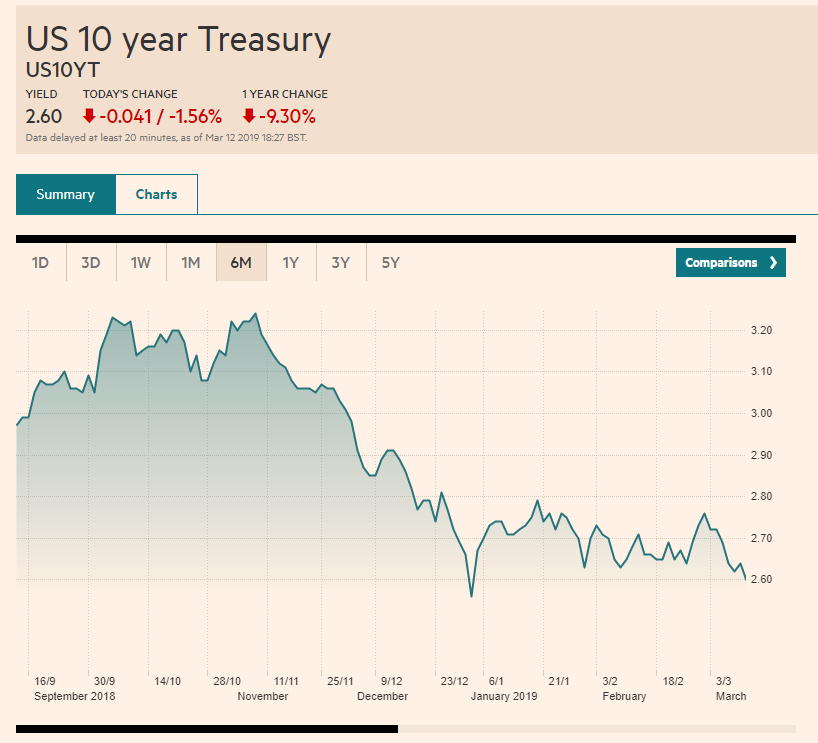

Summary: Sterling slid in volatile trade as the UK Lawmakers rejected PM May’s Brexit plan for the second time. While the margin of NO’s was less than the first vote, Parliament will now vote on whether they want a hard, no trade-deal Brexit later today. This will be followed by a potential extension of the exit deadline set on March 29. GBP/USD settled at 1.3060 in late New York after hitting a high of 1.32892 and low of 1.30050. UK GDP, Manufacturing and Industrial Production all beat forecasts, limiting Sterling’s losses. The Dollar was mostly lower against its peers following a disappointing CPI report. While Headline US CPI matched forecasts, Core Inflation rose less than expected, and remains low. US treasuries rallied, the benchmark 10-year bond yield dropped to 2.60% from 2.64%. Wall Street stocks were mixed. The DOW dropped 0.45% as Boeing shares slumped due to the grounding of its 737 Max 8 planes. The S&P 500 was up 0.2%.

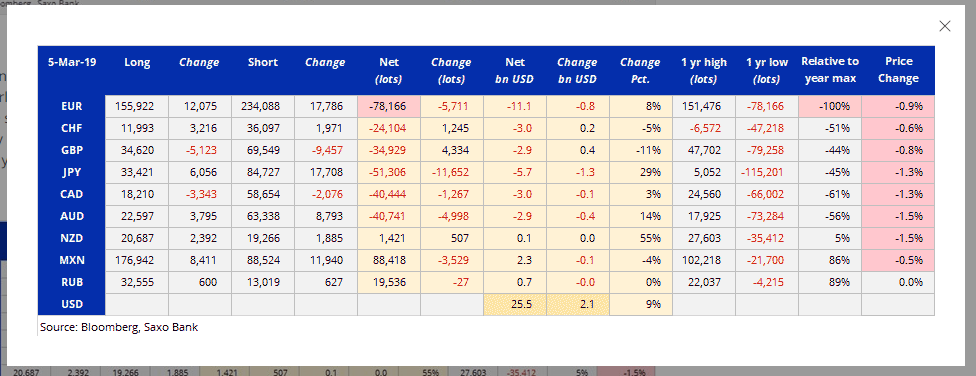

- EUR/USD – the Single currency extended gains, climbing to 1.13049 overnight before settling at 1.1288, up 0.34%. EUR/USD continues to grind higher after hitting 20-month lows following a dovish ECB meeting outcome. Speculative Euro short bets continued to pile higher in the latest COT CFTC report which finally caught up following the recent US government shutdown in December/January.

