Summary: FX Volatility jumped, ignited by an upward explosion in the US Dollar against the Japanese Yen. It was a classic Yen spike of old, not seen since the 2011 Japanese tsunami. What were the drivers? From this writer’s trading experience and the news highlights… the underperformance of the Japanese economy, the impact of the COVID-19 virus on global GDP, and the broad-based US Dollar strength triggered the move. Contrary to Chinese reports yesterday that the daily rise of coronavirus cases was the lowest since January 29, a Global Times report (via Reuters) highlighted that a Beijing hospital recorded 36 new cases. Japan reported two new deaths and while Korea saw a rise in new infections. USD/JPY skyrocketed to 112.225 from 111.55 (its highest in almost 10 months) as Japanese funds were seen dumpling local assets. The Australian Dollar, often the proxy for China, plunged to a near 11-year low at 0.6610 (0.6675) despite a rise in Headline Employment. The Unemployment rate though missed. Sterling slumped to 1.2885 (1.2915), fresh 3-month lows against the overall stronger Greenback. The Euro slipped back under 1.08 to 1.0790. The US Dollar soared against the Asian currencies, up 0.85% versus the Thai Baht to 31.48 (31.20). The Dollar Index (USD/DXY) climbed 0.16% higher to 99.866 (99.693), near 3-year highs, and just shy of the 100 mark. Equities dropped and Treasuries rallied. The DOW was down 0.53% to 29,185 while the S&P 500 closed 0.55% lower to 3,369.00. The US 10-Year bond yield fell to 1.52% (1.56%).

Australia’s economy created 13,500 Jobs, beating median estimates of 10,000. The Jobless rate in January though climbed to 5.3% against forecasts of 5.2% and the previous month’s 5.1%. Germany’s PPI bettered forecasts with a 0.8% rise against 0.1%. UK Retail Sales rose 0.9%, better than expectations of 0.7%. US Philadelphia Fed Manufacturing Index rose to 36.7, beating median forecasts of 10.1.

- USD/JPY – The Dollar exploded against the Yen to 112.225, near 10-month highs from its 111.55 opening yesterday. USD/JPY then consolidated its gains, trading in a 111.70-112.20 range, closing in New York at 112.08.

- AUD/USD – The double-whammy of an overall stronger US Dollar and weaker Asian currencies weighed on the Aussie despite a gain in Jobs Creation. Traders focussed on the rise in the Unemployment rate. AUD/USD plunged to near 11-year lows at 0.66103 from 0.6675, settling at 0.6618 in early Sydney trade.

- EUR/USD – The Euro finished lower at 1.0789 (1.0800) after slipping to 1.0777 overnight. The shared currency was victim to broad-based US Dollar strength despite an improvement in Germany’s Producer Prices.

On the Lookout: Today’s economic calendar sees global Manufacturing and Services PMI reports out. Which could spark more FX volatility and provide the catalyst for a Dollar correction.

Australian Manufacturing and Services PMI kick off the day’s reports. Japanese National Core CPI, All Industry Activity and Flash Manufacturing PMI round up Asia’s data.

Euro area reports begin with French, German and Eurozone Flash Manufacturing and Services PMI.

Eurozone Final and Core CPI data are also released. The UK reports its Manufacturing and Services PMI and Public Sector Net Borrowing. Finally, the US sees Existing Home Sales and Flash Manufacturing and Services data reported.

The coronavirus impact on the global economy will be discussed as a topic at the G20 meeting which begins on Saturday in Riyadh, Saudi Arabia.

Trading Perspective: The US Dollar seems like the only game in town and has been gaining ground against all of it’s Rivals. The relative strength of the US economy and the relatively little alarm by the Americans about the coronavirus outbreak has seen the Greenback steamroll its Rivals. With Friday and the weekend on hand, we will see consolidation and a corrective move lower for the US Dollar.

