Trade truce cues underpin market bulls, but forex market mixed as USD rebound on decreasing odds in favor of fed rate cut later this month.

Summary: Global market today saw equities and forex assets open positive in Asian market hours influenced by trade reprieve. In-line with investor expectations across the globe, the meeting between Presidents of China and US led to yet another reprieve in trade war between both economies. While Trump has commented for now that trade talks are back on track, it remains to be seen as to how much of a progress, representatives would make this time around. Bonds declined and risk assets boomed across Asian market hours and positive cues from Asian market and headlines influenced investor sentiment helped European market open and trade positive. High risk appetite in the market helped STOXX 50 hit seventeen month highs. In Forex market, gains were capped albeit prevalent risk appetite as USD gained strength on decreased probability of Fed rate cut later this month.

Precious Metals: As risk appetite boomed and USD regained luster in the market, Greenback denominated precious metals sustained heavy losses. Especially, Gold which is driven mostly on safe haven demand and fund inflow from Emerging markets went down nearly 2% as profit booking activity also weighed down the yellow metal aside from other dovish factors at play in the global market.

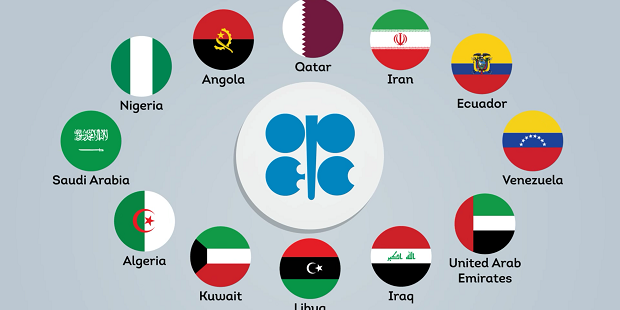

Crude Oil: Crude oil is trading positive today with both major international benchmarks WTI & Brent up by more than 2.50% on OPEC cues. Headlines stated that OPEC and its allies agreed to extend supply cut agreement for nine months which given escalating tensions in Middle East are expected lead demand to supply ration in favor of Crude oil bulls. This has helped US crude oil price scale $60 handle shortly today.

AUD/USD: The pair saw positive price action earlier in the day influenced by news of trade truce between China and US. However, the positive momentum turned out to be short lived as USD grew strong given decreasing odds of Fed rate cut later this month. Further, AUD was weighed down by dovish Chinese PMI data and expectations for another rate cut by Australian central bank resulting in bears gaining dominance in price action today.

On The Lookout: Geo-Political events remain the major driving force behind price action as trading session began for the month. Weekend cues from G20 meeting which saw Trump and Xi Jinping agree to trade truce and delay tariff has helped major risk assets gain positive price momentum, however, the momentum from said cues could be short lived as status quo remains unchanged in long term with no solid details revealed so far. In European market, Brexit still seems to pose a major threat as uncertainties continue to linger and no progress has been made in Brexit decisions given race to replace PM Theresa May which edges closer. Despite, gap between two contenders seeming to shorten last week, Boris Johnson still maintains dominance in the race but we have to wait until later half of the month for decision on same. And it also remains to be seen if Boris will lead to a hard Brexit outcome and manage to secure a deal with EU given their clear stance on no further deal till date. Middle Eastern tensions take backseat ahead of OPEC meeting. On release front, traders await US ISM manufacturing PMI update for short term trading cues.

Trading Perspective: Given positive investor sentiment and headlines inspired cues on Sino-U.S. trade truce, US stock and index futures trading in international market saw positive price action. Further, USD has also been growing strong over decreasing odds on possible rate cut by Fed. This suggests that Wall Street is likely to see positive price action today with major indices set to retake one year highs.

EUR/USD: The pair saw positive price action as trading session opened for the week breaking multiple resistance levels to the upside and testing 1.1370 handle. But rebound in USD’s strength and dovish Germany and UK macro data caused the pair to decline further. While the pair has reversed most of early declines, the pair is still trading in red while traders await US macro data for short term profit opportunities.

GBP/USD: Bears dominate price action unaffected by cues from Sino-U.S. trade war truce decision. Further, dovish macro data and Brexit woes weigh down the pair with firm USD pressuring GBP. Traders now await speech from Boris and Hunt and US ISM Manufacturing PMI for directional bias and short term trading opportunities.

USD/CAD: The pair recovered from 8-month lows hit last week on firm USD which rebound following decreasing odds in favor of Fed rate cut. But the gains were limited as trade truce cues and sharp upward surge in crude oil price on OPEC statement to extend supply cut underpinned CAD bulls. Traders await US ISM manufacturing PMI data which if missed expectations could lead to CAD regaining momentum in American market hours.

Please feel free to let us know your thoughts in the comments below.