Summary: The British Pound slumped 0.67% to 1.2062 (1.2150) as speculation mounted that the UK may hold a general election. Germany’s manufacturing, which is highly export-dependent, continued to contract in August. The Euro extended it’s drop to 16-month lows, trading to 1.0958 before settling at 1.0970. Trade tensions increased after the US and China began imposing fresh tariffs between them while both struggled to schedule the next round of face-to-face talks. The Dollar Index (USD/DXY) lifted above 99.0, closing at 99.04, up 0.24%. The resulting global economic slowdown saw Emerging Market currencies dip further. Argentina, reeling on the brink of default, imposed currency controls to stop the outflow of US Dollars. Ongoing bearish sentiment saw the Australian Dollar dip to 0.6716 (0.6726) ahead of today’s RBA rate decision. Australia’s central bank is expected to hold amidst a weakening economy due to rising trade tensions.

While US markets were closed for the Labour Day holiday, 10-Year bond yield futures dipped.

China’s Caixin Manufacturing PMI beat expectations, rising to 50.4 in August from July’s 49.9. Euro area Manufacturing PMI readings cancelled out each other, resulting in a flat outcome. German Manufacturing PMI dipped to 43.5 from 43.6 while France’s Manufacturing PMI rose to 51.1 from 51.0. Elsewhere, the UK’s August manufacturing PMI reading dropped to 47.4 from 48.0, its lowest since 2012.

- EUR/USD – The Euro dipped further as the trade dispute between the US and China weighed further on Euro area growth. EUR/USD dropped to 1.0958, 16-month lows before settling at 1.0970. Meantime, speculators maintained their level of short Euro positions although they were far from the record highs seen last year.

- GBP/USD – slip-sliding away, the British Pound slumped to 1.20538, worst performer among the major currencies. UK Prime Minister Boris Johnson was reported by the British press to have called an emergency cabinet meeting to prepare for a general election. The UK Labour Party continues to seek a Brexit delay.

- AUD/USD – the bearish bias on the Aussie Battler extended which saw AUD/USD dip 0.22% to 0.6717 after testing an overnight low of 0.67099. The RBA is expected to stay on the sidelines and keep its key cash rate unchanged at 1.0% today. The fall in Emerging Market currencies and the ongoing unrest in Hongkong weighed on the Battler.

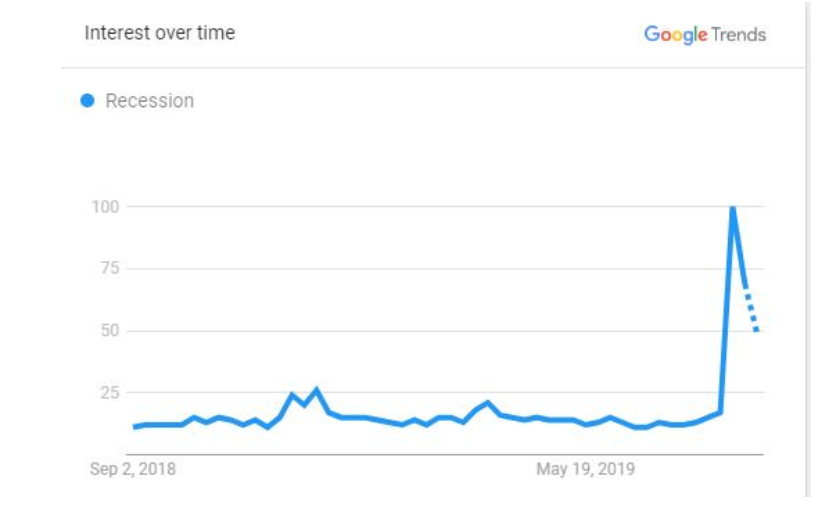

On the Lookout: The ongoing China-US trade dispute has seen the global economy slow and a growing number of central banks have cut interest rates to unprecedented levels. Analysts are beginning to question whether the long expansion in the US economy can continue. Recession signs are growing brought about by the slower growth abroad. A CNBC report highlighted that a Google search on recession fears have seen a spike since the end of July when the Fed cut interest rates for the first time since the 2008 financial crisis. The US Dollar has continued to benefit from the US’s relative better outlook. This may begin to change.

Today sees Australia’s August Retail Sales report, expecting to dip to 0.2% from 0.4%. The RBA Rate Decision and following Statement follow (2.30 pm Sydney). Bears expect another downgrade to the growth forecast. UK Construction PMI’s start off European data. This is followed by Eurozone PPI (August). North American data start off with Canada’s Manufacturing PMI followed by the US Final Manufacturing PMI. Markets will focus on the US ISM Manufacturing PMI which follows shortly after. US Construction Spending rounds up the day’s economic data.

Trading Perspective: The Dollar Index (USD/DXY) rallied above the 99.00 resistance level, managing to close just above at 99.04. Weakness from rival global economies, political uncertainty, easing interest rates to unprecedented levels saw their currencies retreat against the US Dollar. Meantime US interest rate futures saw 10-year yields drop. The latest COT/CFTC report saw speculators maintain similar levels of USD longs against the 9 IMM currencies. While they are far from the extremes seen last year, market positioning remains long the Greenback against the Euro, Sterling, Aussie and Swiss Franc except the Yen. With the potential of a drop in US interest rates and growing recession signs in the world’s largest economy, USD strength will be difficult to maintain at current levels. Expect a Dollar pullback soon.

- EUR/USD – Pressure on the shared currency continues to mount despite mixed economic signals from the Euro area manufacturing PMI. Germany’s economy considered Europe’s growth engine is still distressed. France though is showing signs of recovering. EUR/USD traded to a 16-month low at 1.0958 after breaking 1.10, the previous major support level. Overnight high traded was 1.09966. Speculative Euro shorts increased to a modest -EUR 38,800 bets (from previous -EUR 38.,000). While this is still far from the largest shorts seen last year, the fact is the specs are still short. Immediate support lies at 1.0960 followed by 1.0930. Immediate resistance can be found at 1.1000 and 1.1030. Look for a likely range today of 1.0960-1.1010. Prefer to buy dips.

- AUD/USD – The Aussie maintained its bearish bias heading into today’s RBA rate announcement. The RBA is widely expected to maintain policy and sit on the sidelines. AUD/USD dipped to an overnight low at 0.67099 before rallying to settle at 0.6717. Overnight high traded was 0.67347. Spec Aussie short bets were trimmed to – AUD 61,000 contracts from the previous week’s -AUD 62,800. Which are still near yearly highs. Immediate support for the Battler lies at 0.6700 followed by 0.6680. Immediate resistance can be found at 0.6740 followed by 0.6780. Upcoming Australian data is expected to be poor. Look for a likely range today of 0.6710-0.6740 into the RBA announcement. The preference is to buy dips.

- USD/DXY – The Dollar Index continued to grind its way higher boosted by broad-based Dollar strength. This strength has been at the expense of a weaker performance from almost all of its global counterparts. However, warning signs are flashing, and the US economy may start to falter. USD/DXY has immediate resistance at 99.15 (overnight high was 99.133). Watch for a dip in US yields and further falls in manufacturing. Look to sell rallies in a likely 98.70-99.10 range today.

Happy trading all.