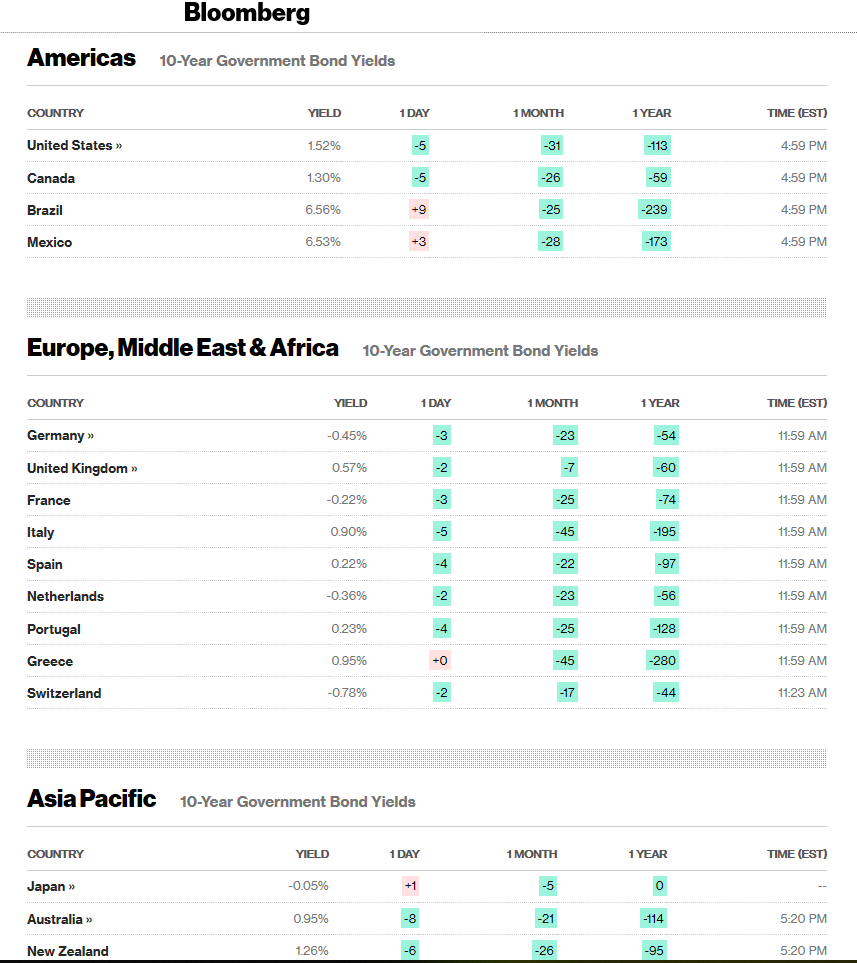

Another factor weighing on the Greenback is the lower level of US yields. The 10-year US Treasury rate dropped 4 basis points to 1.52%, just a couple of basis points from 1.5%. While other global bond yields fell, they were not to the extent of the US drop. Germany’s 10-year Bund yielded -0.45% from -0.42%. Japanese 10-Year JGB yield was 1 basis point higher to -0.05% (-0.06%).

- USD/JPY – After trading to a near 10-month and overnight high at 112.225, expect the Dollar to consolidate with a likely downward correction. The lower US 10-year yield and higher Japanese 10-year rate will cap the USD/JPY at 112.20. The next resistance level is at 112.50. Immediate support can be found at 111.75 followed by 111.35. Look for a likely trading range today of 111.50-112.20. Prefer to sell rallies.

