Asian indices finished mostly lower as trade worries resurface and the attack in two oil tankers in Gulf of Oman weighing on traders sentiment. The Nikkei225 finished 0.40 percent higher to 21,116 and the Hang Seng benchmark in Hong Kong finished 0.83 percent lower at 27,065. The Shanghai Composite finished 0.99 percent lower to 2,881, while in Singapore, the FTSE Straits Times index finished 0.32 percent lower to 3,210. Australian equities finished up 11 points or 0.2% to 6,554. Over the week, the index jumped 1.7%.

European session started lower today amid renewed worries about trade relations between the US and China and a rise in geopolitical tensions. DAX30 is giving up 0.88 percent to 12,062 CAC40 is 0.54 percent lower at 5,346 while the FTSE MIB in Milan is trading 0.32 percent lower at 20,634. The London Stock Exchange is 0.57 percent lower to 7,324 as the Brexit uncertainty continues.

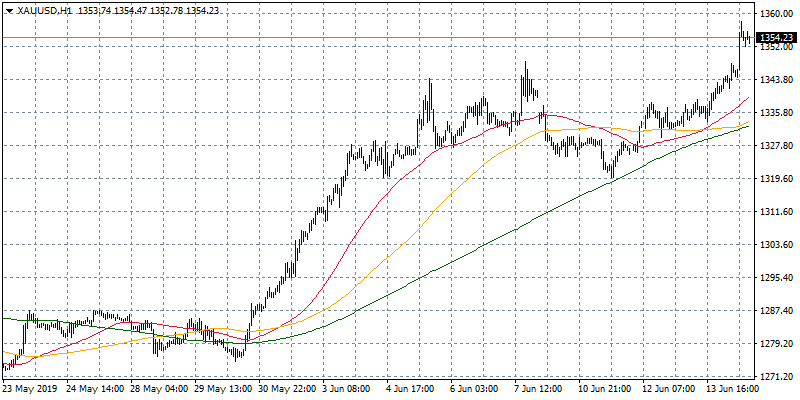

In commodities markets, crude oil consolidates higher at 52.10 after reports that two tankers have been attacked in the Gulf of Oman. Oil is down almost 18% from the high in late April, wiping out about half of its rally earlier this year due to increased global trade worries. Brent oil also trades lower to $61,33 per barrel as major oil producers have yet to agree on adjustments on output. Gold shines and trades higher to 1,356 hitting fresh yearly high, following the recent developments in the Gulf of Oman. The precious metal broke above the 50 and 100-hour moving averages yesterday turning the short-term technical picture to bullish. Gold will find support at the 1300 round figure and then at 1295, the 100-day moving average while more bids will emerge at the 50-day moving average at 1287. On the upside, resistance stands at 1368, the high from April 2018.

In cryptocurrencies market, bitcoin (BTCUSD) continues its trip north to the 8,200 mark. The daily low for BTC was at 8,168 and the daily high at 8,327. Immediate support for BTC stands now at the $8,000 round figure while the next support stands at 7411, the low from the recent trading range. On the upside, strong resistance now stands at 8,327, the high from Asian while I expect extra pressure from sellers at 8,500 and then at 8,700. Ethereum (ETHUSD) gives up four dollars to 254, with capitalization now to 27 billion, on the upside the immediate resistance stands at 287 the recent high while the support stands at 200 round figure, Litecoin (LTCUSD) consolidate retreats from yesterdays high at 128. The crypto market cap holds above $260.0B.

On the Lookout: Geopolitics are driving the markets today, International Energy Agency (IEA) Executive Director Faith Birol commented that recent attacks on tankers in the Gulf raised major concerns for global energy security and oil markets. In the UK, the first Conservative Party leadership contest revealed overwhelming support for Boris Johnson in his bid to become the next PM.

Later today, we await from North America the US retail sales, production and consumer sentiment data.

Trading Perspective: In fx markets, USD trades flat at 96.44 on speculation over Fed rate cut, while the Aussie dollar trades lower to 0.6899 as yesterday jobless rate remained steady at 5.2% in May. Kiwi also trades lower to 0.6545 level as downbeat manufacturing PMI figure flagged further RBNZ rate cuts.

GBPUSD is trading lower today breaking below the 1.27 as the bearish momentum for Cable is still intact amid growing concerns over Brexit. The pair hit the daily low at 1.2625 and the daily high at 1.2621. Major support now stands at 1.26 recent low. On the upside, immediate resistance now stands at 1.2753 the high from yesterday. Pound shows persistent weakness amid UK political uncertainty and also on the back of global risk aversion, so any uptick can match excess offers.

In Sterling futures markets the open interest shrunk by around 6.7K contracts, reversing the previous build. In the same line, the volume went down by just 646 contracts.

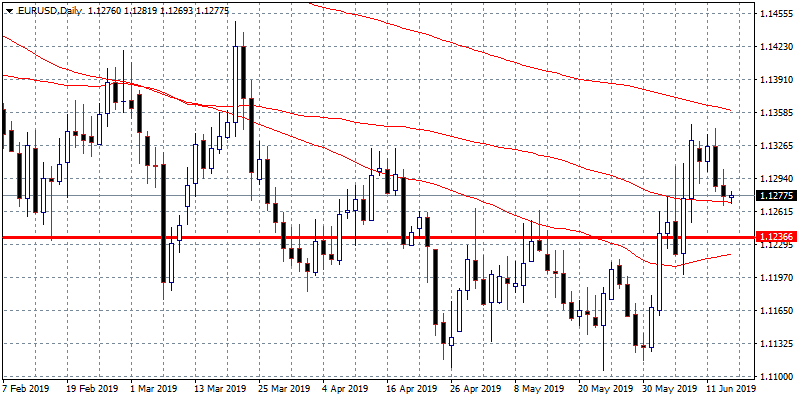

EURUSD started the day lower visiting new low around 1.1251. On the upside, the immediate resistance stands at 1.1340 the high from yesterday, while more offers will emerge at 1.1367 the 200-day moving average. Support stands at 1.1219 the 50-day moving average, while more bids will emerge at 1.12 round figure.

In euro futures markets, the open interest increased by 11.7K contracts on Thursday, volume, shrunk by around 307.2K contracts, the largest single-day drop so far this year.

USDJPY trades 0.15 percent lower to 108,21, today the pair hit the low at 108.15 for the second day in a row and the high at 108.39. The pair will find support at 107.84 recent low, on the upside immediate resistance for the pair now stands at 108.71 the high from yesterday. The USD price dynamics will continue to drive the pair’s momentum as traders focus shifts to FED’s next move.

USDCAD makes an attempt higher and trading as of writing at 1.3337 as the retreat in crude oil prices, Canada’s main export item seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at the 200-day moving average around 1.3250 while extra support stands at the 1.3200 round figure. On the upside, immediate resistance stands at the 1.33 zone before an attempt to 1.3348 where the 100-day moving average stands.