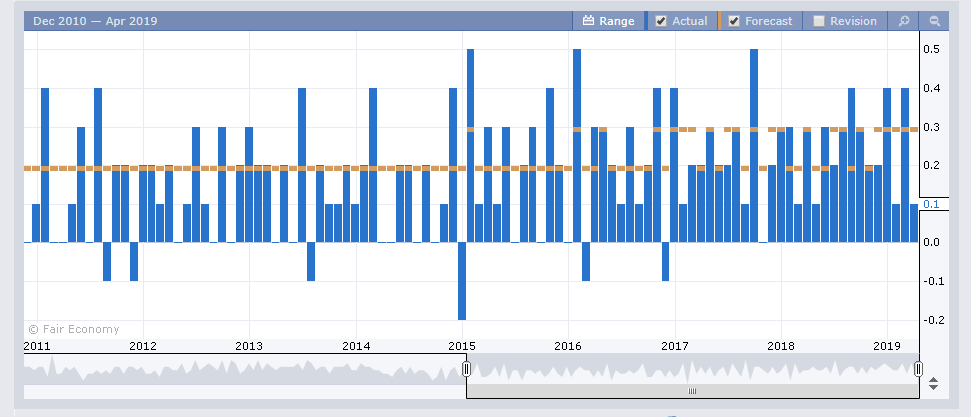

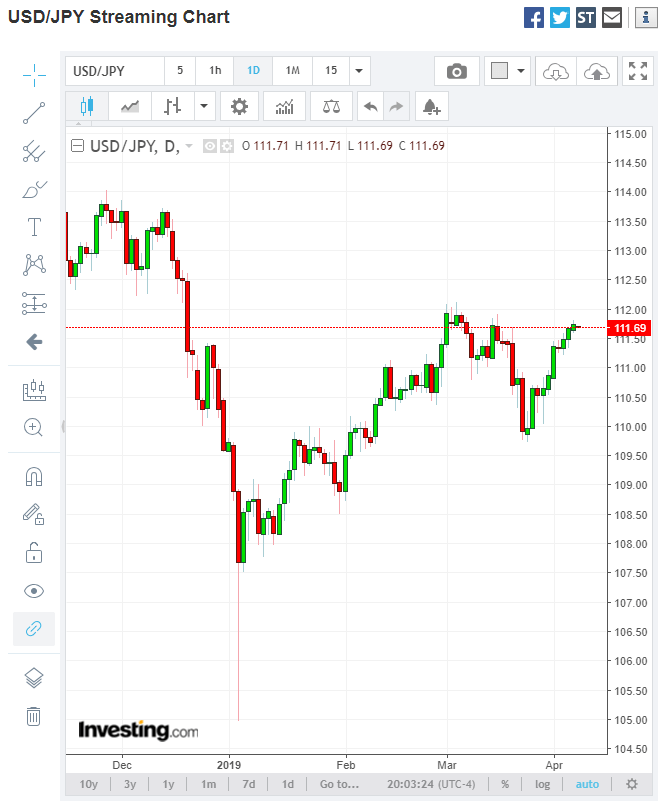

Summary: The Dollar ended little-changed, albeit slightly higher following a mixed US Payrolls report. US March Payrolls bettered forecasts, climbing +196,000 (vs f/c +180,000). February’s employment gains were revised up to +33,000 from +20,000, still the weakest since February 2017. Wage gains however, fell to 0.1% from the previous 0.4%. The Euro closed at 1.1217 from 1.1222, little-changed. The Dollar Index (USD/DXY) was marginally higher at 97.363 from 97.277 Friday. Growing uncertainty due to further delays in Brexit pushed Sterling to one-week lows at 1.2987 before settling in New York at 1.3035, down 0.38%. The Aussie was little-changed at 0.7110. The Dollar closed flat against the Yen at 111.71 in another tight range session.

Currency volatility stayed depressed. One-month implied volatility in the Euro and Yen remained below 5 %. Meantime the latest Commitment of Traders report saw a build-up in Speculative US Dollar longs to the biggest since 2016. The bulk of USD longs were against the Euro, Yen and Australian Dollar.

Wall Street stocks were mixed. The Dow closed flat (26,380.00) while the S&P500 was up 0.49% (2,892.00). The yield on the US 10-year bond slid one basis point to 2.50%.