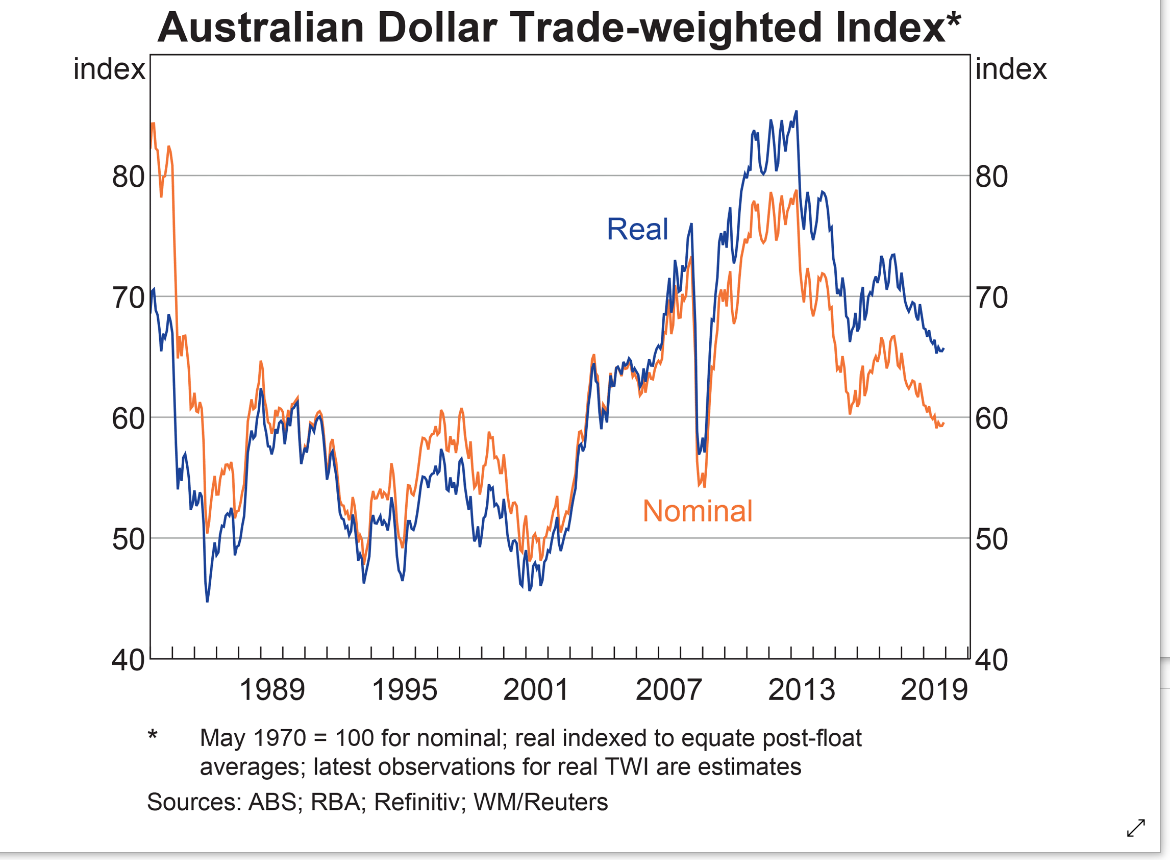

- AUD/USD – The Australian Dollar closed at 0.6617 after trading to a near 11-year low at 0.66103. Overnight RBA Governor Philip Lowe said that the RBA would need to see the Unemployment rate deteriorate “materially” for the Australian central bank to cut rates. The Australian Trade Weighted Index remains at near GFC levels. A few months ago, this writer said that the RBA will not cut rates if the Aussie TWI stays weak. Nothing’s changed. AUD/USD has immediate support at 0.6610 followed by 0.6580. Immediate resistance can be found at 0.6630 and 0.6670. Look for a likely trading range today of 0.6610-0.6680. Prefer to buy dips.

- EUR/USD – The shared currency was sidelined today with all the action in the USD/JPY and Australasian FX pairs. EUR/USD finished at 1.0790, little changed from 1.0800 yesterday. Markets will focus on Euro area and US Manufacturing and Services PMI’s today. EUR/USD has immediate support at 1.0770 followed by 1.0740. Immediate resistance can be found at 1.0820 (overnight high traded was 1.08211) followed by 1.0850. Look for a likely trading range today of 1.0780-1.0830. Prefer to buy dips.

Happy Friday and trading all, enjoy the ride.

Your thoughts are valuable to us, please share them.