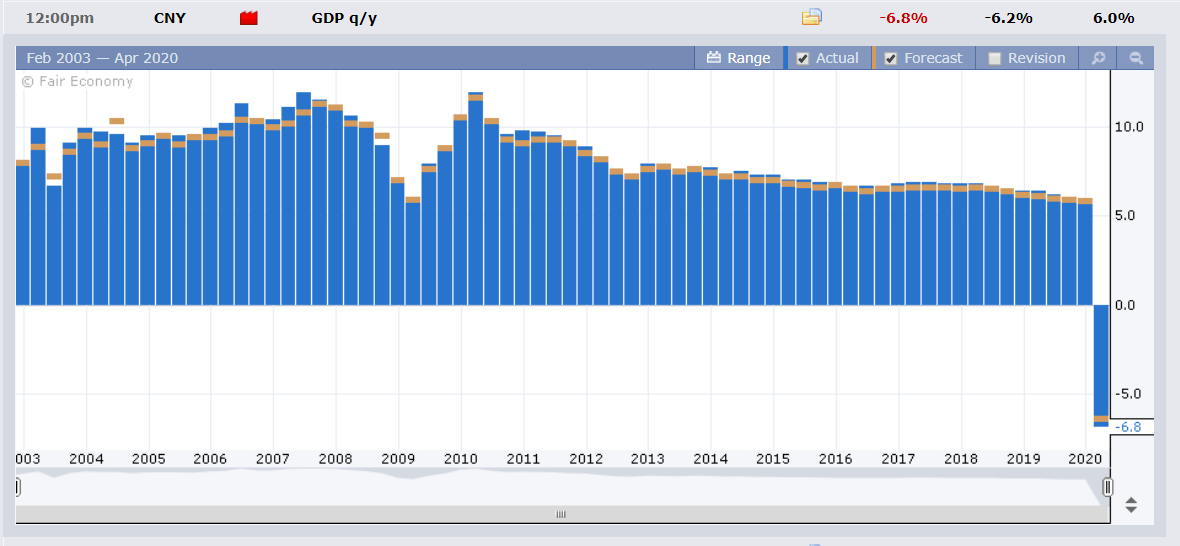

Summary: The Dollar eased against its rivals following two days of safe haven-based gains as the US made plans to reopen the economy, with others due to follow. Markets ignored more dismal economic reports after Thursday’s horrid US Jobless Claims that hit 22 million in a month. Data released on Friday from China saw its economy contract in Q1 2020, the first contraction since the country began publishing the report in 1992. The coronavirus pandemic showed signs of easing in some of the world’s hotspots while the US led other countries with plans to reopen their economies and relax lockdowns. Risk sentiment was stronger, equities rallied, and the US Dollar eased. FX volatility was muted which resulted in relatively narrow trading ranges. The Euro reversed its fall, advancing 0.41% against the US Dollar to 1.0875 from 1.0838 Friday. Sterling rebounded to 1.2506 (1.2450) despite a Times report that saw UK PM Boris Johnson tell colleagues that he is very cautious about easing lock-down restrictions. The Australian Dollar led commodity currencies higher, rallying to 0.6363 (0.6322) in late New York. Against the Canadian Loonie, the US Dollar eased to 1.4008 from 1.4108. The Dollar eased against the Japanese Yen to 107.55 (107.92). US Stocks gained for the 2nd day running, the DOW climbed 1.64% to 24,627 (23,817). The S&P 500 closed at 2,879, up 1.4% from Friday’s 2,830 for a gain of 1.38%. Bond yields were mostly higher.

The benchmark US ten-year treasury yielded 0.64% (0.62% Friday). Germany’s 10-year Bund yield was unchanged at 0.30%. Japan’s 10-year JGB rate was up one basis point to 0.01%.

Data released Friday saw China’s Q1 GDP contract to -6.8% from the previous quarter’s +6.0% expansion, missing expectation at -6.5%. Fixed Asset Investment underwhelmed, falling to -16.1% against forecasts of -15.1%, but better than the previous month’s -24.5%. Industrial Production bettered forecasts, falling -1.1% against -7.3%. China’s March Retail Sales dipped to -15.8% from the previous -20.5%, missing expectations of -10.0%. The US Conference Board’s Leading Index bettered forecasts at -6.7% against -7.1%.

On the Lookout: As cases and fatalities from Covid-19 slow, and countries look to relax lockdowns, the spotlight moves to the economic reports in the week ahead. Today kicks off with New Zealand’s Q1 CPI report. The UK reports on its Rightmove House Price Index. Japan’s Trade Balance follows. Euro area reports start off with Germany’s Producer Price Index followed by the Eurozone’s Current Account and Trade Balance. Finally, Canada releases its Wholesale Sales (March) data.

