Summary: Fresh stimulus talk from the White House lifted risk while the US Dollar reversed its four-day rally against its rivals. Optimism rose on reports that the US is preparing a new stimulus package of up to USD 1 trillion which will include an extension to unemployment and a return to work incentives. Markets shrugged aside a World Health Organisation announcement that saw the biggest single day increase in Covid-19 cases worldwide (+183,000) on Sunday. The Greenback was also pressurised by a report that saw US Existing Home Sales in May drop to their lowest level in 9.1/2 years. The Australian Dollar led the currency rally against the Greenback, soaring to finish 1.23% up in New York to 0.6912 (0.6835 yesterday). Sterling jumped to 1.2468 where it closed, from 1.2350 yesterday. Britain reported the lowest rise in new coronavirus cases since its lockdown in March. The Euro rebounded off its lows near 1.1175 yesterday to finish up 0.87% at 1.1265. Bloomberg reported that the Spanish government is considering pledging up to EUR 50 billion in additional loan guarantee. Against the Yen, the Dollar was up a modest 0.17% to 106.92 (106.87). Equities rallied. The US DOW was up 1.62% to 26,105 (25,650) in late New York. The S&P 500 closed at 3,125 from 3,075 yesterday. Global bond yields were mixed. The US 10-year yield was up 2 basis points to 0.71%. Germany’s 10-year Bund rate finished at -0.44% from -0.42% yesterday.

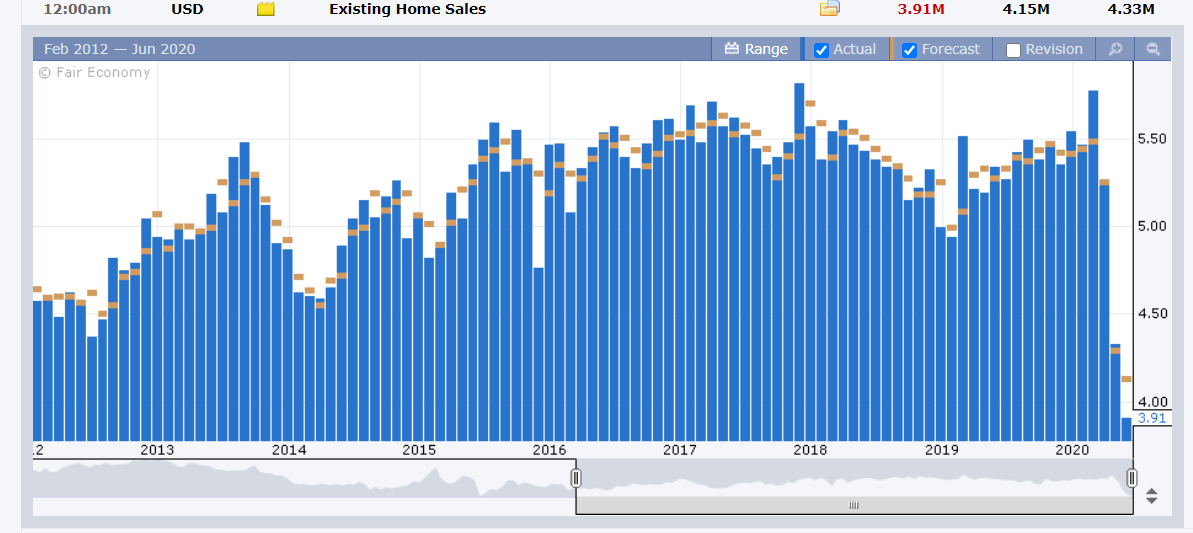

Data released yesterday saw UK Conference Board’s Industrial Orders Expectations in May drop to -58, missing forecasts at -50. US May Existing Home Sales slumped to 3.91 million units from April’s 4.33 million, missing expectations of 4.15 million. It was the lowest level in Home Sales since October 2010.

On the Lookout: Once again it boils down to the two most important factors that are moving the currency and equity markets: fresh stimulus measures versus the number of new Covid-19 cases. The latest bazooka from the White House aimed at the coronavirus pandemic with its rising new cases is a stimulus of up to USD 1 trillion plus which is taking shape. Upcoming data will matter as markets see the toll of the pandemic on global economies.

Today sees the release of global Manufacturing and Services PMI’s. Australia’s Commonwealth Bank PMI, just released, saw June Manufacturing Activity climbed to 49.8 against expectations of 49.3 and a previous 44.0. Australian June Flash Services PMI rose to 53.2 from 26.9 in May, beating forecasts of 25.7. The Aussie spiked to a near one-week high at 0.6929 from 0.6915.

Other data released today see Japan’s Jibun Bank Preliminary Manufacturing PMI. Europe sees the release of French, German and the Eurozone Preliminary June Markit Manufacturing and Services PMI’s. The UK follows with its Markit Manufacturing and Services PMI’s for June. Finally, the US reports its Markit Manufacturing and Services Preliminary PMI’s for June. US New Home Sales and the Richmond Fed Manufacturing Index round up the day’s reports.

