Summary: The Dollar Index (USD/DXY) broke lower to 96.093 (96.65 Friday), 3-month lows as more Federal Reserve officials revealed their easing bias. The Euro outperformed to 1.1370 from 1.1290, lifted by upbeat French and German business activity. Sterling rallied against the Greenback to 1.2747 (1.2707) but fell against the Euro to 5-month lows (EUR/GBP 0.8920 from 0.8887). Brexiteer Boris Johnson remains the favourite to succeed Theresa May as UK Prime Minister. The Australian Dollar was little changed at 0.6930 (0.6925) as odds increased for an RBA July rate cut. USD/JPY was unchanged at 107.35 (107.33) while US bond yields stabilised. Benchmark US 10-year treasury yields steadied to 2.05% from 2.03% Friday.

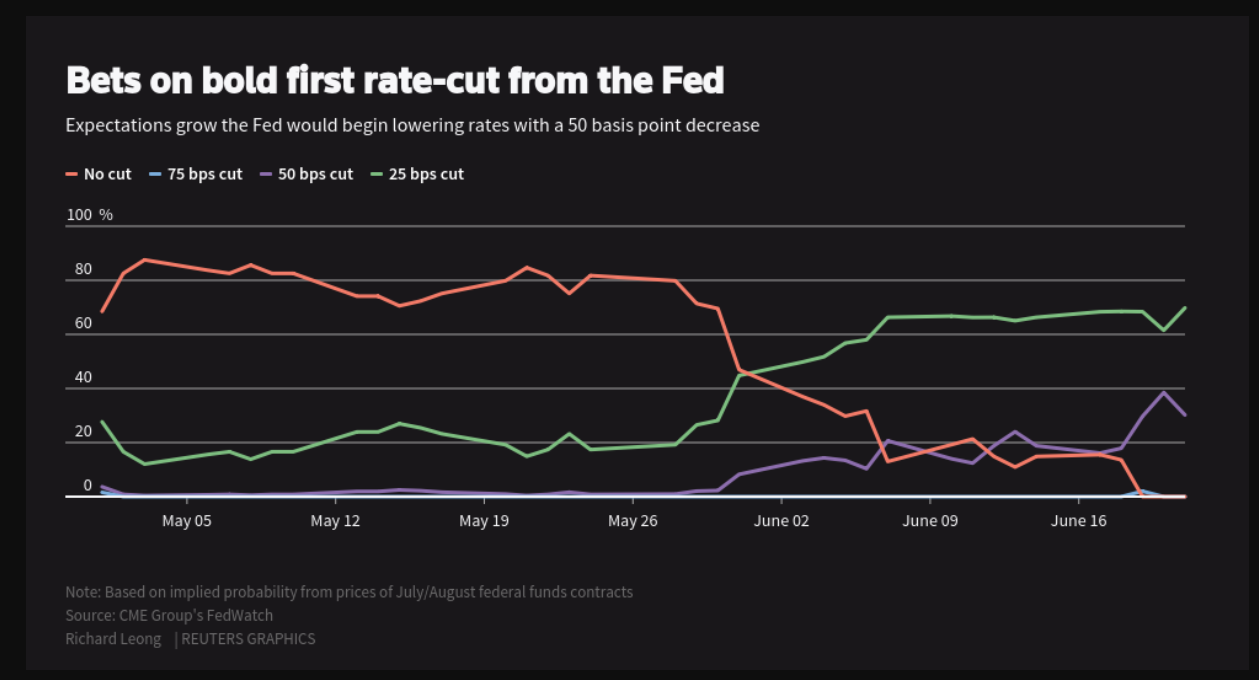

Last week US policymakers signalled they were prepared to lower interest rates this year while keeping policy unchanged. Minneapolis Fed President Neil Kashkari, a non-voting FOMC member, revealed he advocated for a 50-basis point cut now. While Kashkari failed to convince a single colleague, seven officials do agree that cuts of 50 basis points may be appropriate this year.

- EUR/USD – The Single currency lifted to 3-month highs at 1.13778 on the weaker Greenback and better-than-expected French and German business activity. The latest Commitment of Traders report (week ended 18 June) saw a massive clip of short Euro bets into last week’s FOMC meeting.

- USD/DXY (Dollar Index) – The Dollar Index, a mirror of the Euro slumped to 96.093, overnight and 3-month lows at the New York close from 96.65 on Friday. As a growing number of Fed policymakers backed a Fed rate cut, the Index, a popular gauge of the Greenbacks’ value against a basket of major currencies (mainly Euro), dropped.