Tomorrow sees the release of the RBA’s latest monetary policy meeting minutes followed by a speech from Governor Philip Lowe. UK Employment and German ZEW Economic Sentiment Index are also scheduled for release. This week’s highlights are on Thursday where Australia, Japan, France, Germany, the Eurozone, UK, and US report their Manufacturing and non-manufacturing PMI’s.

Trading Perspective: Expect more consolidation ahead in Asia this morning as markets continue to monitor various countries responses to the coronavirus pandemic slowdown. More stimulus efforts to aid economies are in the pipeline. Talks in the US between the US House Speaker Nancy Pelosi and Treasury Secretary Mnuchin were optimistic about reaching a deal to top up funds aimed at assisting small businesses stay afloat. Germany prepares for a limited reopening today.

Further stabilisation is good for equities and negative for the Dollar. Risk-on takes away the safe-haven support for the Greenback. The spotlight falls in the upcoming economic data.

USD/CAD – Headed Back Towards 1.3950/1.40 Support, 1.4170-1.4200 Resists

The Dollar slipped against the Canadian Loonie to 1.4010 in late New York from 1.4030 on Friday as risk appetite increased and stocks climbed. Trading was more subdued on Friday than in the past 2 weeks which saw some big swings in the Loonie. The US Dollar started grinded lower in the last two sessions after its failure to rally past the 1.4200 barrier (1.41823). Prior to that, the USD/CAD pair slumped to 1.3855 (14 April).

USD/CAD has immediate support at 1.4000 and 1.3980 and 1.3950. Strong support can be found at 1.3930 and 1.3870. Immediate resistance lies at 1.4050, 1.4080 and 1.4120. The big resistance level in USD/CAD lies at 1.4200, followed by 1.4250.

Canadian data out this week starts off with today’s Wholesale Sales report which is secondary. Tomorrow, Canada reports its Headline and Core Retail Sales. Wednesdays sees more crucial Headline and Core, Trimmed CPI. Expect the USD/CAD pair to be dictated more by its Canada’s bigger southern neighbour. Look for a likely range today of 1.3985-1.4125. Prefer to buy dips.

AUD/USD – Stuck, Solid Base at 0.6250, Strong Barrier at 0.6450

The Aussie Dollar lifted in tandem with risk appetite leading commodity currencies higher on Friday. Against the Greenback, the Battler rose to 0.6365 following Friday’s 0.6322 opening. AUD/USD fell to an overnight low at 0.6314. Overnight high traded was 0.63850. The week ahead sees the RBA release its latest monetary policy meeting minutes as well as a speech from RBA Governor Philip Lowe tomorrow. Thursday sees Australia’s Flash Manufacturing and Services PMI are due on Thursday. Australia’s leading economists have warned Prime Minister Scott Morrison against easing social distancing too early as job estimates grow. New South Wales, Australia’s biggest state confirmed 6 new COvid-19 cases, brining the nation’s total to 6,619 with 71 deaths.

The AUD/USD pair has been in rally mode for the most part of two weeks. A combinations of speculative Aussie short bets and an improvement in risk sentiment which saw equities bounce strongly from their lows has boosted the Australian Dollar. However, it would need to break above the strong barrier at 0.6450 to climb to its next target of 0.6600-0.6700 range. For now, it looks like 0.6250-0.6450.

AUD/USD has immediate resistance at 0.6390 and 0.6420 followed by 0.6450 (strong). Immediate support can be found at 0.6315 followed by 0.6280 and 0.6250. Look to trade a likely range today of 0.6280 to 0.6380. Just trade the range shag on this puppy today.

EUR/USD – Recovery in Place, Near Term Range Forming, 1.08-1.10

The Euro recovered from Friday’s overnight and April 7 low at 1.08121 to finish at 1.0875 in late New York Friday. Earlier this week, the EUR/USD rally stalled near the 1.10 level (1.09907). A short-term range is likely between 1.08-1.10 with a base forming at the 1.0800 area.

Market positioning from the last COT/CFTC (week ended 30 March) report saw net speculative Euro long bets at their biggest since June 2018. Last week’s long Easter weekend saw no report and we look to this week for the latest statistics. Much of the Euro’s drop has been the result of long bets exiting their positions. We can assume that the core positions remain long Euro bets which suggests a weaker rather than a stronger Euro.

Immediate support can be found at 1.0840 followed by 1.0810. Immediate resistance lies at 1.0900 followed by 1.0930. Look for a likely range today between 1.0830 and 1.0930. Prefer to sell into Euro strength.