Summary: The Dollar eased further against most of its Rivals as US bond yields resumed their decline. Benchmark 10-year yields slipped back to 2.016% 92.05% yesterday). Despite a fall in German business confidence in June to the lowest in over 8 years, the Euro hit 3-month highs at 1.1404 (1.1370 yesterday). Sterling eased against the Greenback, bucking the trend, to 1.2737 from 1.2748. BBC News reported that leading UK Prime Minister candidate Boris Johnson commented that Parliament was ready to back a No-Deal Brexit. The Australian Dollar jumped 0.52% to 0.6962 (0.6929), outperforming its peers after RBA Governor Philip Lowe questioned the effectiveness of monetary policy easing. New Zealand’s Kiwi rose in tandem with its cousin Aussie, to 0.6962 (0.6930) ahead of tomorrow’s RBNZ rate announcement. The Dollar was unchanged against the Yen at 107.32 despite US-Iran tensions. Gold extended it’s advance to US$1,419.00, up 1.8%. Wall Street stocks pared gains to finish flat.

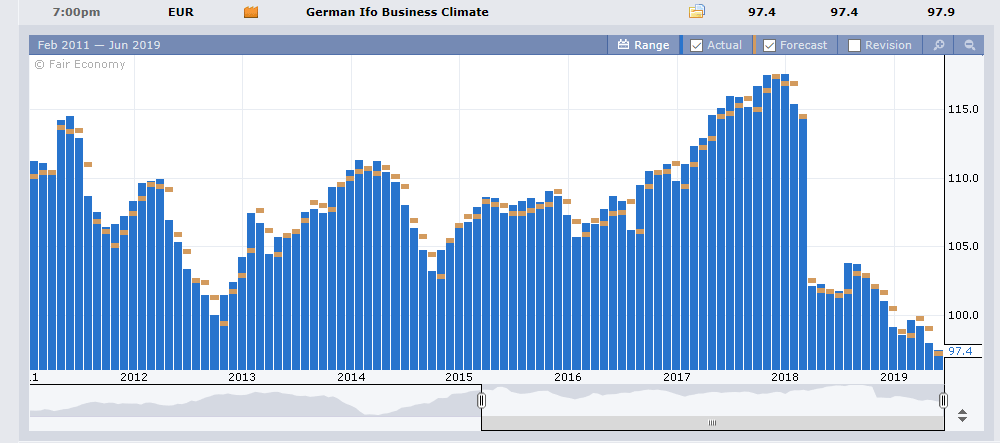

Germany’s IFO Business Climate Index fell in June to 97.4 from May’s 97.9. US Dallas Fed Manufacturing Index underwhelmed in June, missing forecasts.

