Summary: The Yen outperformed, rising 0.3% against the US Dollar as fears of a global recession resurfaced. The IMF downgraded its outlook on the global economy while the Trump administration threatened tariffs on the European Union. China-US trade talks are still unsettled. Risk appetite and the Dollar Yen took a hit. USD/JPY slid 0.30% to 111.16 from 111.48 yesterday. The Dollar Index (USD/DXY) recovered to end little-changed at 97.020 (97.062 yesterday) after falling to 96.858, two-week lows. Sterling slipped to 1.3055 from 1.3065 as the EU looked set to force the UK to delay Brexit for as long as a year. The Euro finished at 1.1265 (1.1262) after trading to 1.1284, a 2-week top. The risk-off mode hit Wall Street stocks, ending an 8-day rally. The DOW slid 0.74% to 26,143. The S&P 500 lost 0.6% to 2,878.

Treasuries rose pushing bond yields lower. The US 10-year bond yield slid back to 2.50% (2.52%).

US JOLTS (Job Openings and Labour Turnover Survey) for February fell to 7.09 million from 7.58 million in January, the lowest level since March 2018.

- EUR/USD – The Single currency rallied to 1.1284, fresh 2-week highs where it faced strong resistance, slipping back to end flat at 1.1265. The ECB is expected to keep rates unchanged, but traders will be looking at the Press Conference after the meeting. Policymakers may further delay their 1st rate hike to early 2020.

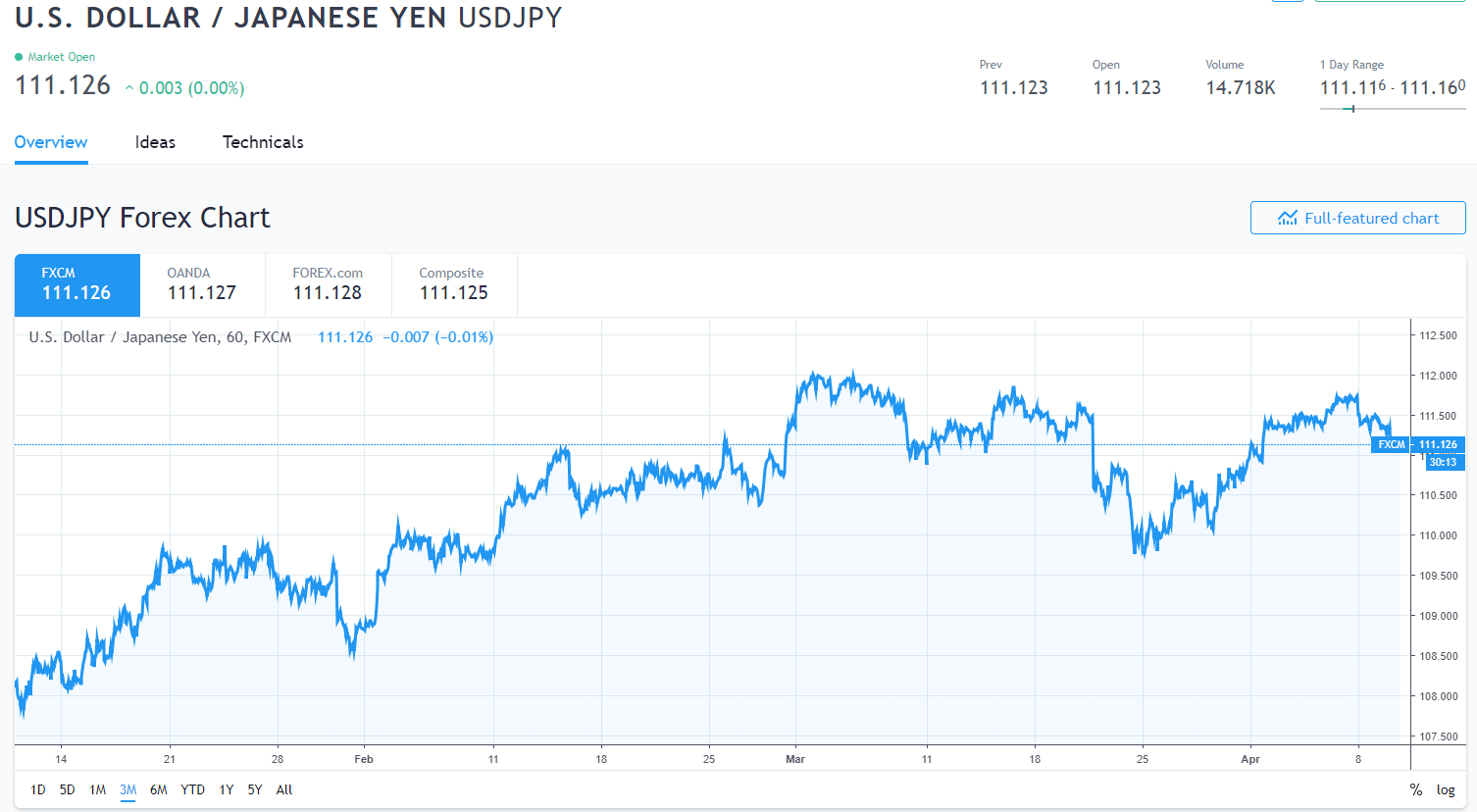

- USD/JPY – The Yen outperformed all currencies, climbing 0.3% against the US Dollar as risk appetite soured. US 10-year treasury yields slipped to 2.5% from 2.52%. USD/JPY closed at 111.16 after trading to 110.979.

