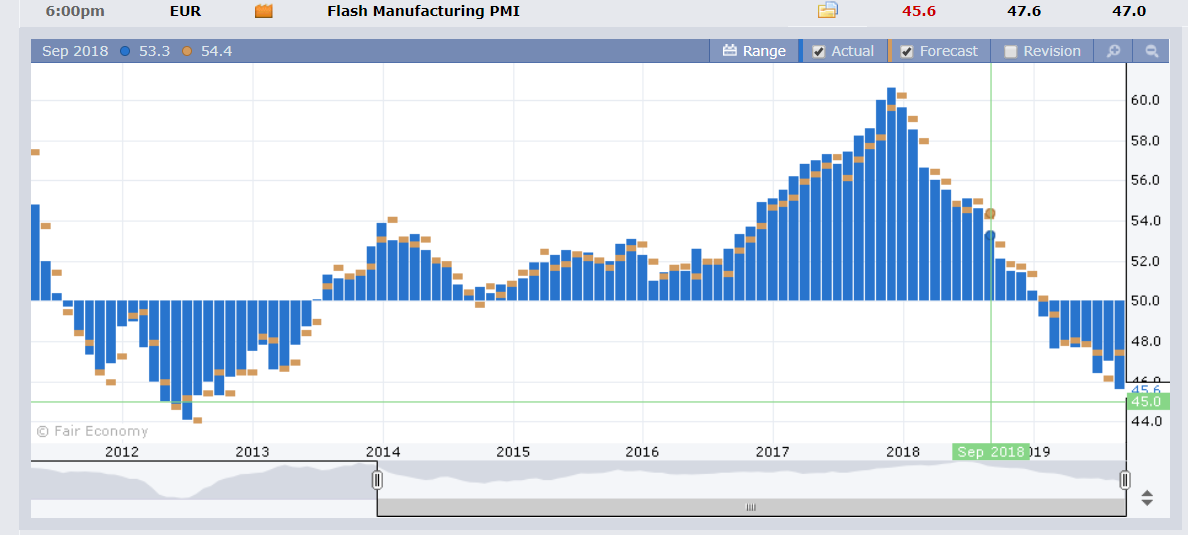

Summary: The Euro finished under 1.1000, (1.0995) for the first time in 10 trading days following the release of dismal Euro area manufacturing and services data. Germany’s September Manufacturing PMI slumped to 41.4, missing forecasts of 44.6, and bringing its Composite Index to 49.1, the lowest since October 2012. The Eurozone’s Composite PMI Index in September slumped to 50.4 from 51.9 in August and well below median forecasts at 51.9. The poor data will see further calls for decisive ECB action as the Eurozone’s economy shows no signs of recovery. The Dollar Index (USD/DXY), often a mirror of the Euro was up 0.13% to 98.632, its highest almost 2 weeks. Overall performance by the Greenback was mixed against its other Rivals. While US Manufacturing PMI beat forecasts (51.0 vs 50.3) Services PMI missed at 50.9 against 51.5. The latest Commitment of Traders report (week ended 17 September) saw speculators increase net total US Dollar long bets to the highest since June. Speculative New Zealand Dollar short bets increased to the biggest total on record. This saw the Kiwi bounce 0.7% to 0.6295 (0.6255) ahead of tomorrow’s RBNZ policy meeting. The Dollar was little changed against the Yen (107.50) and Aussie (0.6775). Sterling slipped 0.35% to 1.2435 on a lack of progress in Brexit talks. On the trade front, US and Chinese officials continued their “smoothing” rhetoric on recent events.

Wall Street stocks ended with modest gains. US bond yields were mostly flat.

- EUR/USD – The Euro dipped to 1.09662 lows after poor PMI’s elevated concerns on the state of the Eurozone economy. The shared currency rallied to close at 1.0996 on short covering. The latest COT report saw net Euro shorts increase to 3-month highs.