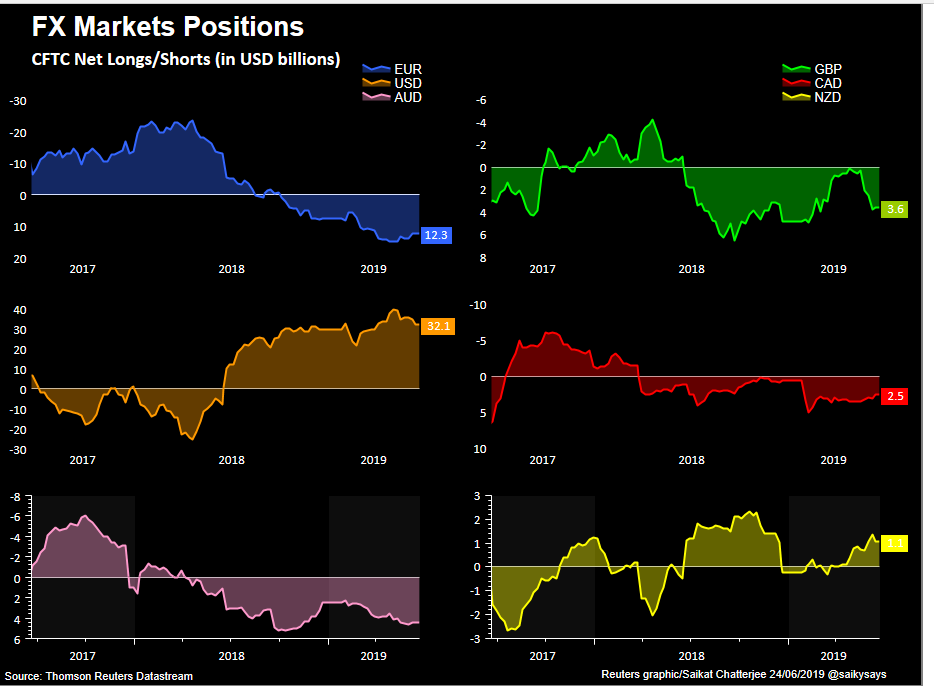

- EUR/USD – The Euro extended its climb to fresh 3-month highs to 1.1404 before easing at 1.1398 at the NY close. Yield differentials between US and German rates narrowed. The latest COT/CFTC report showed that speculators cut their net short Euro bets, fuelling the Single currency’s advance. German 10-year Bund yields were down 2 basis points to -0.31%.

- AUD/USD – After hovering around the 0.6925 level since Friday, the Australian Dollar jumped to settle at 0.6962, up 0.53%. RBA Governor Lowe’s comments lowered expectations of an immediate RBA rate cut.

- USD/JPY – The Dollar closed unchanged against the Yen at 107.32. USD/JPY found resistance at 107.50. Lower US bond yields saw USD/JPY ease to 107.25 in quiet trade. Minutes from the Bank of Japan’s May policy meeting are released today.

On the Lookout: The economic calendar swings into action today with a spate of US data releases. New York Fed President John Williams kicks off this week’s Fedspeak in New York at the OPEN Finance forum in New York. Later on, Federal Reserve Chairman Jerome Powell discusses monetary policy with a speech to the Council of Foreign Relations, also in New York. St Louis Fed President James Bullard in St. Louis, Missouri at a Fed hosted event. Dallas Fed President Robert Kaplan pushed back on dovish calls, saying that time was needed to consider changing interest rates.

New Zealand’s Trade Balance starts off today’s reports followed by the release of BOJ May meeting minutes and the BOJ’s Core CPI report. Canada reports on its Wholesale Sales data. The US reports its latest housing data with HPI (House Price Index) for June, Case Shiller Composite 20-year HPI, and New Home Sales. Economic reports finish off with US Conference Board’s latest release of its Consumer Confidence Index and June Richmond Manufacturing Index.

The G20 summit in Osaka at the end of the week is the focus. While both China and the US remain sceptical, both Trump and Xi have agreed to a meeting.

Trading Perspective: The easing of US bond yields will keep the Dollar under pressure against its peers. After two days of losses, we can expect consolidation around current levels. The latest CFTC report on market positioning saw a hefty cut in short Euro and JPY bets. Against the British Pound and Australian Dollar, short bets were increased.

- EUR/USD – The Single currency traded to an overnight and fresh 3-month high at 1.1404 before easing to settle at 1.1398 in New York. Despite the fall in German business confidence, the Euro extended its advance as short bets continued to cover. EUR/USD has immediate resistance at 1.1410 followed by 1.1440. Immediate support can be found at 1.1360 (overnight low was 1.13657). The next support level lies at 1.1320. Look to trade a range as the Euro consolidates within a 1.1370-1.1420 band today.

- AUD/USD – The Australian Dollar jumped back to life after RBA Governor Philip Lowe questioned the effectivity of monetary policy easing “if everyone else is doing it.” Lowe’s point was that it resulted in exchange rate parity although lower rates can be beneficial to the economy. Which begs the question if the next frontier following the trade war is the currencies. The latest COT/CFTC report saw an increase in Aussie short bets to -AUD 64,900 from the previous week’s -AUD 63,200. While the increase is not large, its opposite to what occurred in the Euro and Yen where short bets were cut. AUD/USD has immediate resistance at 0.6970 followed by 0.7000. Immediate support can be found at 0.6930 and 0.6900. Look for a likely trading range today of 0.6940 to 0.7010. Prefer to buy dips.

- USD/JPY – The Dollar was unchanged against the Yen at 107.32. The latest COT/CFTC report (week ended 18 May) saw speculative short JPY bets cut to -JPY 16,600 from -JPY 45,200. Which is massive. USD/JPY has immediate support at 107.25 followed by 107.00. The next support level can be found at 106.50. Immediate resistance can be found at 107.55 (overnight high 107.539) followed by 107.75. The lower US 10-year yield as well as geopolitical tensions (Iran and the US) should keep a lid to the Dollar. On the other hand, expect Japanese corporations to continue bidding the 107 level. Look for a likely trading range today of 107.25-107.75. Prefer to buy dips.

Happy trading all.