- USD/JPY – The Dollar was unchanged versus the Yen at 107.35 after trading to 5-month lows. The overall weaker Greenback and geopolitical fears due to US-Iran tensions buoyed the haven darling Yen. US bond yields steadied despite growing rate cut chatter among Fed chiefs, which supported USD/JPY.

- AUD/USD – The Australian Dollar ended little changed at 0.6925. RBA Governor Philip Lowe is due to participate in the Australian National University Leadership forum in Canberra this morning. Traders will be looking for further evidence of the RBA’s willingness to trim interest rates next month.

On the Lookout: Markets turn their sights to this week’s big event, the G20 conference in Osaka, Japan (begins on Friday, 28 June). The US and China will meet on the sidelines and try to reach a trade deal. Today, Germany reports on its IFO Business Climate for June. US data sees Chicago Fed National Activity as well as Dallas’s Fed Manufacturing Business Index.

US Federal Reserve Chair Jerome Powell speaks tomorrow on the economic outlook and monetary policy at the Council of Foreign Relations in New York.

Wednesday sees the RBNZ Interest rate decision, Official Cash Rate announcement and Rate Statement. On Thursday, Germany releases Preliminary June CPI report while the US Final Q1 GDP is released. The week finishes on Friday with Japan’s Tokyo CPI, UK Q1 GDP, Eurozone Preliminary Headline and Core CPI and US Core PCE and Personal Spending data.

The G20 begin their meeting in Osaka, Japan on Friday.

Trading Perspective: While the Dollar broke lower on Friday to end at 3-month lows, the break down was not broad-based. US bond yields steadied at their lows with the 10-year finishing at 2.05%, up 2 basis points. Two-year US treasury yields ended at 1.77% from 1.78%. Momentum is still in favour of a lower Dollar but be prepared for more two-way trading markets from here.

The latest Commitment of Traders CFTC report for the week ended 18 June saw a small reduction in net total USD long bets to +USD 51,900 contracts from +USD 54,900. It’s the breakdown of currencies that provide an interesting read into current market positioning. Speculators gave their short EUR and JPY bets a massive cut while GBP and AUD shorts saw modest increases.

- EUR/USD – The Euro traded to 3-month highs at 1.13778 before settling at 1.1369 in early Sydney. The upbeat French and German business activity survey, overall US Dollar weakness and a massive cut in speculative Euro short bets lifted the Single currency. The latest COT/CFTC report for the week ended 18 June saw net speculative Euro short bets slump to

-EUR 52,300 contracts from the previous week’s -EUR 86,800. That’s huge. Immediate resistance lies at 1.1380 followed by 1.1400. The next big resistance level is at 1.1450. Immediate support can be found at 1.1350 followed by 1.1320. Look for a likely trading range today of 1.1330-1.1380. Look to trade the range shag. - USD/JPY – The Dollar slid to an overnight and fresh 5-month low at 107.048 before rallying in late New York to finish at 107.35. The climb in the US 10-year bond yield to 2.05% (2.03% Friday) supported the Greenback. Following Wednesday’s FOMC turn to a more dovish stance the US 10-year yield slumped to a low at 1.98% (20 June) before steadying. The latest COT/CFTC report saw speculators cut their short JPY bets to -JPY 16,600 (week ended 18 June) from the previous week’s -JPY 45,200. That’s huge. USD/JPY has immediate support at 107.10 followed by 106.80. Immediate resistance lies at 107.70 and 108.00. Look for a likely trade today between 107.20-107.70. Prefer to buy USD/JPY dips toward 107.00.

- AUD/USD – The Australian Dollar ended little-changed against the Greenback at 0.6925 (0.6922 Friday). Growing bets of an RBA rate cut next month have seen the Aussie underperform its rivals against the broad-based US Dollar weakness. The Battler has risen less than 0.8% against the Greenback. EUR/USD in contrast, gained 1.4% last week. The latest COT report (week ended 18 June) saw speculative Aussie shorts increase to -AUD 64,900 from the previous week’s -AUD 63,200. Immediate resistance on the Aussie Battler lies at 0.6940 (overnight high 0.69379) followed by 0.6980 and 0.7000. Immediate support can be found at 0.6900 followed by 0.6870. Look for a likely range today of 0.6920-0.6970. Prefer to buy dips.

Have a good week ahead all, happy trading.