- GBP/USD – Sterling closed marginally lower at 1.3055 (1.3065). British PM May is set to meet with European political leaders to try and break the Brexit gridlock ahead of the EU’s crucial summit meeting on Brexit.

- AUD/USD – The Aussie Dollar rallied to a high of 0.71527 mainly on the back of a generally weaker Greenback. Australian Home Loans for March saw an unexpected rebound, up 2% against a forecast fall of 3%. AUD/USD slid back to finish at 0.7125 in New York.

On the Lookout: A busy, first-tier event day lies ahead with the ECB’s policy meeting, US CPI report (March), the EU’s Council Summit meeting on Brexit and the FOMC’s March meeting minutes.

Other data releases are mostly second-tier. Japanese Bank Lending and Preliminary Machine Orders (March) start off the day. Euro-area data follow next with French and Italian Industrial Production reports for March. First-tier UK Manufacturing Production, Construction Output, Goods Trade Balance, and Industrial Production data follow next. All eyes will then be on the European Central Bank’s policy meeting, the EU Summit, US Inflation Report and March FOMC Meeting minutes release.

Trading Perspective: The Dollar Index (USD/DXY), of which almost 60% of its weight is the Euro, bounced off it’s lows to close mildly down at 97.020 (97.062). This is just above it’s immediate support. The Euro pared gains ahead of today’s ECB meeting where most analysts expect no change in policy. Traders will look for additional details on the ECB’s Longer Term Repurchase Operations (TLTRO).

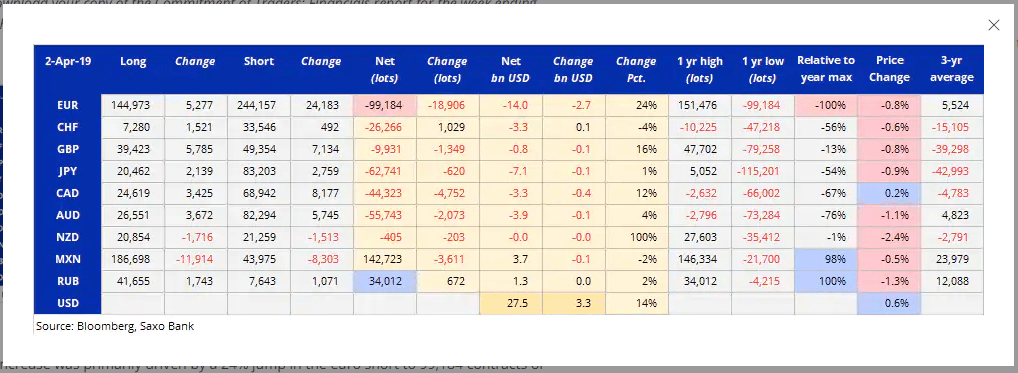

Market positioning highlighted by Saxo Bank’s feature article on the Commitment of Traders report (week ended 2 April) saw Total Speculative (non-commercial) US Dollar longs rise to a 3-month high of +USD 27.5 billion. The Greenback saw rises against all 9 IMM currencies except the Canadian Dollar. The increase was primarily due to a 24% jump in Euro short contracts to -EUR 99,184 contracts, the equivalent of which is -EUR 12.4 billion according to the Saxo Bank report. This spells danger for USD longs, and Euro shorts. As the robot in the old 60’s television series “Lost In Space” used to warn Will Robinson – “danger, danger ..”

- EUR/USD – The Euro was unable to break up through immediate and strong resistance at 1.1285. This remains a barrier today, a break of which should see 1.1325 next. Immediate support lies at 1.1240 followed by 1.1200. With the ECB meeting looming, look for the Euro to consolidate between 1.1245-85 first up. Look to buy any dips toward 1.1200-40 area. The big short squeeze could be just around the corner.

- USD/JPY – The Dollar is slip-sliding against the Yen in the current environment. The 2-basis fall in the US 10-year yields was not matched by its Japanese counterpart. The latest COT report for the week ended 2 April saw net speculative JPY shorts to their biggest since January (-JPY 62,741 vs previous week’s -JPY 62,121). USD/JPY has immediate support at 110.90-111.00 (overnight low 110.979). The next support level lies at 110.50. Immediate resistance can be found at 111.35 followed by 111.55. Look to sell rallies with a likely range today of 110.90-111.30.

- AUD/USD – The Aussie slipped back to 0.7125 from its high of 0.71522 on the market’s risk-off stance and lower assets. At the end of the day, the Australian Dollar is quoted against the US Dollar. Any further general USD weakness will translate into Aussie strength. The latest COT report saw net speculative Aussie short contracts to their highest since November 2018 (-AUD 55,743 contracts). AUD/USD has immediate support at 0.7115 followed by 0.7090. Immediate resistance can be found at 0.7150 followed by 0.7180 and 0.7200. Look to buy AUD/USD on dips toward 0.7110 today.

Happy trading all.