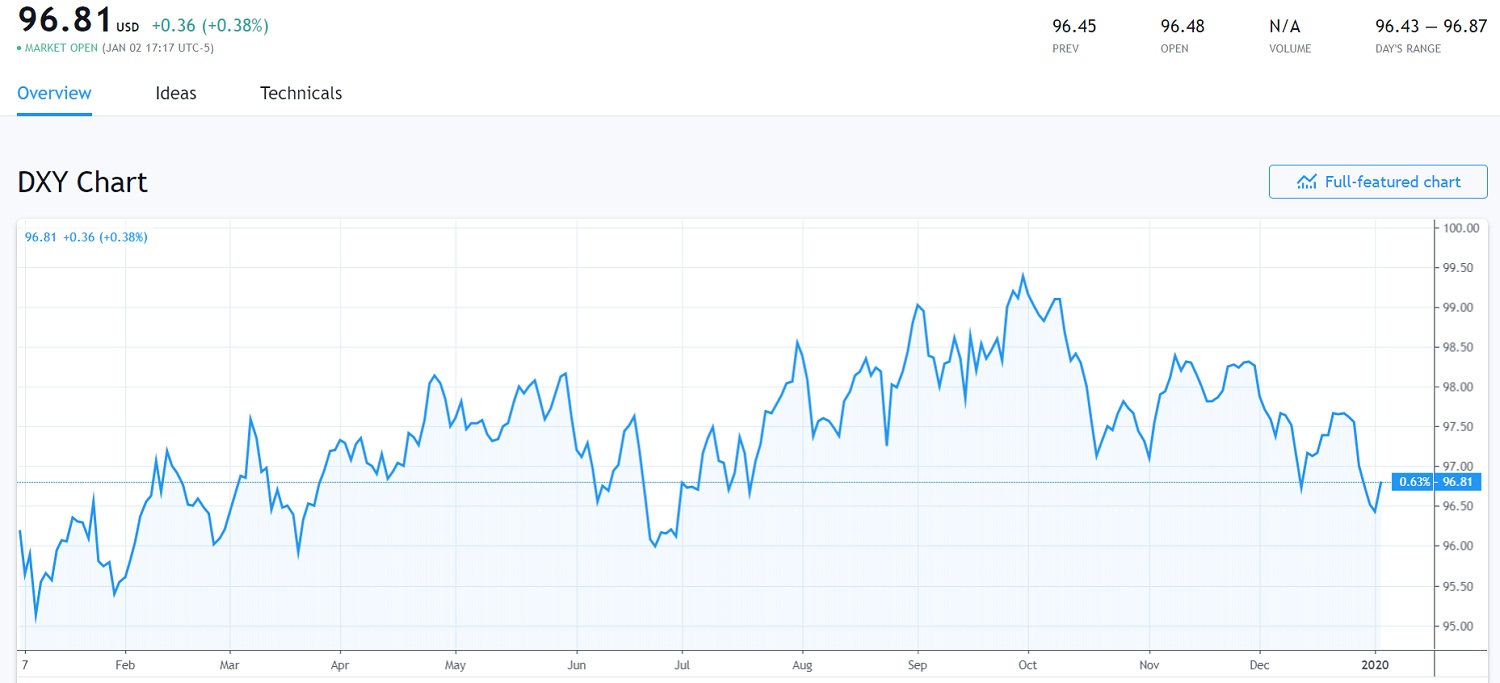

Summary: The Dollar Index (USD/DXY) recovered from 6-month lows and a 4-day losing streak, gaining 0.47% to 96.844 (96.42). Euro-area and British factory activity mostly unimpressed and triggered a sell-off in the Euro and Pound, ending a 4-day winning streak. Extended thin trading conditions saw Sterling slump 0.9% to 1.3135 (1.3250) while the Euro dropped 0.47% to 1.1167 (1.1215). In the US, Claims for Unemployment benefits decreased to 222,000 from the previous week’s 224,000. Which is a positive signal for the US Labour market. The Australian Dollar fell below 0.70 cents to 0.6980 from 0.7015, a loss of 0.55%. Against the Loonie (strongest Major currency for 2019), the US Dollar edged higher to 1.2991 from 1.2980. Canada’s Manufacturing PMI slumped to a 4-month low at 50.4 in December, down from 51.4 the previous month. Against the Yen, the Dollar dipped 0.16% to 108.55. The Dollar extended its gains versus Emerging Market currencies. USD/THB closed above the 30.00 psychological support level at 30.17.

