Asia stocks finished almost flat today as traders awaited the U.S. Federal Reserve meeting later on Wednesday. In Japan, the Nikkei225 main index lost 0.08 percent to 21,566, and the Hang Seng benchmark in Hong Kong finished 0.19 percent higher at 29,466. The Shanghai Composite finished 0.18 percent lower at 3,090, while stocks in Australia has again seesawed in and out of negative territory, held back by losses in the Financial, IT, Healthcare and Energy sectors. Miners extended yesterday’s strong gains, buoyed by further strength in the price of iron ore. The ASX 200 closed down 5 points or 0.1% to 6,184.

In commodities markets Light Crude Oil keeps the positive momentum close to four-month high, trading at 59.19, Brent oil trading unchanged at $67.73/barrel just shy from highs at 68 supported by global production cuts and supply disruptions in Venezuela. OPEC has already helped oil prices rise by 30% this year as it moves to cut global supplies. Gold is muted around $1305 searching for a catalyst. XAUUSD may find support at $1297 where the 50-day moving average crosses, ahead of testing 100-day simple moving average down to $1293.

A neutral to positive start for equities in early European session mirroring the sentiment seen in US equity futures, with investors watching the developments surrounding Brexit, and an eye on FED meeting later on the week, DAX30 is giving up 0.01 percent to 11,654, CAC40 is 0.13 percent lower at 5,405 while FTSE100 in London is 0.22 higher at 7,314. Any delay to the Brexit process will now need to be agreed by the other 27 EU members, with talks about possible conditions for an extension to be held before this week’s EU summit

On the Lookout: Minutes of the recent Reserve Bank of Australia meeting on March 05 present significant uncertainties on the economic outlook while giving equal importance to both the directions of interest rate change depending upon the incoming economic data. The fourth quarter (Q4) house price index details dropped more than -2.0% forecast and -1.5% earlier on QoQ to -2.4% while yearly data marked -5.1% contraction versus -0.4% market consensus and -1.9% prior.

In the economic calendar today in the US, final January durable and capital goods orders revisions, and January factory orders are due. Late evening we’ll get BoJ minutes from the January meeting.

The Federal Reserve will conclude its two-day policy (FOMC) meeting on Wednesday, March 20th. It will issue its rate decision, FOMC statement and Projection Materials at 18:00GMT. The Fed has raised rates four times in 2018 and three times in 2017.

Trading Perspective: In forex markets, the Aussie dollar is trading lower and broke below the 0.71 zone amid downbeat Australian housing data and RBA minutes. The Kiwi is trading higher to 0.6855 helped by the recent surge in oil prices. The US dollar index lost the 96 figure and trading at 3-week low at 95.80.

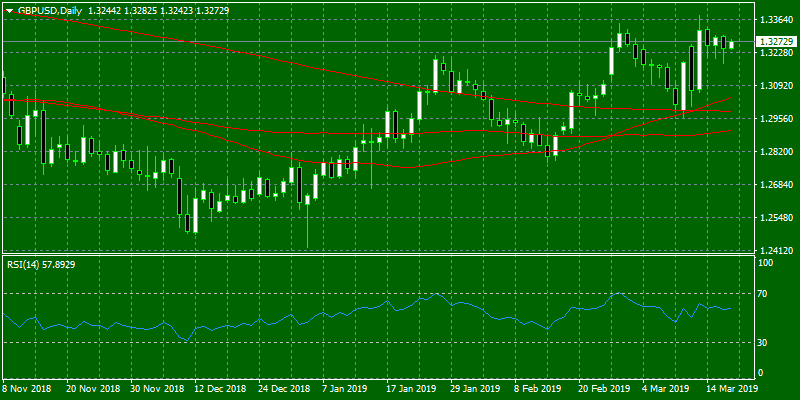

GBPUSD is trading in just 40 pips trading range between 1.3242 and 1.3282, the bull trend is still intact as volatility fading away and the traders closely watching the developments around Brexit votes and rumors. The technical picture is bullish for GBPUSD and a second attempt today at 1.33 looks possible. On the downside, major support will be found at 1.2990 where the 50 and 200-day moving averages are crossing. On the flip side, major resistance can be found at 1.3382 the yearly high.

A delay in the Brexit process with almost two more years of uncertainty and postponed business decisions and investments will be extremely damaging to the UK economy, which is a Sterling negative scenario.

EURUSD keeps the bullish tone making two-week high above 1.1350. The pair will find immediate resistance at the 50-day moving average at 1.1363 and is looking to break above in order to establish a new bullish trend targeting 1.14. The low from the previous Thursday session at 1.1277 provides solid support if the pair manages to break the 1.13 round figure. In FX option expires today we have at 1.13 strike 1.2bn of EURUSD cut at 10:00 Eastern Time.

On the Euro political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist and right-wing option among voters.

In Euro future markets, investors added just 4 contracts to their open interest positions at the beginning of the week, recording the third build in a row. On the other hand, volume shrunk once again, this time by nearly 152.3K contracts.

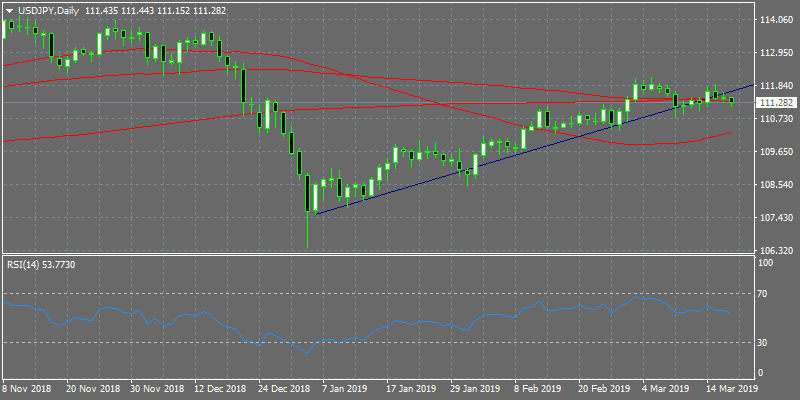

USDJPY is under selling pressure for the third day in a row, down 22 pips to 111.30. Technical picture has deteriorated as the pair broke below the ascending channel from December 2018 and the 100-day moving average, but the luck of volumes and volatility doesn’t convince the bulls. Expect further pullback today to the 111 level where initial support lies. Resistance for the pair stands at 112 round figure while support can be found at the low from the previous week at 111.27.

In Yen futures markets, Open interest increased by just 750 contracts on Monday, while volume shrunk for the second straight session, this time by more than 86K contracts.