Asian stocks finished mixed today in a quiet Easter Monday session. U.S. Secretary of State Mike Pompeo will announce “that as of May 2, the State Department will no longer grant sanctions waivers to any country that is currently importing Iranian crude or condensate.” The Nikkei225 main index added 0,08 percent to 22,217. Shanghai Composite finished 1.73 percent lower at 3,214, and in Singapore, the FTSE Straits Times index finished 0.18 percent higher at 3,353, while all other stock markets were closed.

In commodities markets, crude oil rallied to a five-month high at 65.51 for the first time since November 2018 boosted by the US additional sanctions on Iran. The near-term upside target that we have at the 65.00 figure has materialized, and now the $67 area is the next target as the bullish momentum builds up. Brent oil also started the week strong to $73,95 per barrel. Gold bearish momentum is still intact with the precious metal trading at $1277 figure. XAUUSD technical picture is negative, and now the support stands at the 200-day moving average down to $1250, which if broken can accelerate the downward move to 1200 as sellers are in full control. Strong resistance stands at the $1300 round figure and then at the 50-day moving average around $1305.

In cryptocurrencies market, Bitcoin (BTCUSD) continues its up and down around the key 200-day moving average at $5,134. Currently, it trades at $5,275 making the daily low at 5,239 and daily high at 5,303. BTCUSD’s strong support stands at the $5,000 level, and then extra support stands at the 50-day moving average at 4,201. Ethereum (ETHUSD) trades flat at 169, and it is placed nicely above the 100-day moving average, facing strong resistance at 193 the 200-day moving average, while Litecoin (LTCUSD) trades lower at 75.87. The cryptocurrencies market cap holds above $160.0B.

On the Lookout: The news today is around oil as the US will likely announce later today that all importers of Iranian crude will have to end their purchases shortly or be ready to face US sanctions, according to Washington Post. The article boosted crude prices to levels we hadn’t seen since November last year.

In the macro calendar from the Americas today, we have the US existing home sales data due later today at 14:00GMT.

Trading Perspective: In Forex markets, the US dollar managed to break above the 71 figure, while AUDUSD retreats to 0.7139 as Fitch Ratings confirmed the sovereign rating at AAA with a stable outlook. The pair needs to break convincingly above the 200-day moving average at 0.7190 to establish a long term positive momentum. Kiwi underperforms for one more day and trades lower at 0.6680.

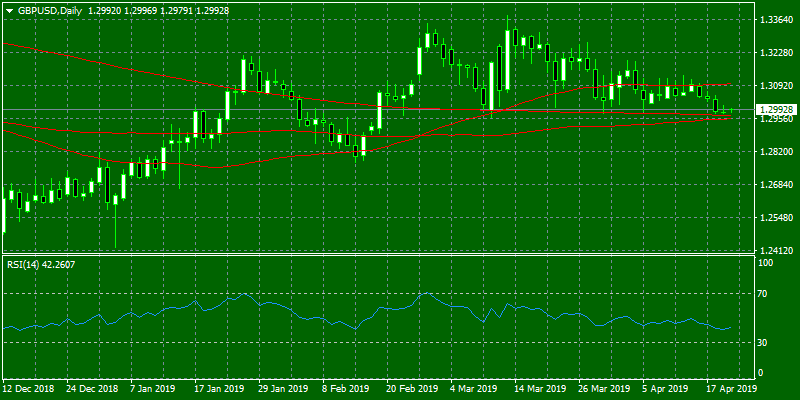

GBPUSD The pair trades in a narrow trading range today as the volatility remains at monthly low. Currently, the pair is at 1.2993 making the low at 1.2979 and the high at 1.2996. On the downside, major support will be found at 1.2975, at the 200-day moving average, while solid protection can be found at the 100-day moving average around 1.2942. On the flipside, immediate resistance stands at 1.3195, the high from previous week session, and from there, major resistance can be found at 1.3232, while 1.3382, the yearly high, will be met with strong supply.

In the Pound futures market, open interest rose for the second session in a row on Thursday, this time by just 718 contracts. On the other hand, volume decreased for another day by almost 21.7K contracts.

EURUSD trades at 1.1245 at two week low. The pair made the Asian high at 1.1247 and the low at 1.1235 amid low volumes. Immediate support can be found at the horizontal support line at 1.1235, and further bids will emerge at the 1.1200 zone.

EURO remains in a negative mood following recent poor figures in Eurozone. In fact, recent disappointing readings in the region somehow confirm that the slowdown in the bloc and the ‘patient-for-longer’ stance from the ECB could be among us for longer than expected.

In Euro futures markets, traders added more than 1.7K contracts to their open interest positions on Thursday, reaching the third build in a row. Volume, in the same line, reversed the previous drop and also increased by nearly 72K contracts.

USDJPY is trading just below the 112 zone, having hit the low at 111.83 and the high at 111.98. Major support for the pair stands at 111.51, the 200-day moving average, and then at the 111 round figure if the pair manages to break below the 100-day simple moving average at 111.10. Immediate resistance for the pair stands at 112.10, the March 2019 high.

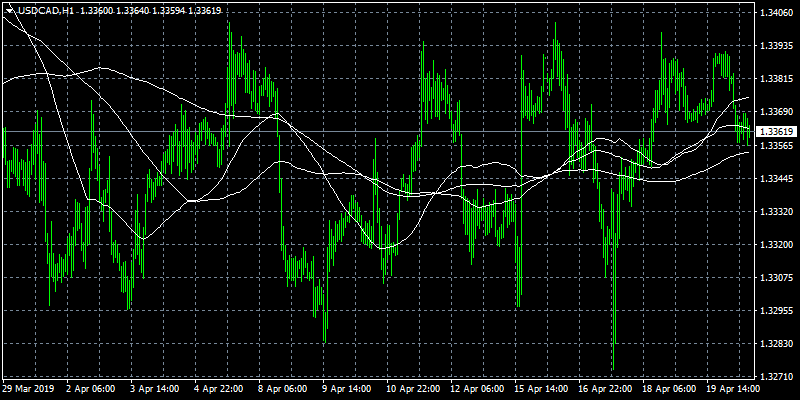

USDCAD: Canadian dollar started strong on higher oil prices pressures the pair down to 1.3345. The pair will find immediate support at the 200-day moving average around 1.3318 while extra support stands at 1.32, and the 200-day moving average which if breached will drive prices down to 1.31 key support. On the upside, immediate resistance stands at 1.34 a break of which can escalate the rebound towards 1.3430.