In the equity markets, a rally in tech stocks lifted Wall Street. The DOW finished up 1.5% at 28,875 (28,425). The S&P 500 was 1.2% higher at 3,258 (3,220). The 10-year US Bond yield closed 4 basis points lower at 1.87%. Two-year US note yields were unchanged at 1.57%. The 10-year-to-2-year spread narrowed to .30% (0.34% yesterday). There were no new developments in global trade or Brexit.

China’s Caixin Manufacturing PMI dipped to 51.5 in December from 51.8 the previous month.

The Eurozone Final Manufacturing PMI outperformed, printing at 46.3 against 45.9 expected. Germany’s Factory Activity contracted further in December. UK Final Manufacturing PMI dipped to 47.5 against forecasts of 47.6.

- EUR/USD – The Euro retreated 0.47% against the Dollar to 1.1167 from 1.1215 yesterday. Euro area factory activity mostly unimpressed and growth concerns on the continent in 2020 remained.

- GBP/USD – Sterling saw renewed selling following its strong rebound in thin markets. The Pound slumped to close at 1.3135, down 0.92% from 1.3250 yesterday. Unimpressive UK factory activity and an overall stronger US Dollar weighed on the British currency.

- USD/DXY – The Dollar Index recovered to 96.844 from yesterday’s close at 96.42. The sell-off that began from 97.66 (just before Christmas) was a bit overdone. And in thin trade, the bounce was likely given that US economic data were mostly better this week.

- AUD/USD – The Australian Dollar fell back under 0.70 cents to close at 0.6981 (0.7015 yesterday). The Battler rallied off lows on December 18 at 0.6850 as shorts scrambled to cover in low volume trade all the way up to 0.7032 yesterday.

On the Lookout: Trading conditions will remain thin today. A data dump from Europe and the US await traders.

UK BRC Shop Price Index (annual) for December and monthly Nationwide House Price Index begin the reporting for today. German and French Preliminary CPI reports follow. Next is Spain’s Unemployment Change and German Unemployment rate for December. UK Construction PMI, Mortgage Approvals, and Net Lending to Individuals follow. Finally, the US ISM Manufacturing PMI, Manufacturing Prices, Construction Spending, Wards Total Vehicle Sales follow. The FOMC’s latest Meeting Minutes are released (6 am Saturday morning, Sydney).

Trading Perspective: The Dollar’s rebound was inevitable given it’s 4-day fall after better than expected US economic reports boosted the Greenback. The bigger picture in 2020 for the US Dollar is still up in the air right now. Meantime, the thin trading conditions should see wider ranges within levels that we’ve seen. It’s a time to remain flexible and trade your ranges, know your levels.

- EUR/USD – The Euro finished 0.47% lower at 1.1167 from 1.1215 yesterday. EUR/USD hit a high at 1.12392 on the last trading day of 2019. This should cap the shared currency for this week. Today expect immediate resistance at 1.1200 followed by 1.1225. Immediate support can be found at 1.1160 (overnight low 1.11635). The next support level is found at 1.1140 and 1.1110. Look to trade a likely range today of 1.1150-1.1200.

- AUD/USD – The Aussie Battler finished at 0.6982, down 0.54% from 0.7015 yesterday. Immediate support for the Aussie lies at 0.6970 followed by 0.6940 and 0.6920. Immediate resistance can be found at 0.7000 and 0.7020. There are no Australian economic reports today. The Aussie’s moves will be determined by the Greenback and any news out of Asia. Look to trade a likely range of 0.6970-0.7020. Prefer to buy dips to 0.6960.

- USD/DXY – The Dollar Index had a good bounce to 96.844 NY close from 96.42 yesterday. Immediate resistance for the Dollar Index is found at 97.00 followed by 97.30 and 97.50. Immediate support can be found at 96.40 followed by 96.10. If US economic data out-perform we could see a bounce to 97.30 before we retreat again. Look for a likely trading range today of 96.70-97.00. Prefer to sell rallies to 97.20.

- USD/CAD – The Dollar had a moderate bounce against the Canadian Dollar to 1.2990 (1.2980 yesterday). Despite weaker than expected Canadian Manufacturing PMI, the Dollar’s recovery against the Loonie, 2019’s strongest currency was muted. USD/CAD plunged to 1.29516, October 2018 lows. Against the Loonie, the Dollar remains a buy. Immediate support can be found at 1.2970 (overnight low 1.29687) followed by 1.2950. Immediate resistance lies at 1.3010 followed by 1.3040. Look to buy USD dips with a likely range today of 1.2980-1.3030.

Happy Friday and trading all.