– EUR/USD – the Euro finished with modest losses to 1.1217 from 1.1222 Friday morning. Volatility stay depressed with a tight trading range of 1.1210-1.12461. The Euro managed to hold above 1.1200. The week ahead sees the ECB meet on policy (Thursday, 11 April.) Meantime its steady as she goes.

– GBP/USD – Sterling slid following another delay move by PM May on the UK’s inability to agree a Brexit deal. The British Pound slid to one-week lows at 1.2987, settling at 1.3037. Sterling has traded the past week between 1.30-1.32.

– USD/JPY – the Dollar has steadily climbed in the previous 8 days on the bounce in the US 10-year bond yield from 2.38% to 2.52%. On Friday, the 10-year yield slipped back to 2.5%. USD/JPY finished flat at 111.71. Net Speculative JPY shorts rose to the biggest in 3 months according to the latest COT/CFTC report.

On the Lookout: The Dollar edged slightly higher without breaking new ground after a mixed US Payrolls report. While March Payrolls beat forecasts, which was expected, the rise was below 200,000. February’s Employment Gain was revised up, but it was still the smallest in 2 years. The fall in Wages was a big disappointment for Dollar bulls. A lack of any wage pressures argues against any Fed rate hikes. Markets will keep their eyes fixed on this week’s US CPI and PPI reports (Wednesday and Thursday), as well as the Fed’s FOMC meeting minutes. The week ahead also sees the ECB rates policy meeting (Thursday).

Today sees Japanese Current Account, Consumer Confidence, Economic Watcher’s Sentiment Index. Australian ANZ Job Ads round of Asia’s data reports. Europe sees German March Trade Balance, Eurozone Sentix Investor Confidence data. Canada reports on March Housing Starts and Building Permits. US Factory Orders round out today’s data.

Markets will continue to monitor developments on the US-China trade negotiations.

Trading Perspective: The market has continued to try and drive the Dollar higher. And the Euro lower. The Dollar Index continued to grind its way its way up with 97.50 strong resistance. The Euro has held attempts to push it below 1.1200 convincingly. Speculative US Dollar long bets against most of the Majors (IMM) increased to the biggest total since 2016, according to the latest Commitment of Traders report (week ended 2 April). This spells danger for the shorts in the Euro, the Yen and the Aussie. Sterling in the meantime could go anywhere. But further uncertainty will breed contempt.

1. EUR/USD – The Euro managed to hold above 1.1200 and trade to an overnight high of 1.12461 before edging lower to close at 1.1217. Total net speculative Euro short bets (week ended 2 April) increased to a whopping -EUR 99,200 contracts from the previous week’s

-EUR 80,300. The total number of speculative Euro shorts are at an extreme. Immediate support at 1.1200 is strong with further support at 1.1170. Immediate resistance can be found at 1.1240/50 followed by 1.1280. Likely trading range today 1.1210-1.1250. Prefer to buy dips. A dovish ECB at this week’s coming policy meeting may be totally discounted. Shorts beware.

2. USD/JPY – The Dollar grinded its way higher against the Yen as it has been doing so all week. USD/JPY traded to a high of 111.823, which is immediate resistance for today. The next resistance level is at 112.00 which is strong. Immediate support can be found at 111.55, overnight lows. The next support level lies at 111.30. The latest COT/CFTC report for the week ended 2 April saw an increase in net speculative JPY shorts to -JPY 62,700 contracts from the previous week’s -JPY 62,100. JPY shorts are at their biggest in three months. Look to sell rallies with a likely range of 111.40-111.80 likely.

3. AUD/USD – The Australian Dollar finished with little-changed at 0.7107 (0.7114 Friday). The Aussie Battler hit an overnight high at 0.71318 before slipping lower. Overnight low was 0.70923. Immediate support lies at 0.7090 followed by 0.7060. Immediate resistance can be found at 0.7130 followed by 0.7160. The latest Commitment of Traders report saw net speculative Aussie short bets increase to -AUD 55,700 contracts from the previous week’s -AUD 53,700. Which is the biggest total of shorts in 5 months. Look to buy dips with a likely range of 0.7100-50 today.

Many Thanks and Have a good Week ahead!.