- NZD/USD – The Kiwi had a decent bounce to 0.6295 from 0.6258 in cautious trade ahead of tomorrow’s RBNZ policy meeting.

- USD/JPY – The Dollar closed moderately lower at 107.50 from 107.60 yesterday. Trading was subdued with Tokyo on holiday yesterday.

- GBP/USD – Sterling slipped to 1.2435 from 1.2475. Markets are waiting for the results of a Court ruling on whether PM Boris Johnson misled the Queen on why he suspended Parliament earlier this month.

On the Lookout: Traders will continue to monitor the progress of trade talks between China and the US as well as upcoming economic data. Today sees Japan’s Flash Manufacturing PMI report. Bank of Japan President Kuroda speaks to a business leader’s meeting in Osaka. Germany’s September IFO Business Climate Index starts off Europe’s reports. The UK reports its Public Sector Net Borrowing and CBI Industrial Orders Expectations. RBA Governor Philip Lowe, under intense pressure to reduce interest rates by Australian economists, speaks at a regional business dinner in Armidale, New South Wales. US Case Shiller 20-House Price Index (y/y) and Conference Board Consumer Sentiment Index round up the day’s reports.

Trading Perspective: The Euro managed to bounce off its low despite dismal Composite PMI’s. While the US economy is performing slightly better than most of Its peers, a slowdown is gaining momentum. Meantime market positioning bears monitoring.

Saxo Bank’s latest Commitment of Traders/CFTC report saw an increase in net speculative Dollar by USD 15.5 billion to their highest since June. This was due to a 38% rise in Euro shorts to 3- month highs and a 27% reduction in JPY longs. A build in NZD shorts to their biggest on record, which is a highlight for me.

- EUR/USD – The Euro finished under the 1.1000 immediate and pivotal support level. Which could see further pressure on the shared currency. Traders will focus on German IFO Business Climate report due later today. EUR/USD has immediate support at 1.0960 (overnight low 1.0966). The next support level is 1.0920, which is near this year’s lows. Immediate resistance can be found at 1.1000 followed by 1.1030. The latest COT/CFTC report saw an increase in net total Euro shorts to -EUR 68,559 contracts from -EUR 49,842. That’s a hefty build which total 3-month highs. Look for a likely trading range today of 1.0960-1.1010. Prefer to buy dips.

- USD/JPY – The Dollar slipped to 107.50 from 107.60 in subdued trade with Tokyo out on a holiday. USD/JPY traded to an overnight low at 107.311. Immediate support can be found at 107.30 followed by 107.00. Immediate resistance lies at 107.80 (overnight high 107.77) followed by 108.10. The latest COT report saw a further reduction in net JPY long bets to +JPY 23,862 contracts from +JPY 32,591. Look to trade a likely range today of 107.30-107.80. Prefer to buy dips.

- NZD/USD – The Kiwi had a strong bounce to 0.6295 from 0.6255, which were fresh 4-year lows. We highlighted that market bets are at 25% for a rate cut from the RBNZ at the outcome of their meeting tomorrow. The Official Cash Rate stands at 1.00%. Immediate resistance for the Kiwi lies at 0.6300 followed by 0.6330. Immediate support can be found at 0.6280 and 0.6250. Look to buy dips in a likely 0.6265-0.6325 range today.

- AUD/USD – The Australian Dollar was little changed, closing at 0.6775 (0.6770 yesterday). Overnight high traded was 0.67815. Immediate resistance lies at 0.6785 followed by 0.6805. Immediate support can be found at 0.6760 followed by 0.6730. The latest Commitment of Traders report (week ended 17 September) saw net speculative Aussie short bets reduced to -AUD 40,082 from -AUD 53,014 the previous week. Markets will focus on RBA Governor Philip Lowe’s speech tonight regarding the economy and likely path of interest rates. The local press is all over Lowe to reduce interest rates further. We shall see. Look to trade a likely range today of 0.6760-0.6820. Prefer to buy dips.

Happy trading all.