Asian markets ended higher with Hong Kong’s Hang Seng gain 0.7%, and the Shanghai Composite index climbed 0.4% while Nikkei added 2.44%. On Friday, the FED chairman Jerome H. Powell said that the Fed would be flexible amid market turbulence and broader concerns about slowing global growth. The comments sent shares in the United States higher, as did strong job numbers and the resumption of trade talks between the United States and China.

European stocks opened positive as well, following Friday’s stock market performance after several days of drops. Futures trading predicting how Wall Street will start the week also painted a bullish picture.

On the Lookout: The economic calendar, today sees German Factory Orders and Retail Sales (December) as well as Euro-Zone Retail Sales. North America sees Canada’s Ivey PMI and US ISM Non-Manufacturing for December. Later in the week we see the US Trade Balance, as well as Headline and Core CPI.

Morten Helt, senior analyst at Danske Bank, points out that on Friday, Federal Chairman Powell said that the FOMC’s policy is flexible and that officials are ‘listening carefully’ to financial markets.

“Powell also said that the Fed will be patient as it observes how the economy evolves and referred to 2016 as an example where the FOMC indicated four hikes but only raised the target range once in December.”

“Powell’s comments came after FOMC members Kaplan (on Thursday) and Mester (earlier on Friday) said something similar and overall, the Fed is clearly indicating flexibility in its policy both in terms of the interest rate and quantitative tightening. The market expects the Fed to stay on hold in March.”

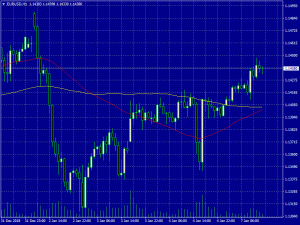

Trading Perspective: EURUSD positive momentum is still intact and now the pair trading in 1.1436 helped by positive macro news, as European Monetary Union Retail Sales (MoM) registered at 0.6% above analyst’s expectations (0.1%) in November. The monthly high of 1.1486 is the next resistance. On the flipside previous week low at 1.1345 is the first support area.

Trading Perspective: EURUSD positive momentum is still intact and now the pair trading in 1.1436 helped by positive macro news, as European Monetary Union Retail Sales (MoM) registered at 0.6% above analyst’s expectations (0.1%) in November. The monthly high of 1.1486 is the next resistance. On the flipside previous week low at 1.1345 is the first support area.

AUDUSD hits 2 week highs at 0.7126, and now the buyers are in control looking for the first resistance at 0.7170 area. Investors are optimistic about a US-China trade deal with high-level negotiators meeting in Beijing today and tomorrow.

GBPUSD is trading higher today in an attempt to break above the 50 day moving average at 1.2770 a level which if breached will attract the bulls. Open interest in GBP futures markets shrunk by almost 5.6K contracts on Friday vs. Thursday ’s final 214,437 contracts. In the same line, volume decreased by around 1.6K contracts, recording the second consecutive drop.