- GBP/USD – Sterling had another roller-coaster session, moving 2% between highs and lows before settling at 1.3065, down 1.3% from yesterday’s 1.3145 opening. While the second rejection of UK lawmakers of PM May’s Brexit plan weighed on the British currency, it’s fall was limited. The ongoing drama extends with another vote later today which will keep the currency choppy.

- USD/JPY – the Dollar ended flat at 111.27 (111.24 yesterday). The fall in the US 10-year bond yield had little effect on the USD/JPY but will keep its topside limited. Japanese data released today should see more movement in this currency pair. The COT/CFTC report saw an increase in net speculative JPY shorts.

On the Lookout: Today sees further economic data reads from Japan, the Euro-Zone, UK and US. Australia starts off with its Westpac Consumer Sentiment, not a big one, but nevertheless a gauge of consumer appetite which accounts for majority of overall economic activity. Japanese Core Machinery Orders (leading indicator of production), PPI and Tertiary Industry Activity for February follow next. China reports on its year-to-date Foreign Direct Investment. Europe sees the Euro-Zone Industrial Production for February while the UK Annual Budget is released. Lastly the US reports on its Headline and Core Durable Goods Orders (Feb), Headline and Core PPI and Construction Spending. Quite a bit to digest.

Trading Perspective: The Dollar Index (USD/DXY) continues to grind lower. US Core Inflation data disappointed and remains low. This follows the dismal Jobs Gains last week. While US retail sales grew in February, January’s negative sales report was revised lower. Market positioning remains long US Dollar bets in 6 out of 9 IMM currencies (exception: New Zealand Dollar, Russian Rouble and Mexican Peso). Saxo Bank-Bloomberg’s Commitment of Traders/CFTC report for the week ended May 5 shows the breakdown of these currencies.

Many analysts continue to call for a higher Dollar, given that the US near-term economic prospects look much less grim than the rest of the world. The US Dollar is also bid due to “safe-haven” demand. While both facts are true, market positioning is already biased that way. And the US 10-year bond yield continues to slide to one-year lows. Further correction in the Greenback looms.

- EUR/USD – The Euro topped out at 1.13049 which remains a strong resistance level. The big topside level is at 1.1340. A sustained move above that will see further Euro gains as further short Euro stops could be triggered. Immediate support lies at 1.1260 followed by 1.1220. Would look to buy dips to 1.1260 today for an eventual test of 1.1340.

- USD/JPY – The Dollar has been remarkably stable against the Japanese currency. USD/JPY closed virtually flat at 111.28 (111.23 yesterday). Immediate resistance lies at 111.40/50 which should hold on the day given the 4-basis point fall in the US 10-year yield to 2.60%. Japan’s 10-year JGB by contrast rose one basis point to -0.04% (-0.05%). Immediate support can be found at 111.10 followed by 110.80. Look to sell rallies to 111.50 today.

- GBP/USD – the British Pound had another volatile session moving 2% between the high and low. Sterling held above 1.30, trading to 1.3005 lows before rallying to 1.3065 at the New York close, post the UK Parliamentary rejection vote. With another vote scheduled for later today (Lawmakers will vote on whether they want a hard or no-Brexit deal). This will probably result in another vote Thursday to extend the March 29 deadline. UK economic data released all beat forecasts. Expect further volatility on the Pound. GBP/USD has immediate support at 1.3020 followed by 1.2960. Immediate resistance lies at 1.3100 and 1.3160. Look to trade the extremes between 1.3020 and 1.3120 today. While net speculative Sterling shorts were trimmed, market positioning remains short Pounds.

- AUD/USD – The Australian Dollar also continues to grind higher following its test of 0.7003 lows on Friday. The large drop in China’s exports weighed on the Aussie. Last night saw the third consecutive day of gains for the Battler. The Aussie will continue to benefit from a generally weaker US Dollar. Australian 10-year bond yields were unchanged at 2.03%. AUD/USD has immediate resistance at 0.7090/0.7100 (overnight high 0.70919). Immediate support can be found at 0.7060 and 0.7020. The latest COT/CFTC report (week ended March 5) saw speculative Aussie short bets increased to -AUD 40,741 contracts. Would look to buy dips to 0.7060 today.

Happy trading all.