Trading Perspective: Will worldwide fresh stimulus measures bazooka be able to offset the rising coronavirus numbers as the second wave in developed nations start? It is hard to imagine that the worst is over yet with this pandemic until a vaccine in found. In many of the developing countries, the rapid rise in Covid-19 is still in its first phase. India, Brazil, Mexico continue to record big numbers of new cases.

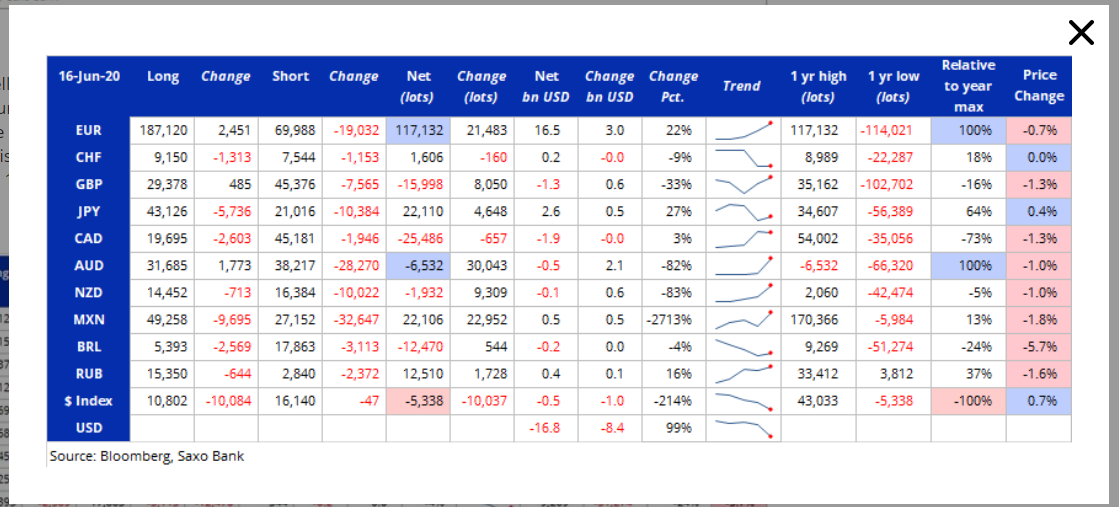

Meantime the latest Commitment of Traders CFTC report for the week ended June 16 saw net speculative US Dollar short bets almost double according to Saxo Bank. The latest week saw net short USD bets jump by USD 8.4 billion to total -USD 16.8 billion. This is the biggest total of net short US Dollar positions since May 2018. According to Saxo Bank, the heavy selling of Greenbacks was broad-based, benefitting the Euro and the Australian Dollar the most. We take a look at the individual currencies in their reports.

AUD/USD – Outperforms as Short Bets Cut Further, 0.6950 Caps

The Australian Dollar ended its four-day losing streak against the Greenback, soaring to an overnight high at 0.69226, its highest since June 18 before easing to close at 0.6912, up 1.23%. This morning saw the Aussie Battler climb further to 0.6935 on better-than-expected Australian Manufacturing and Services PMI reported by the Commonwealth Bank. AUD/USD currently sits at 0.6927.

The latest Commitment of Traders/CFTC report saw net speculative Aussie short bets cut further to its lowest total since May 2018. According to Saxo Bank, speculative total Australian Dollar short bets fell to -AUD 6,532 contracts in the week ended June 16 from the previous week’s -AUD 36,575.

Which is a hefty cut that saw the Aussie Battler rebound 28% of its March lows.

Any spike in new Covid-19 cases that will hit risk appetite will hit the Aussie. Which now has more downside room since many of the shorts are out of play.

AUD/USD has immediate resistance at 0.6950 followed by 0.6980 and 0.7010. Immediate support can be found at 0.6910 and 0.6880. Look for consolidation in a likely range today of 0.6880-0.6940. Prefer to sell rallies toward 0.6970.

EUR/USD – Rebounds Off Lows, Spec Long Bet Build Will Limit Rallies

The Euro rebounded off its low traded 1.11682 over the weekend, ending a 4-day losing streak to finish at 1.1265 in late New York. EUR/USD rallied further in early Asian trade to 1.1281 before easing to settle at its current 1.1277. The shared currency benefited from the broad-based US Dollar fall and rise in risk appetite. The news of a possible fresh Spanish stimulus also lifted the Euro.

Market positioning in the Euro remains long at dangerous levels. According to Saxo Bank, the latest Commitment of Traders/CFTC report saw net speculative Euro long bets jump by +EUR 21,483 contracts to total +EUR 117,132 which are the biggest number of long contracts in the Euro since May 2018. Total long Euro contracts totalled +EUR 14.6 billion. Which is huge.

EUR/USD has immediate resistance today at 1.1300, 1.1330 and 1.1360. Immediate support lies at 1.1250, 1.1220 and 1.1180. Look for consolidation today into the global PMI data and any fresh news on Covid-19 with a likely range between 1.1240-1.1340. Prefer to sell into any rally.